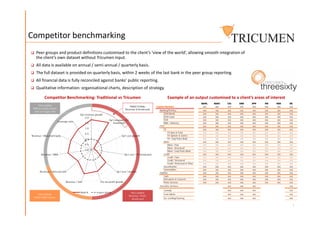

Tricumen offers market intelligence and competitor benchmarking services for financial institutions. They provide customized data and analysis on over 50 competitors across various products and geographies. Their offerings include quarterly datasets with financial metrics and qualitative information on competitors, allowing clients to benchmark their performance against peers.