The document provides an overview of several theories of international trade, including:

1) Mercantilism which holds that nations should accumulate wealth through trade surpluses and restricting imports.

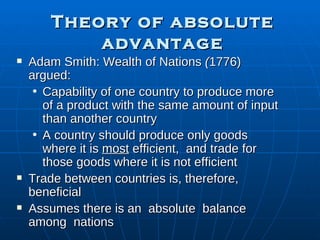

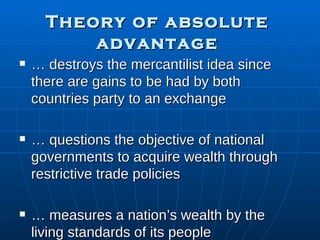

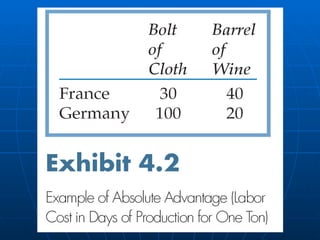

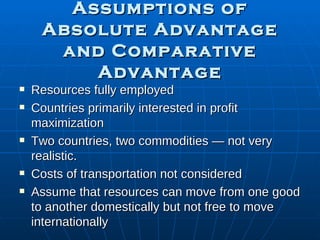

2) Absolute advantage theory proposed by Adam Smith which argues that countries should specialize in goods they produce most efficiently.

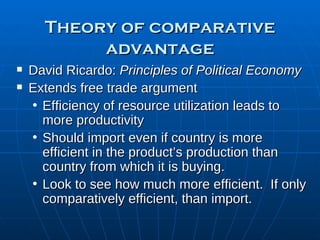

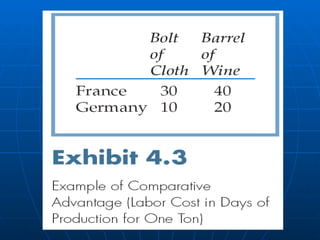

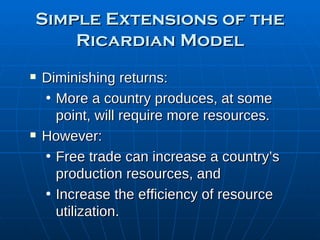

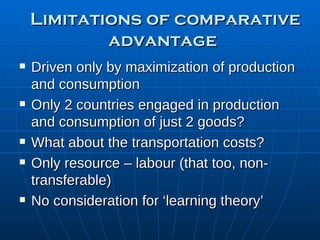

3) Comparative advantage theory of David Ricardo which extends this to argue for importing even if less efficient in production to maximize efficiency.

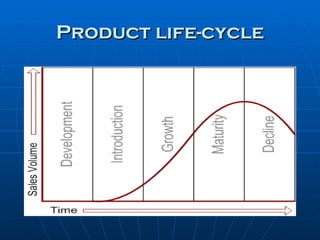

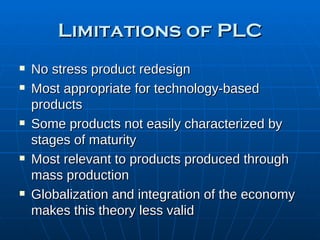

4) Product life cycle theory which proposes that products move through stages from export to foreign investment as they mature.