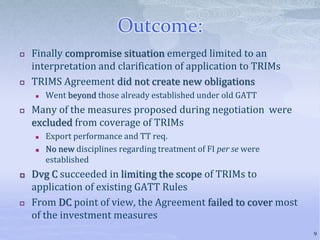

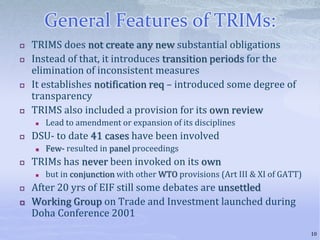

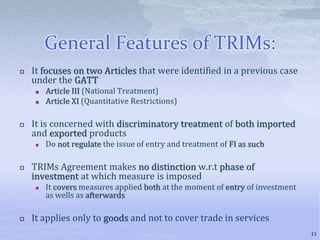

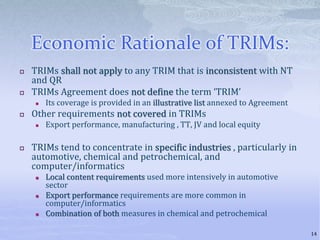

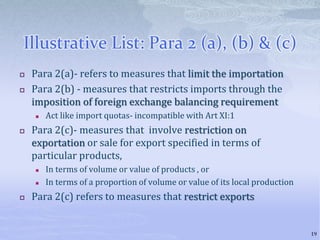

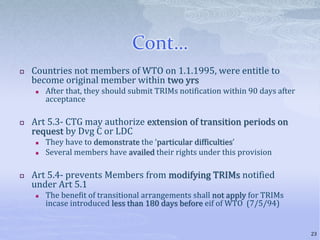

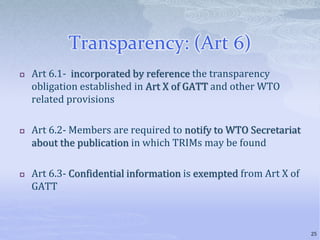

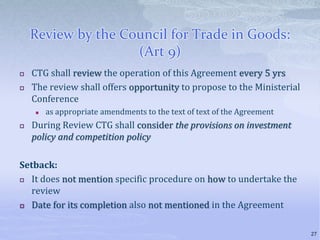

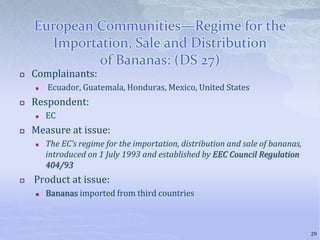

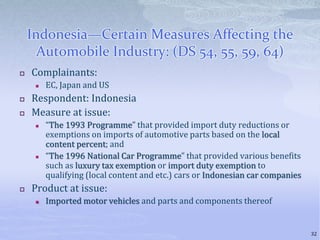

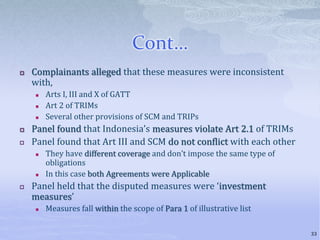

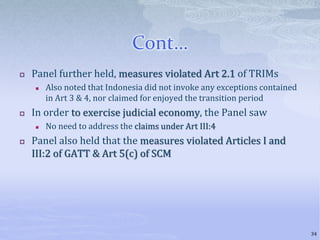

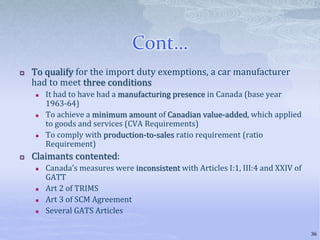

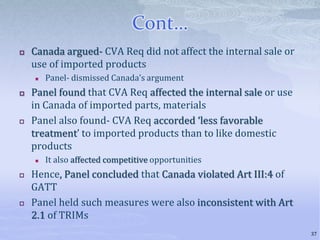

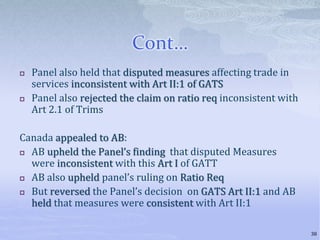

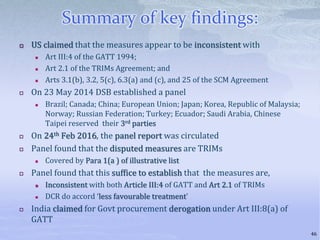

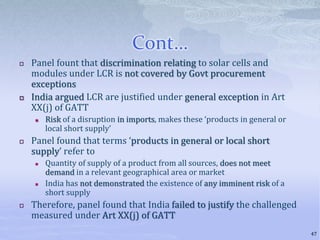

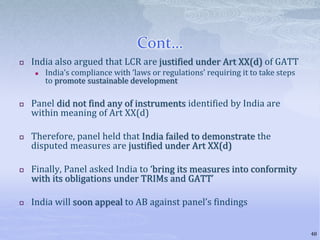

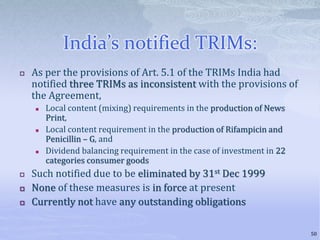

The Agreement on Trade-Related Investment Measures (TRIMs) aims to promote trade liberalization while ensuring competition. It recognizes that certain investment measures can distort trade. The TRIMs Agreement clarifies that GATT Articles III (national treatment) and XI (prohibition of quantitative restrictions) apply to investment measures related to trade in goods. It includes an illustrative list of measures inconsistent with these articles, such as local content requirements and import/export balancing requirements. The agreement establishes notification requirements for members and transition periods for eliminating inconsistent measures. It focuses on limiting investment measures' impact on trade in goods and does not regulate foreign investment or services.