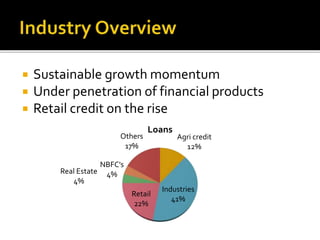

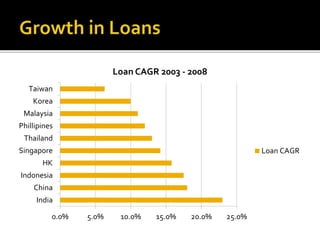

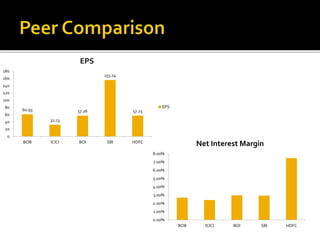

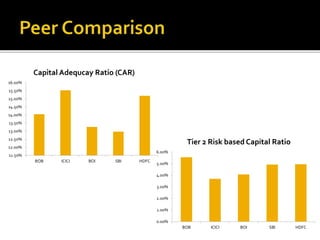

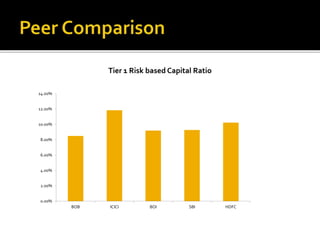

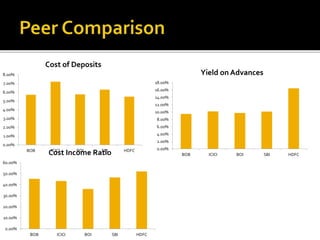

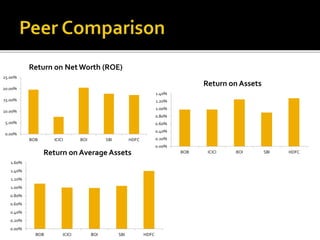

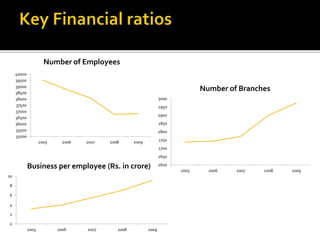

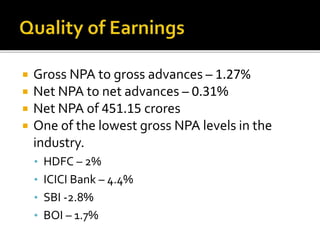

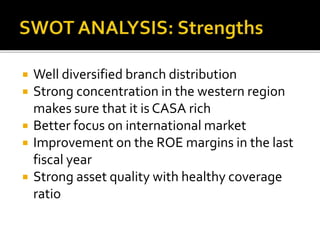

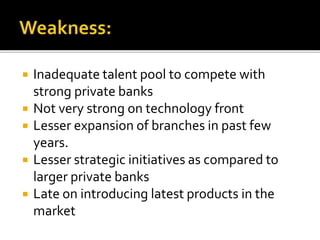

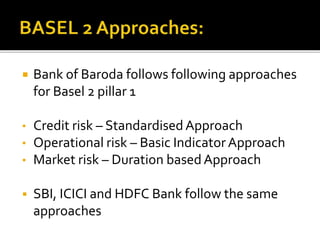

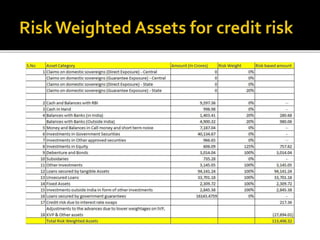

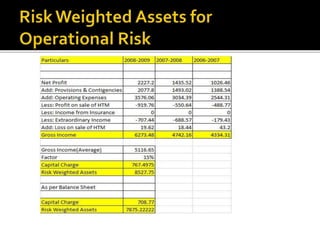

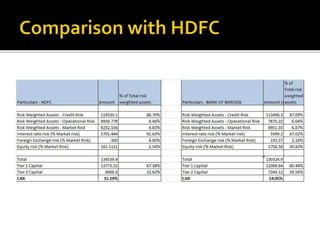

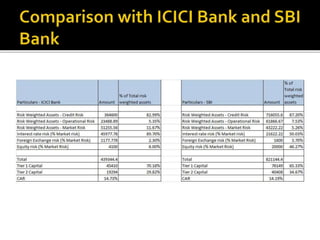

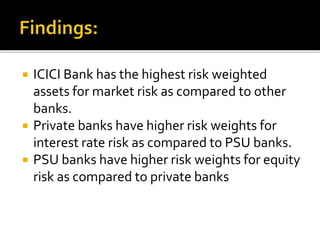

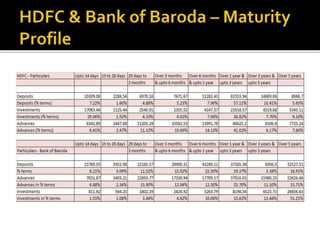

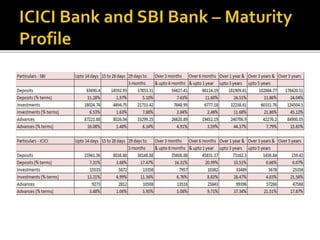

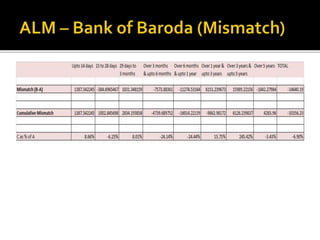

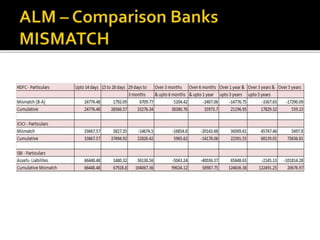

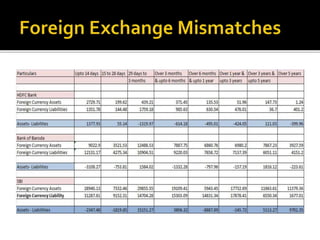

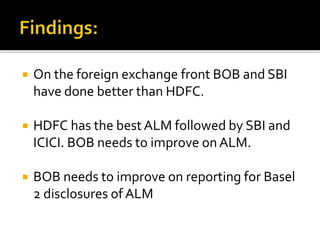

This document provides an overview of Bank of Baroda, including its business segments, financial performance, and risk management approaches. It summarizes that Bank of Baroda is the 3rd largest public sector bank in India with over 3000 branches and total assets exceeding Rs. 2.27 lakh crore. It offers a wide range of banking products and follows the standardized approach for credit risk, basic indicator approach for operational risk, and duration-based approach for market risk under Basel 2 regulations. The document also compares Bank of Baroda's asset-liability management and risk-weighted assets to other major banks in India.