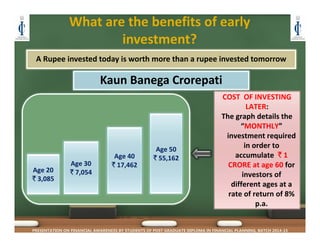

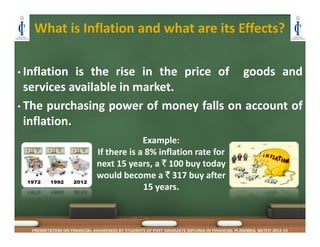

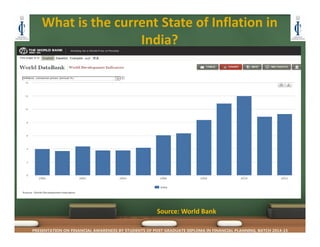

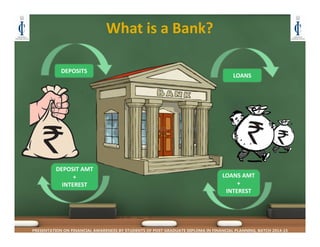

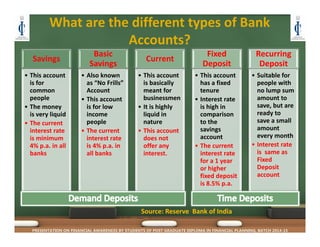

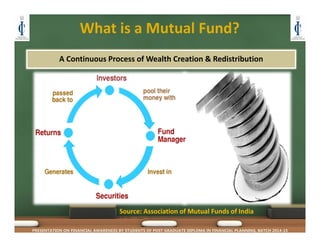

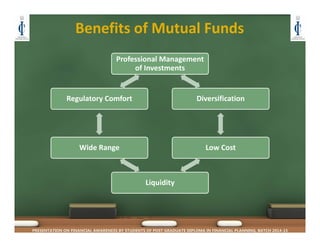

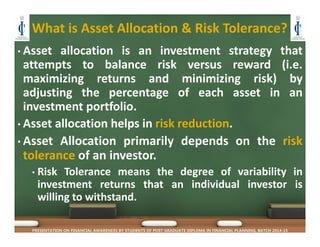

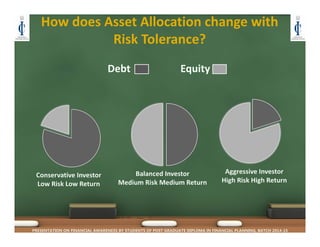

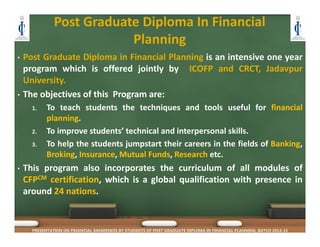

The document provides a comprehensive overview of financial awareness, emphasizing the importance of savings and investments, the impact of inflation, and various types of bank accounts and mutual funds. It highlights the benefits of early investment, the need for asset allocation based on risk tolerance, and the safe options for wealth creation. The presentation is by students of the Post Graduate Diploma in Financial Planning from the International College of Financial Planning.