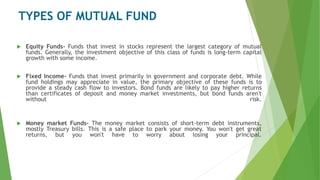

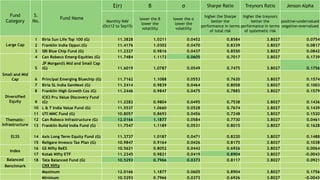

Mutual funds allow investors to pool their money together and invest in a variety of securities like stocks, bonds, and money market instruments. They offer the benefits of diversification and professional management. The document discusses the different types of mutual funds such as equity funds, fixed income funds, and money market funds. It also covers mutual fund fees, risks, performance measurement metrics, and past performance of some Indian mutual funds. The top mutual fund houses in India have been using the market decline in August to buy stocks at attractive prices.