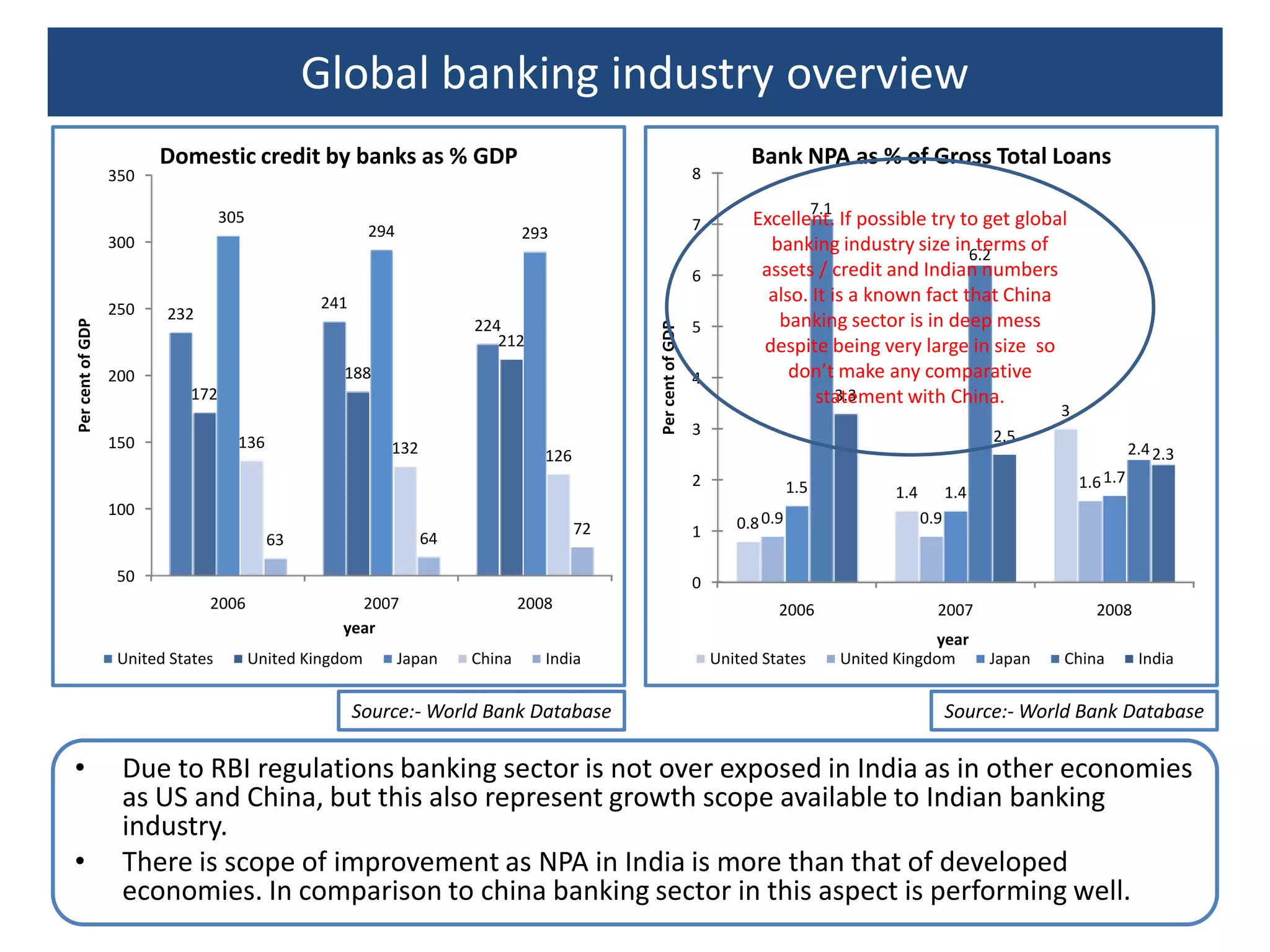

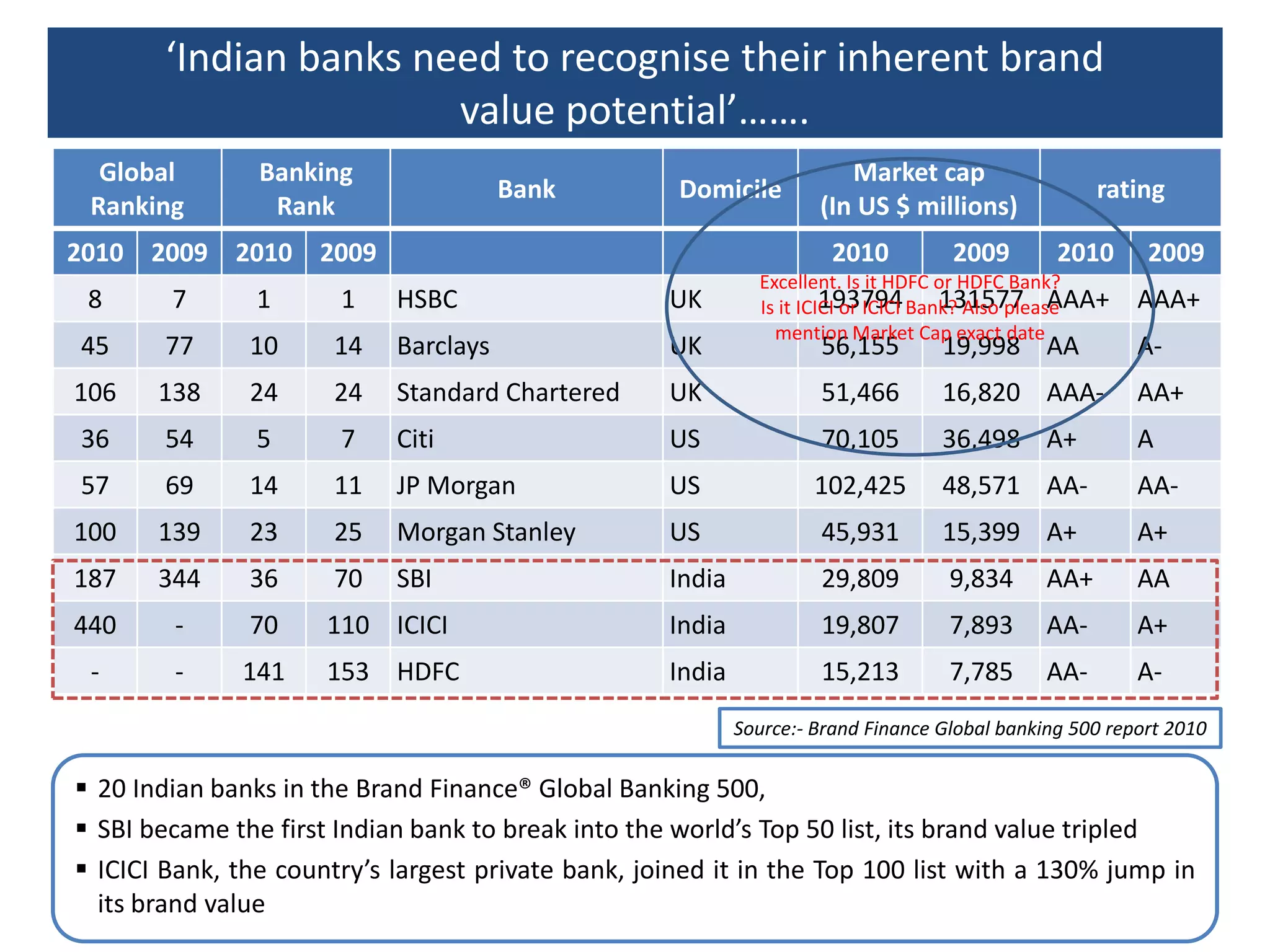

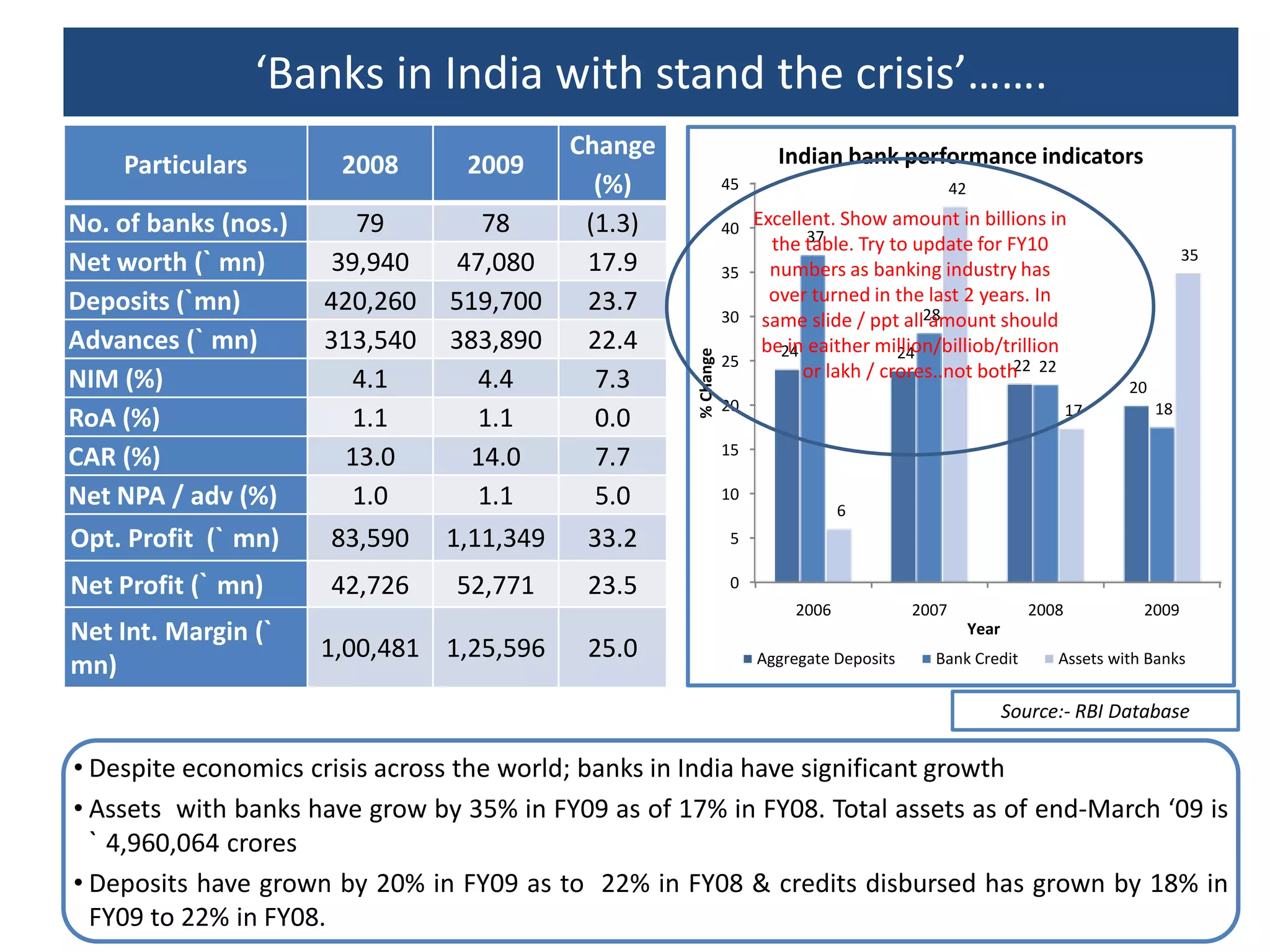

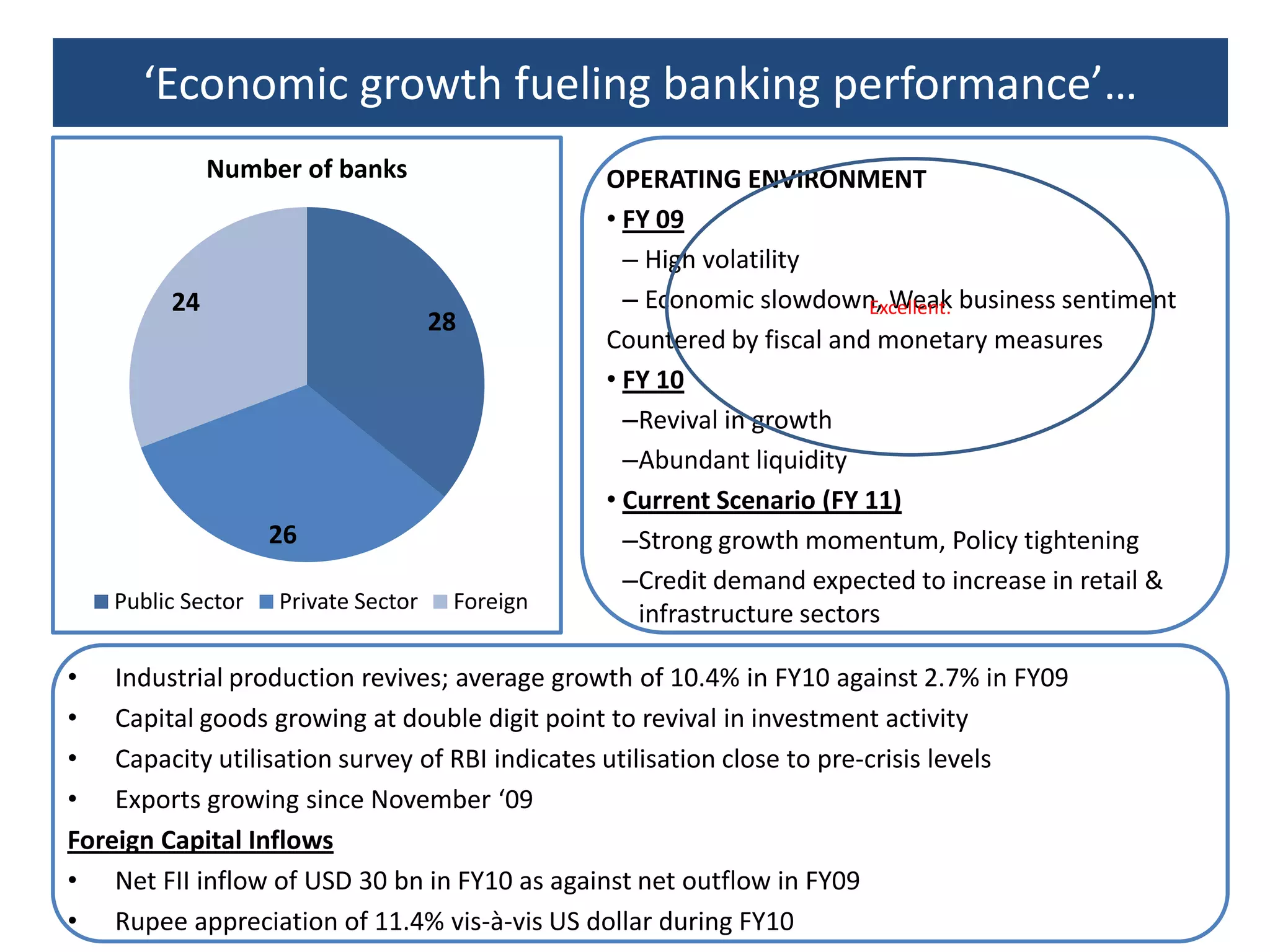

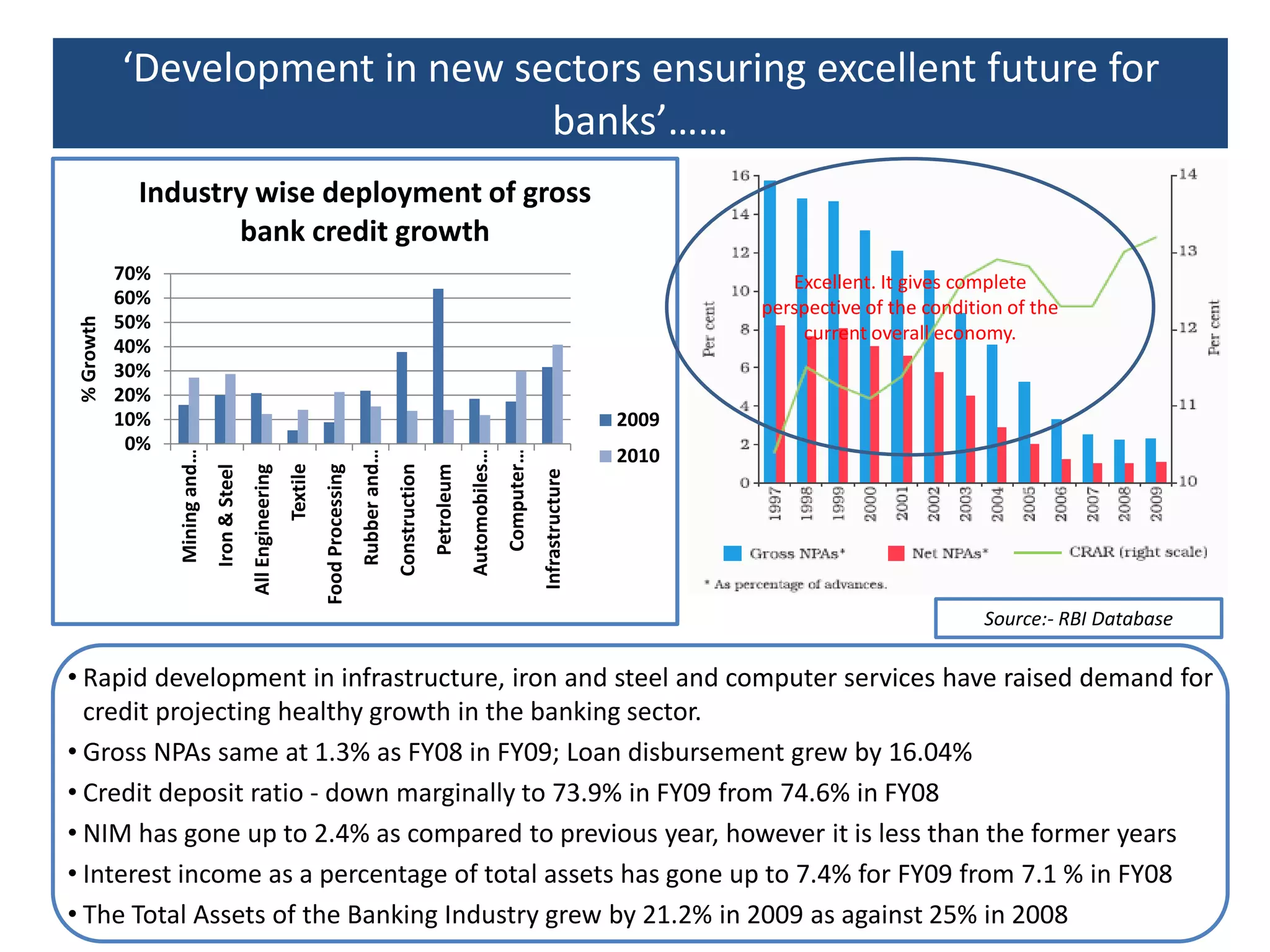

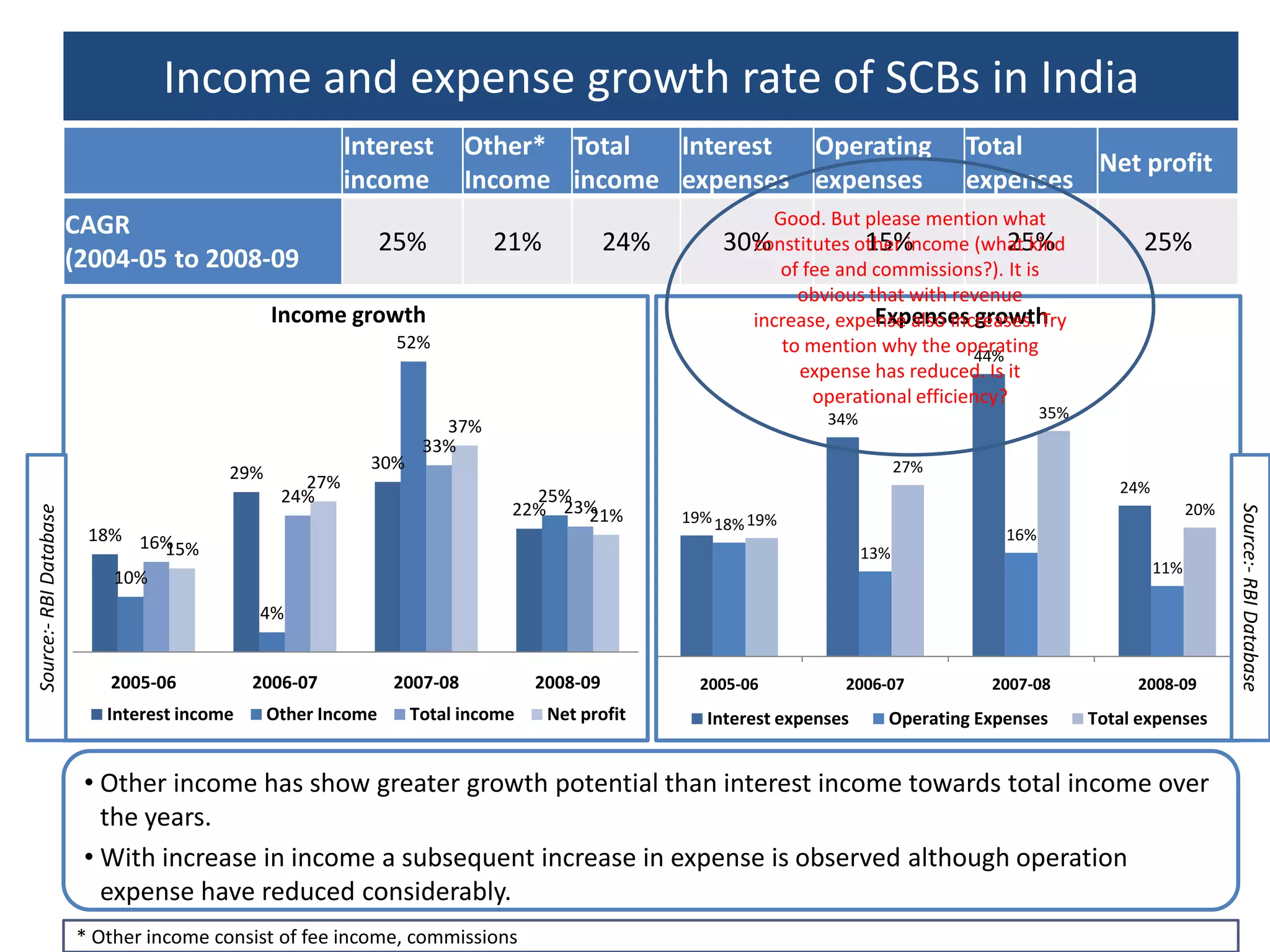

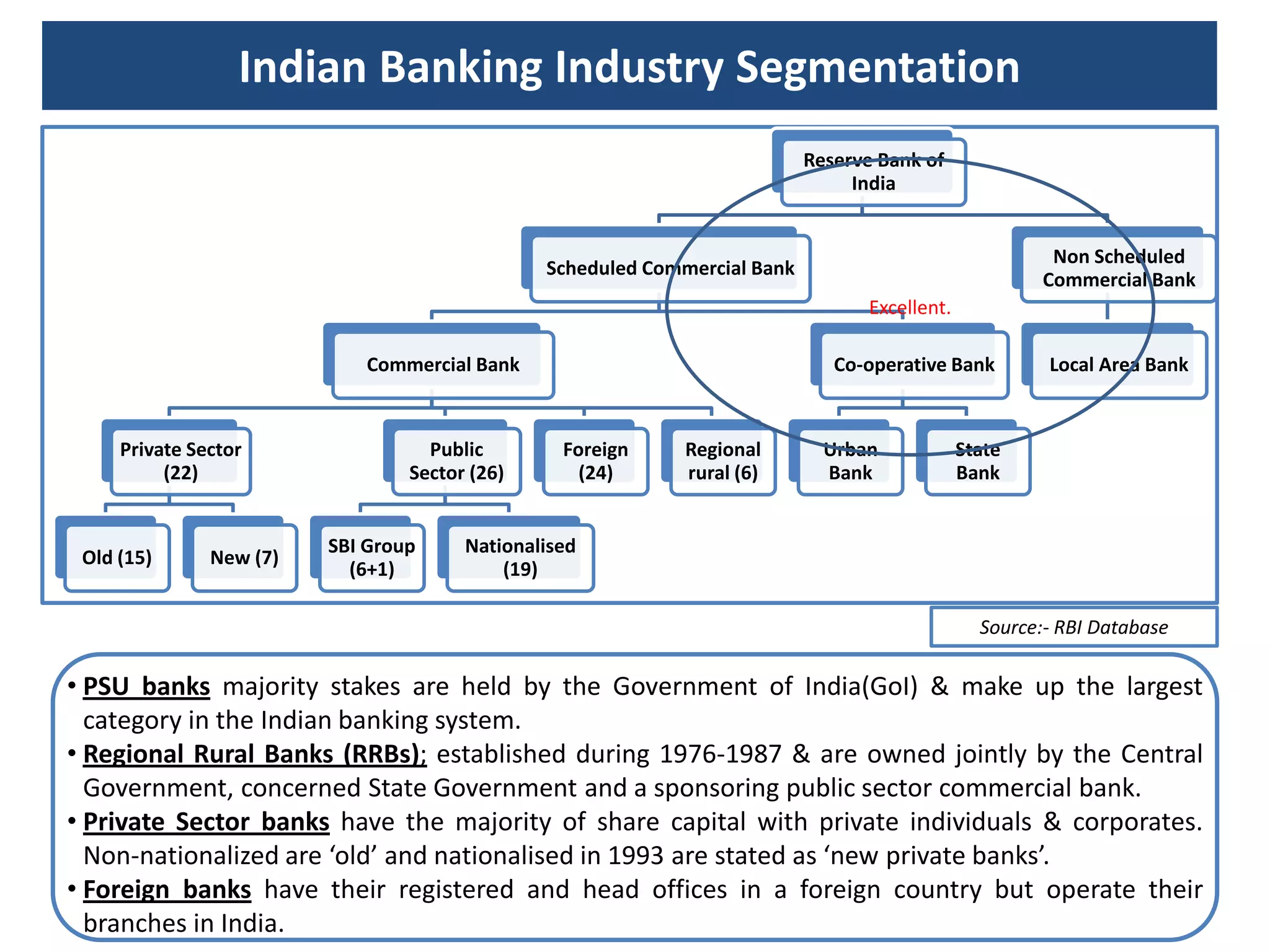

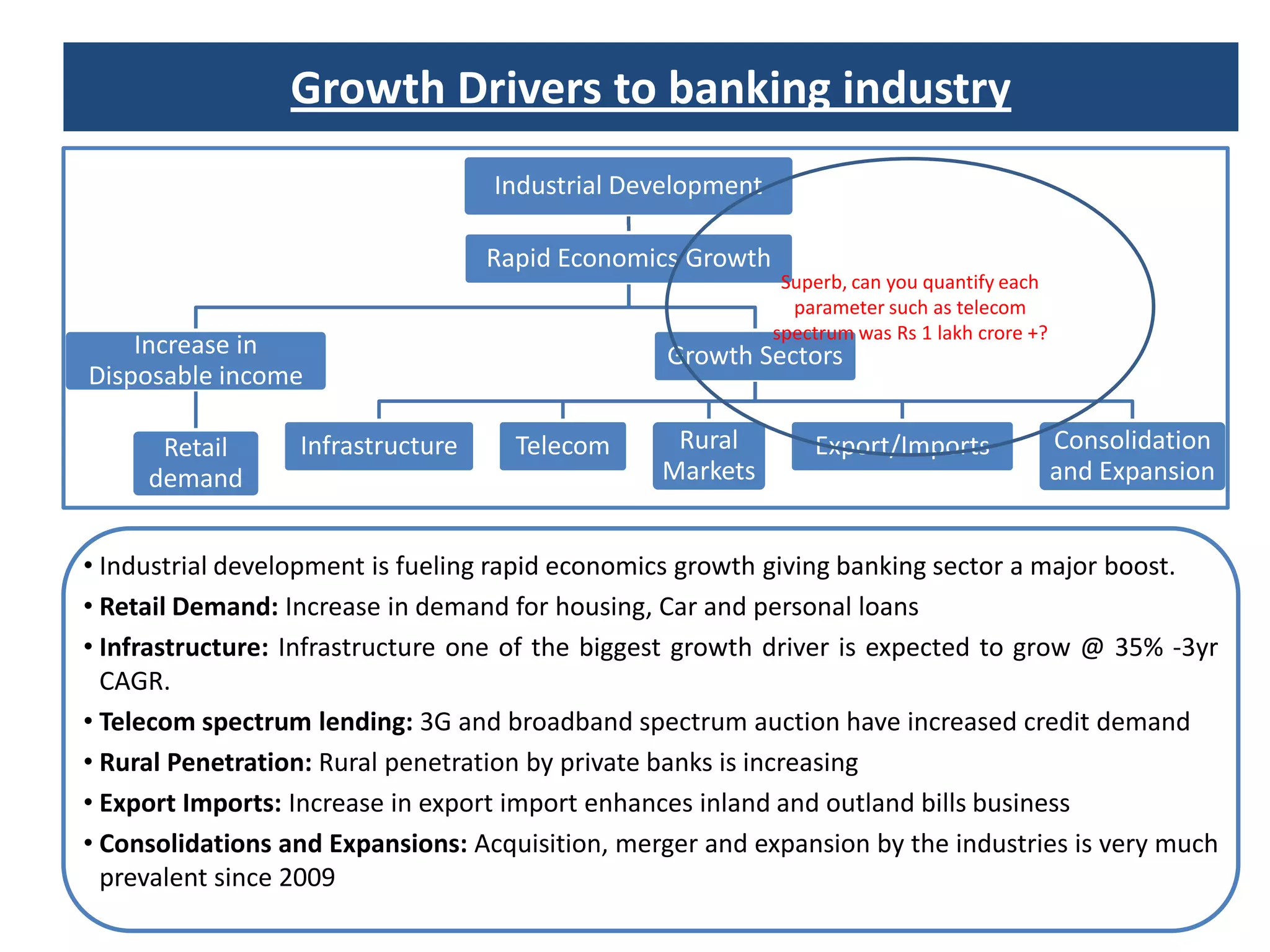

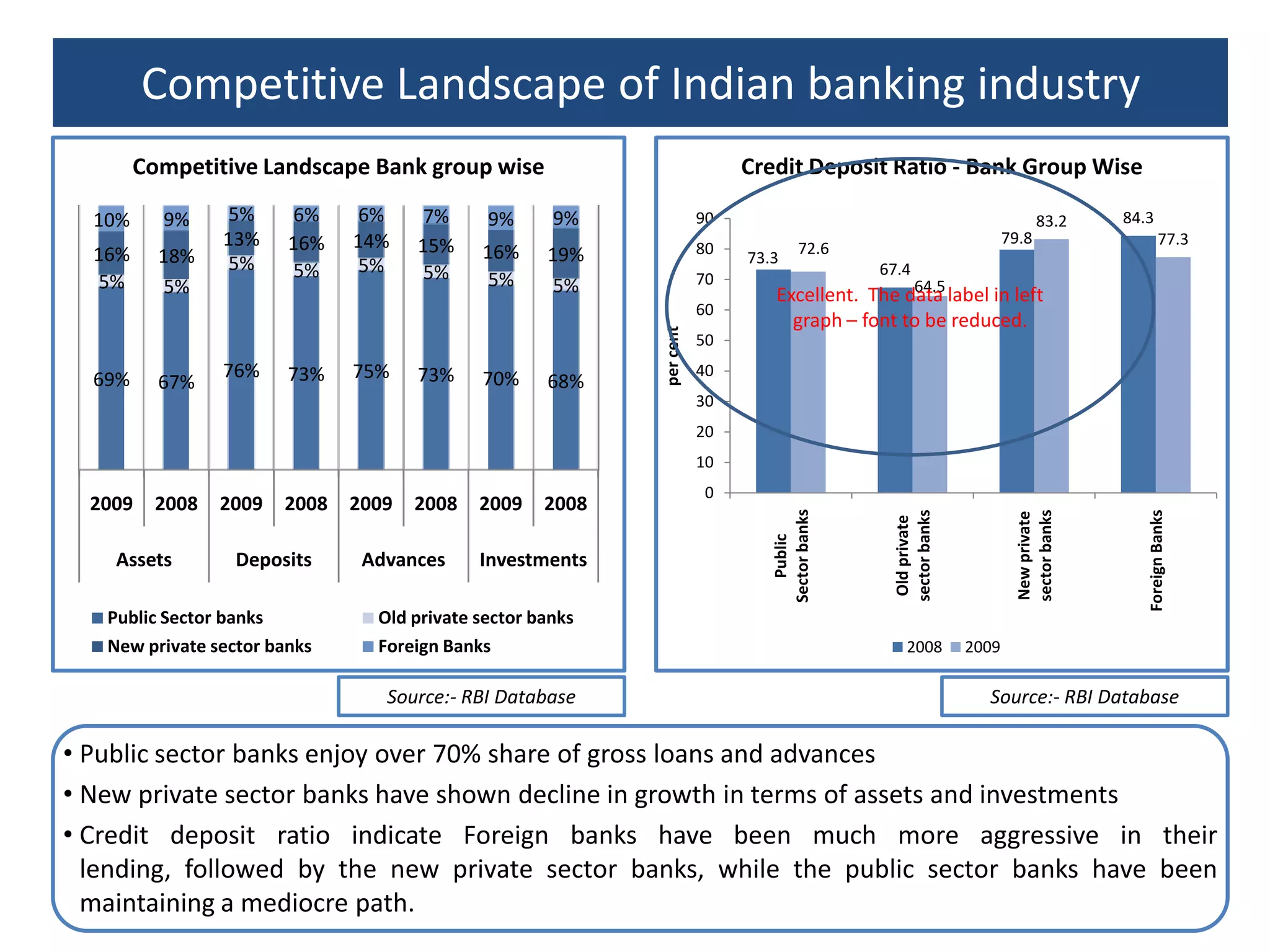

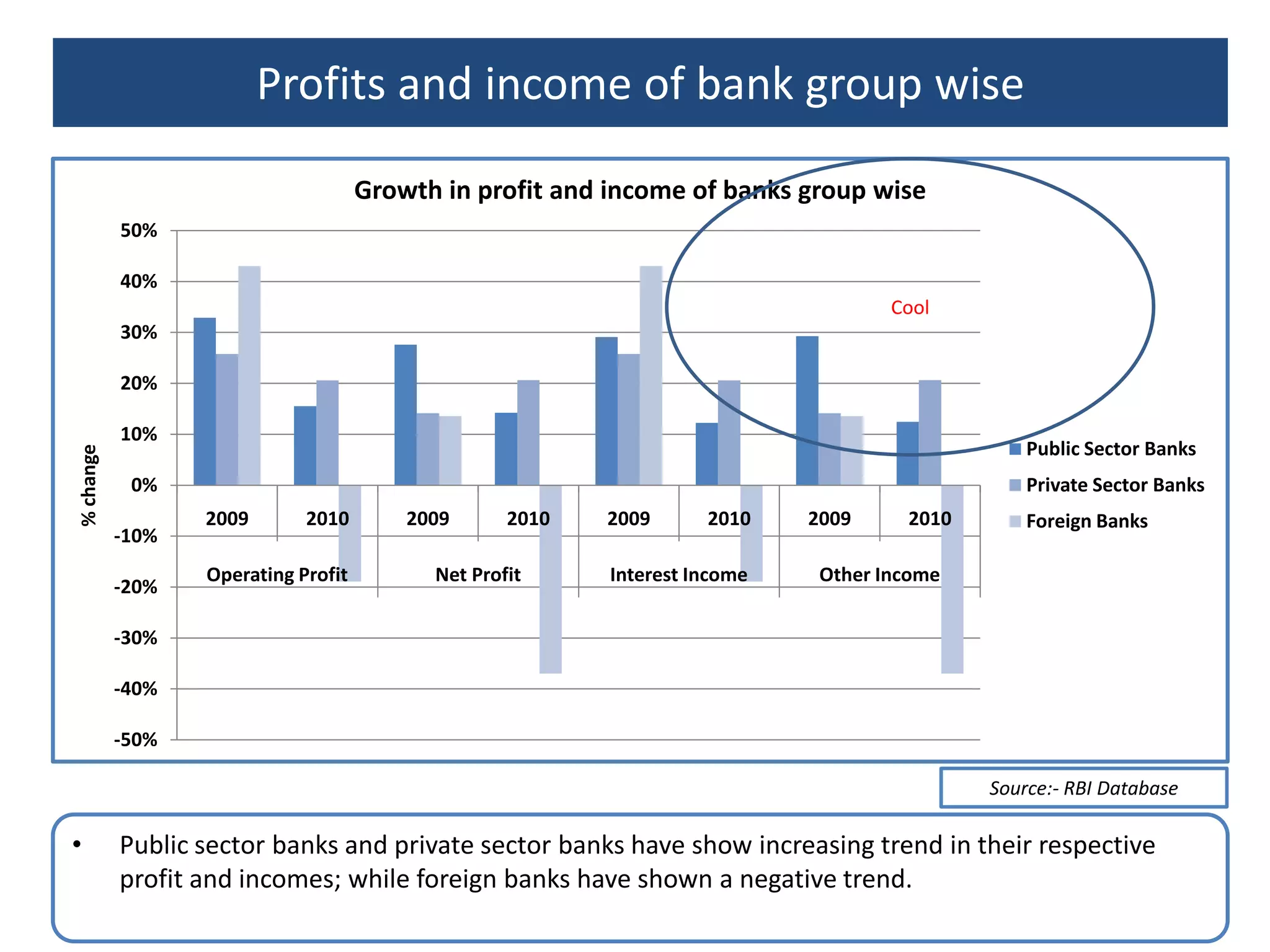

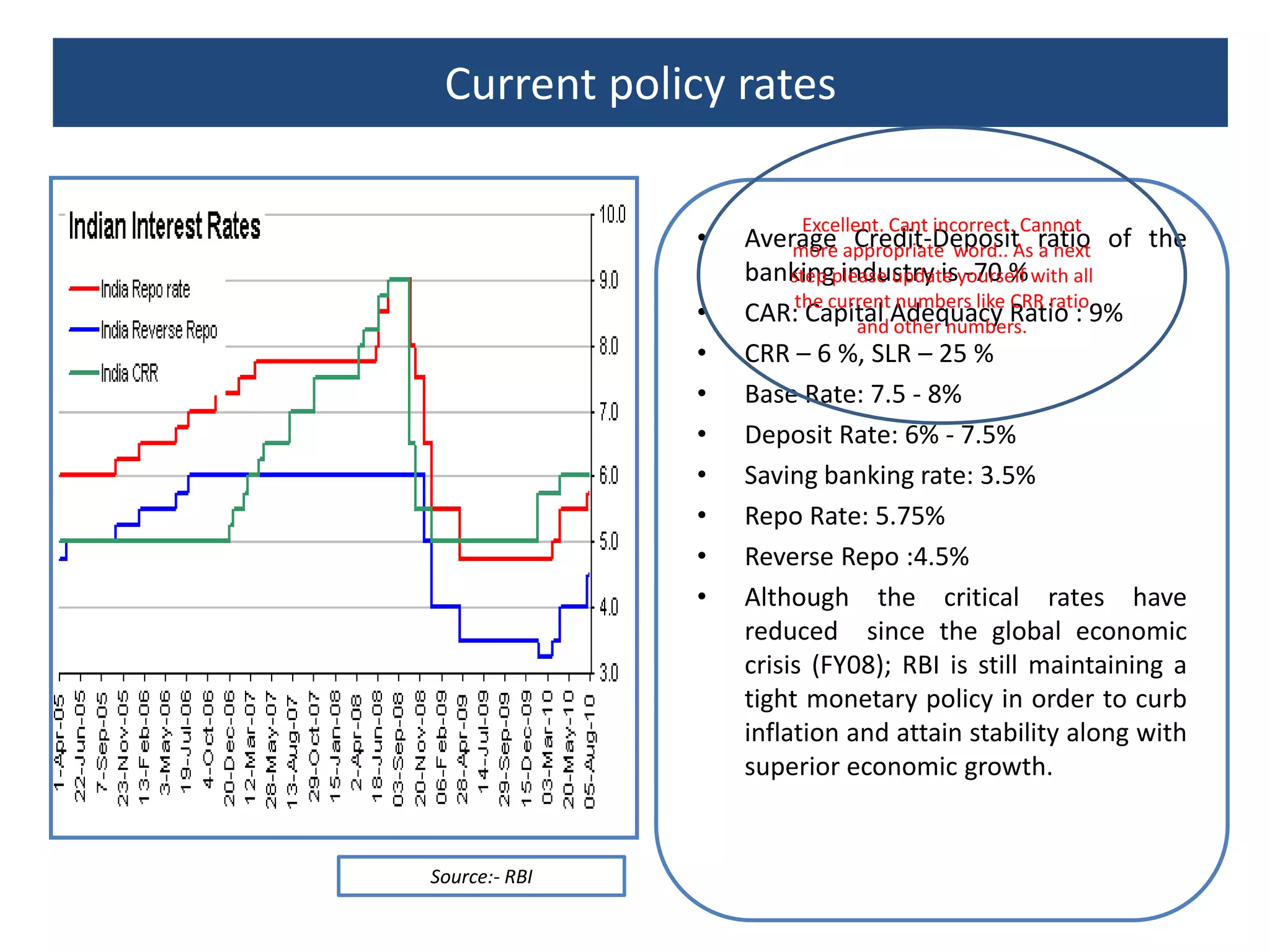

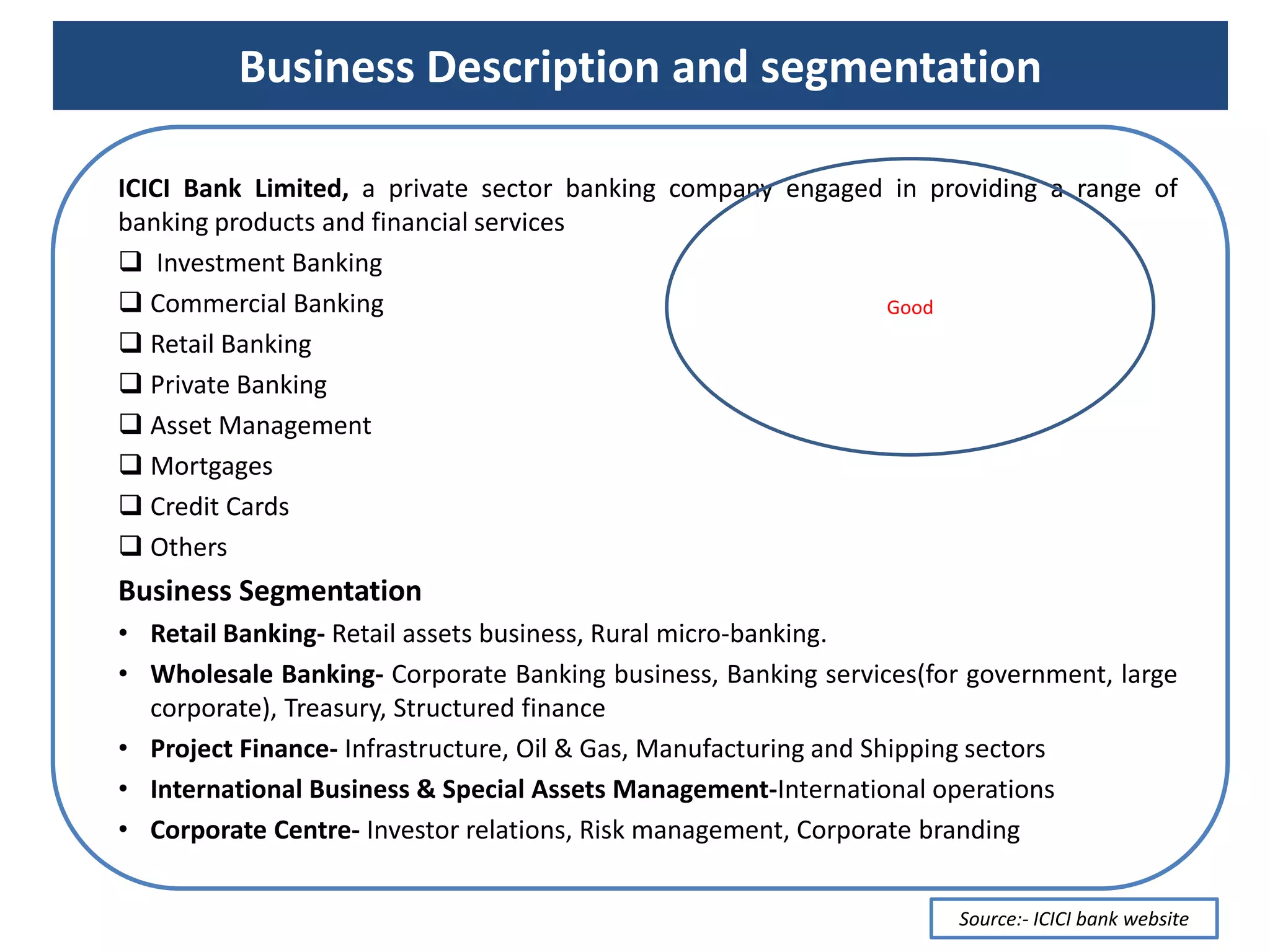

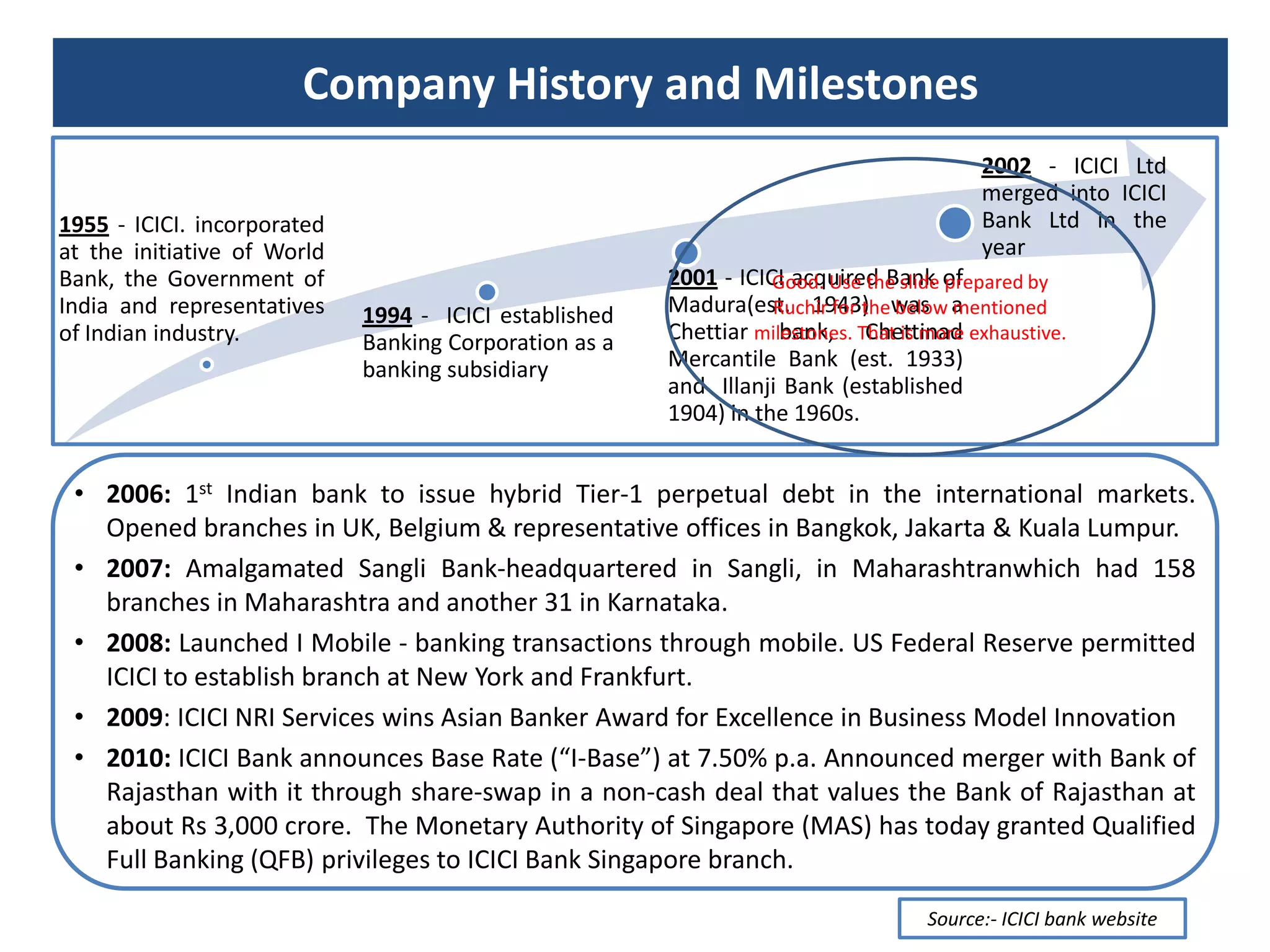

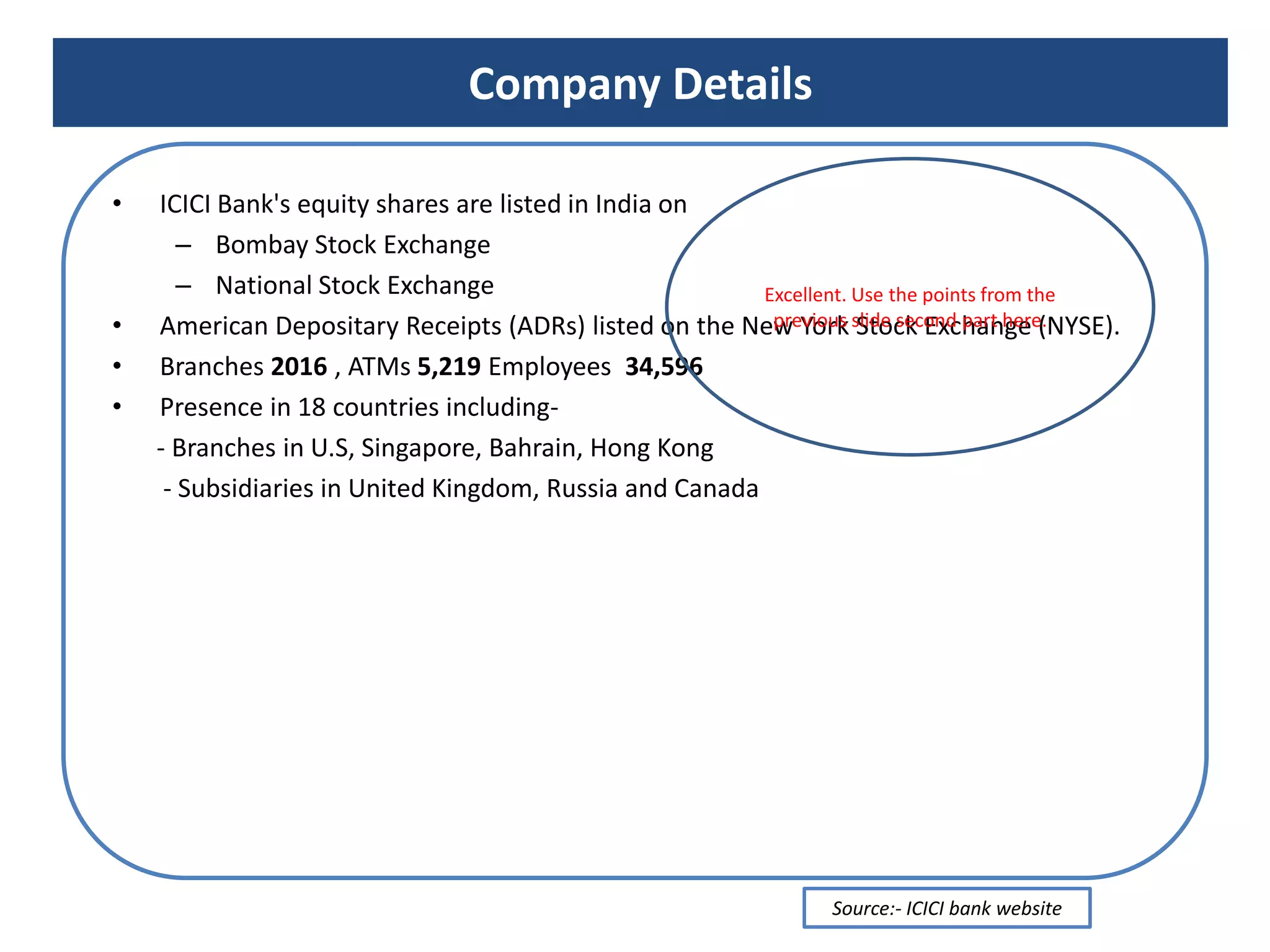

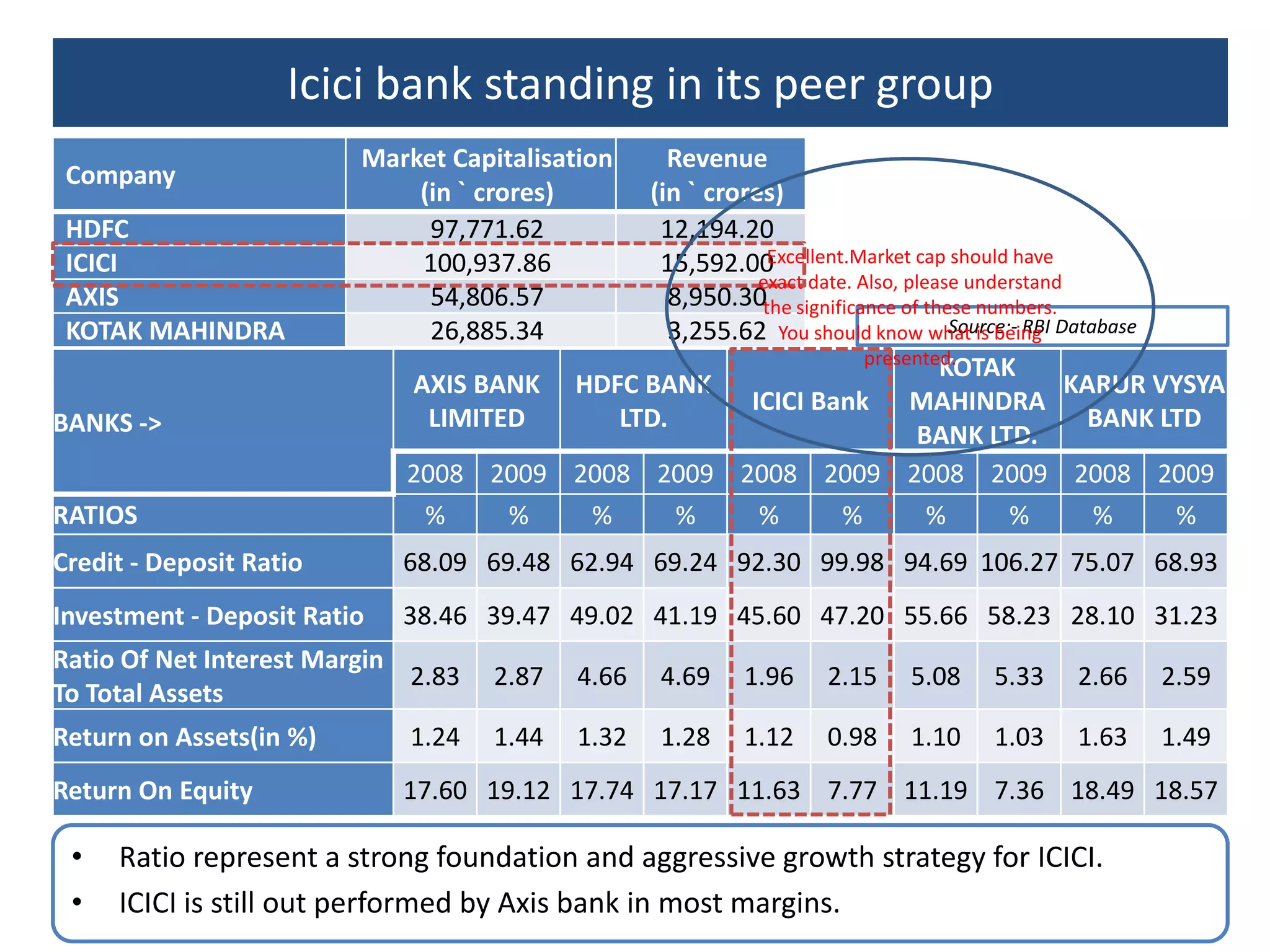

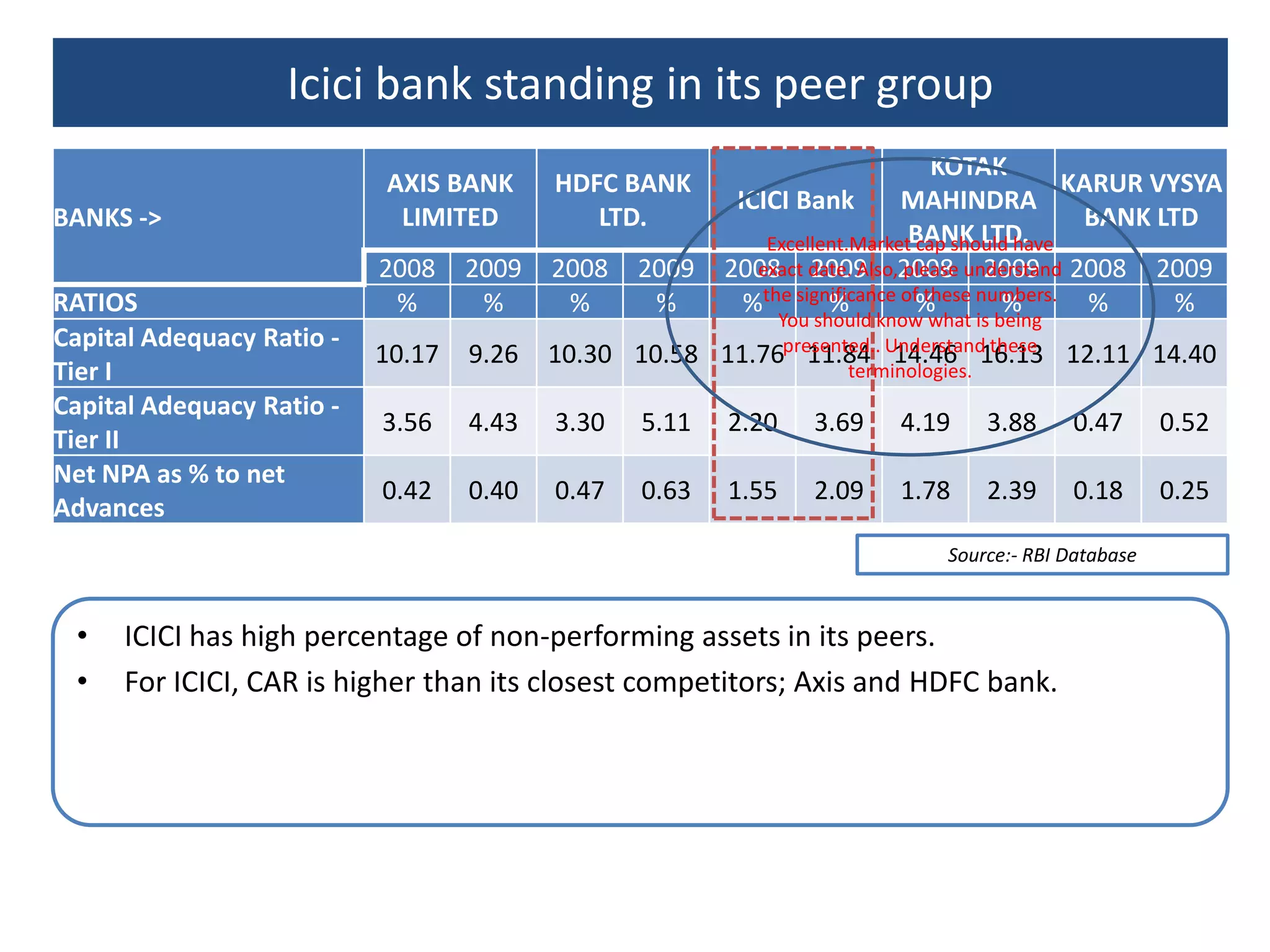

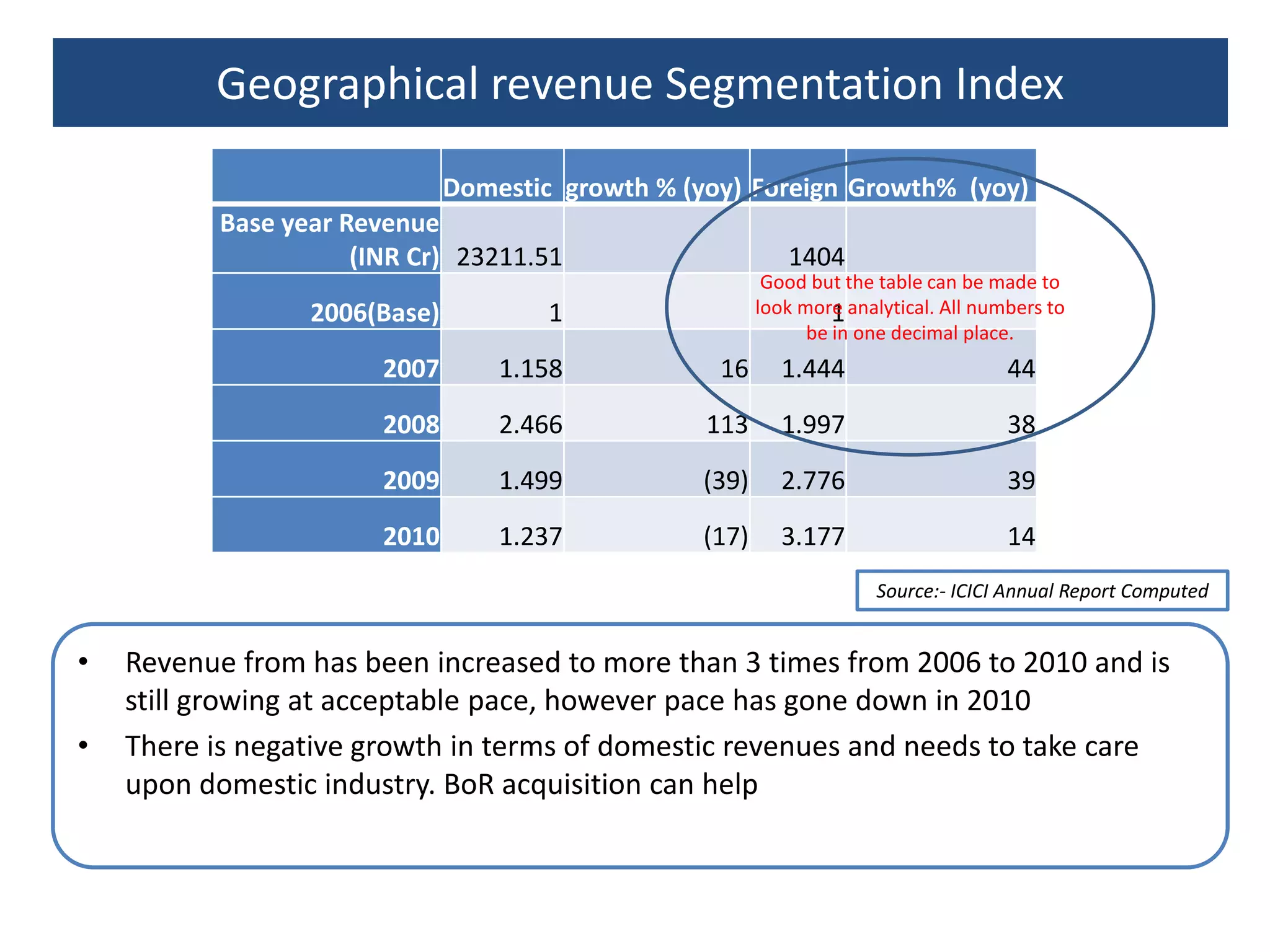

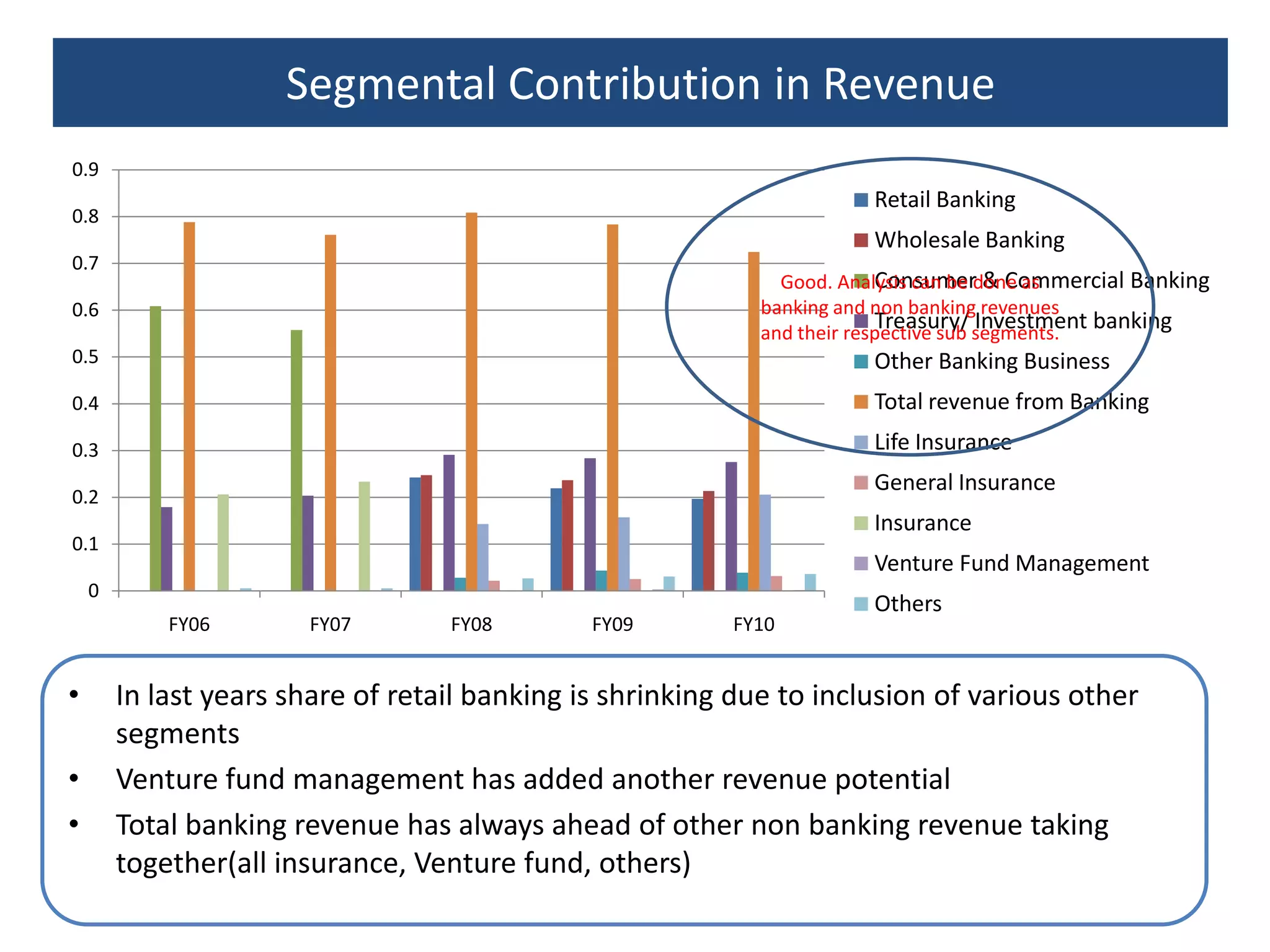

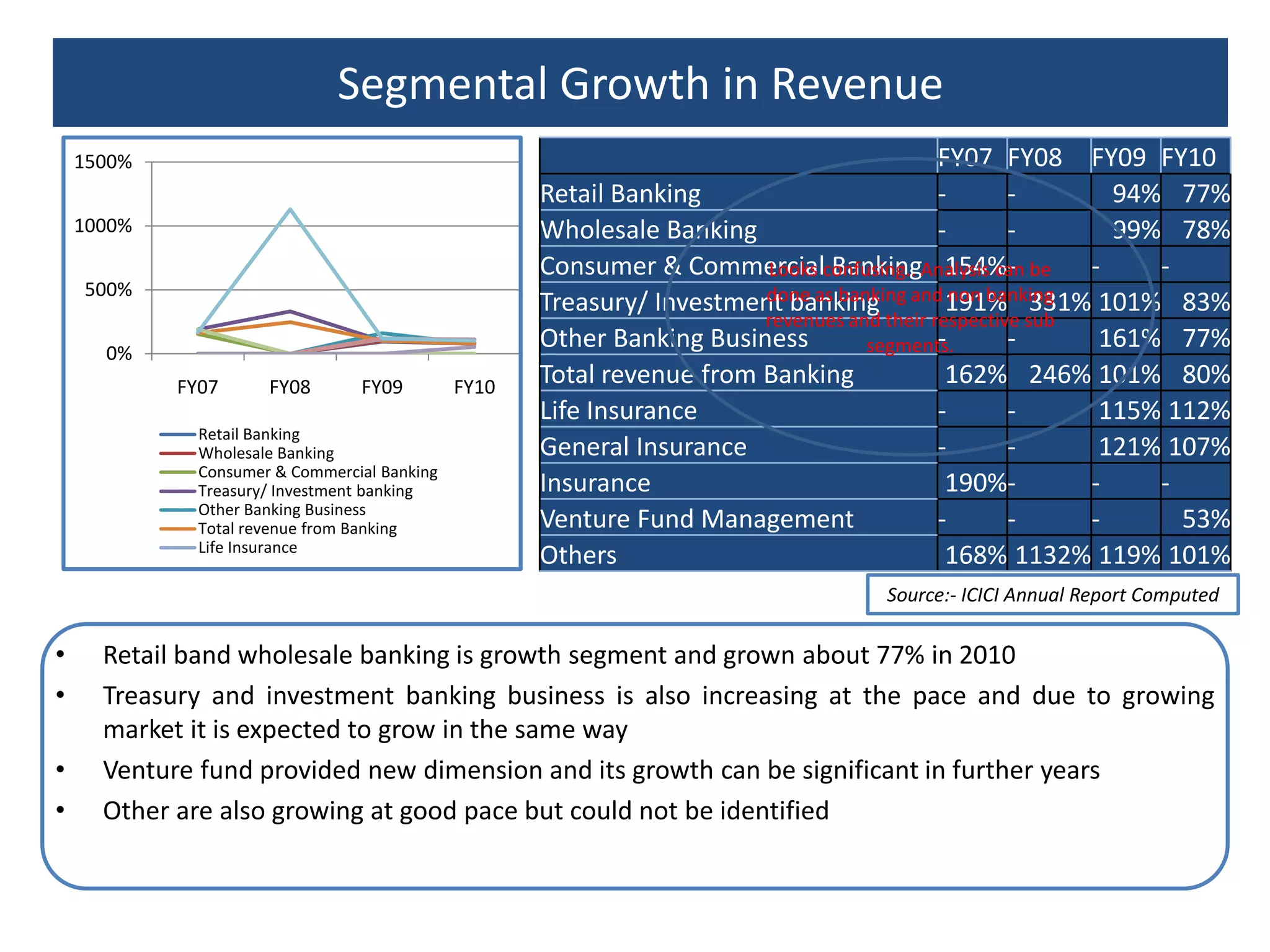

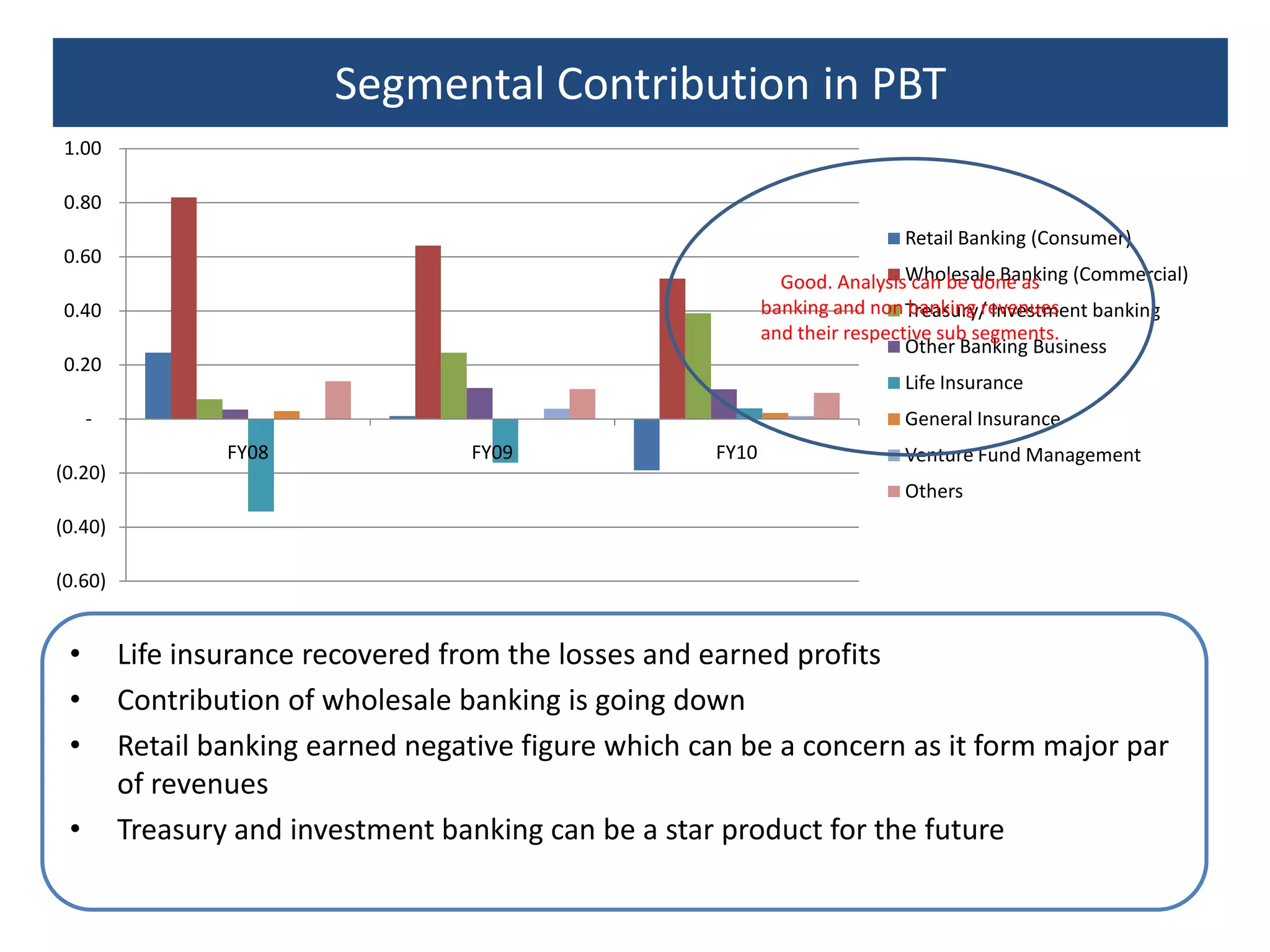

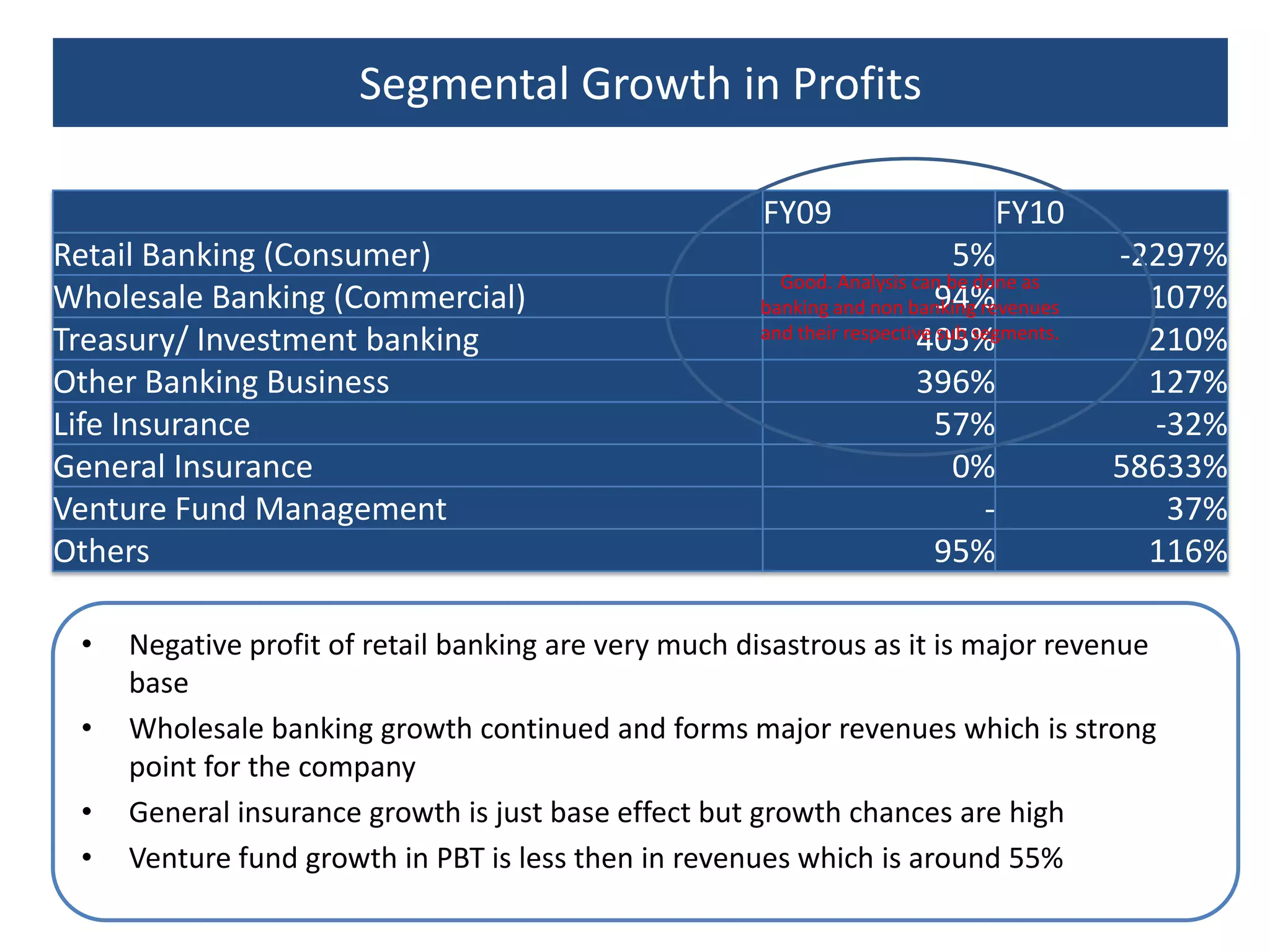

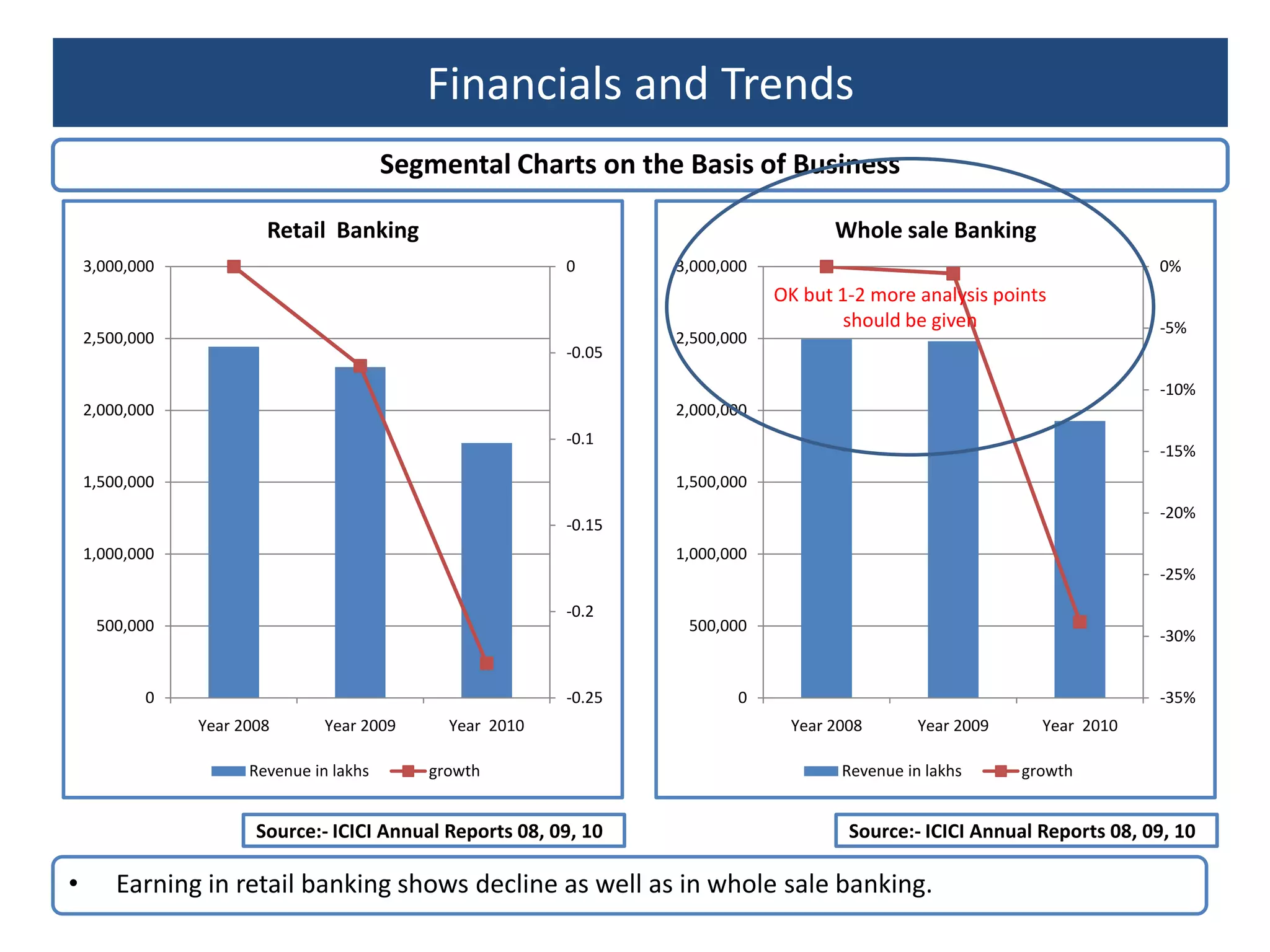

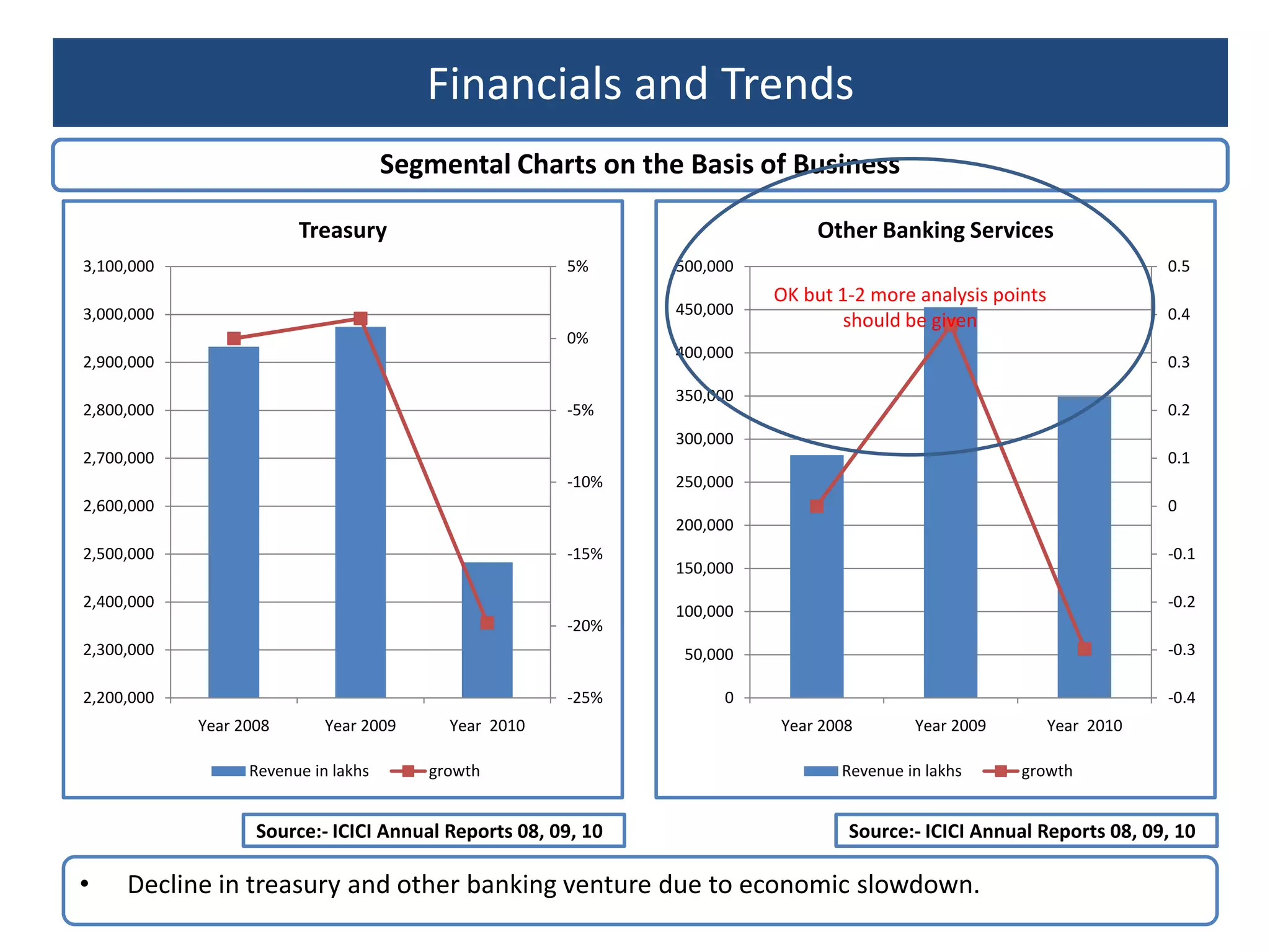

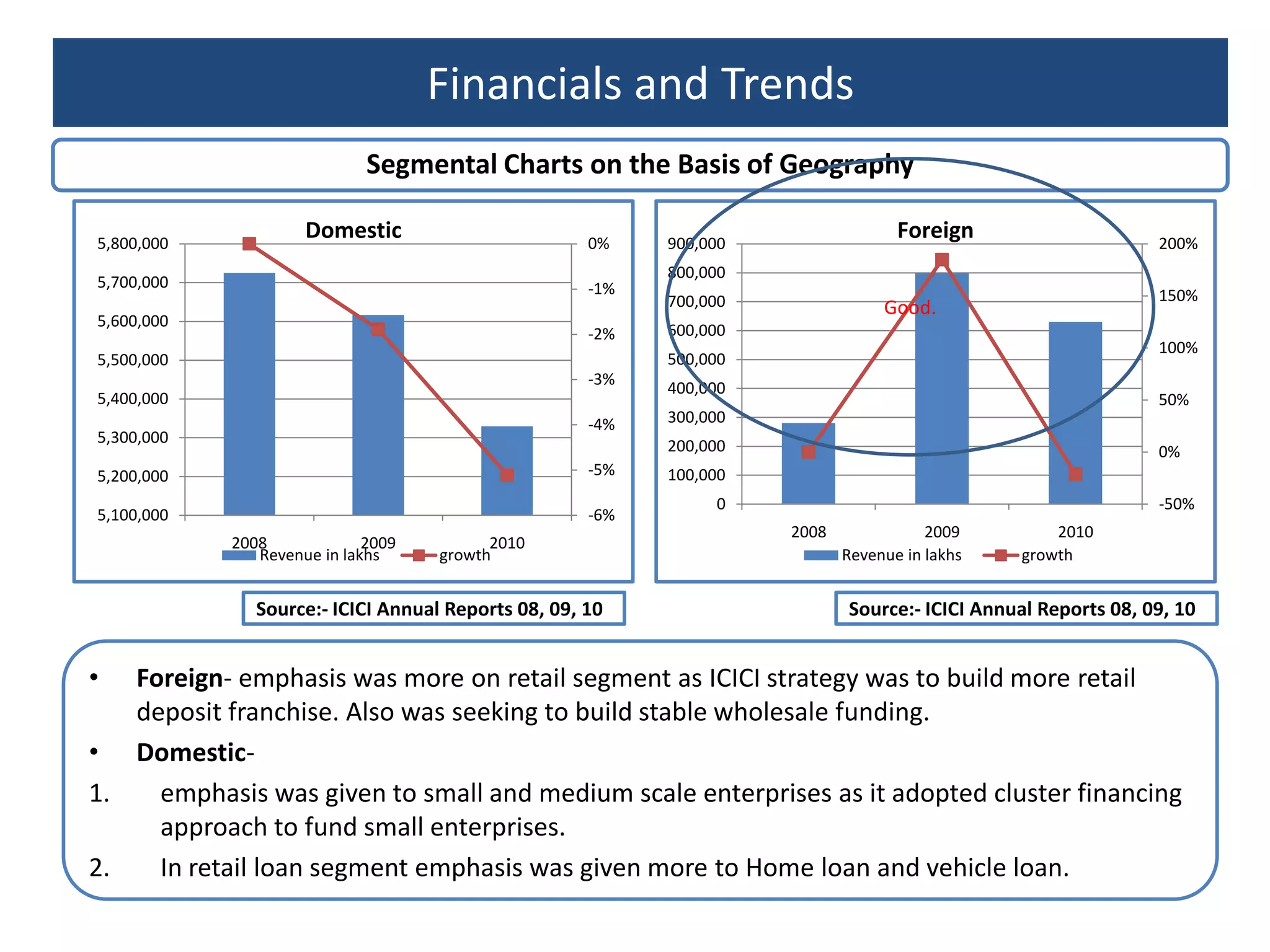

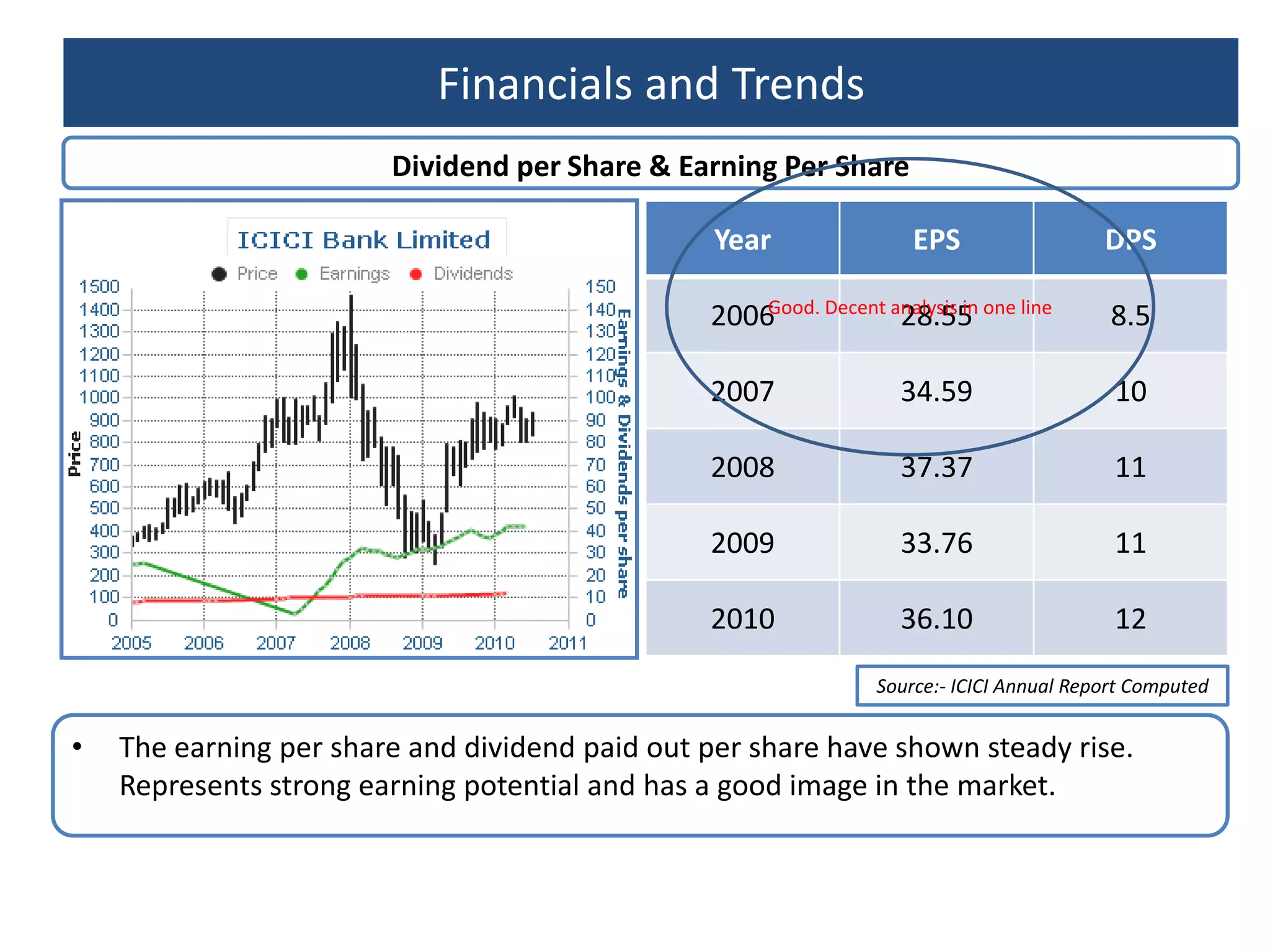

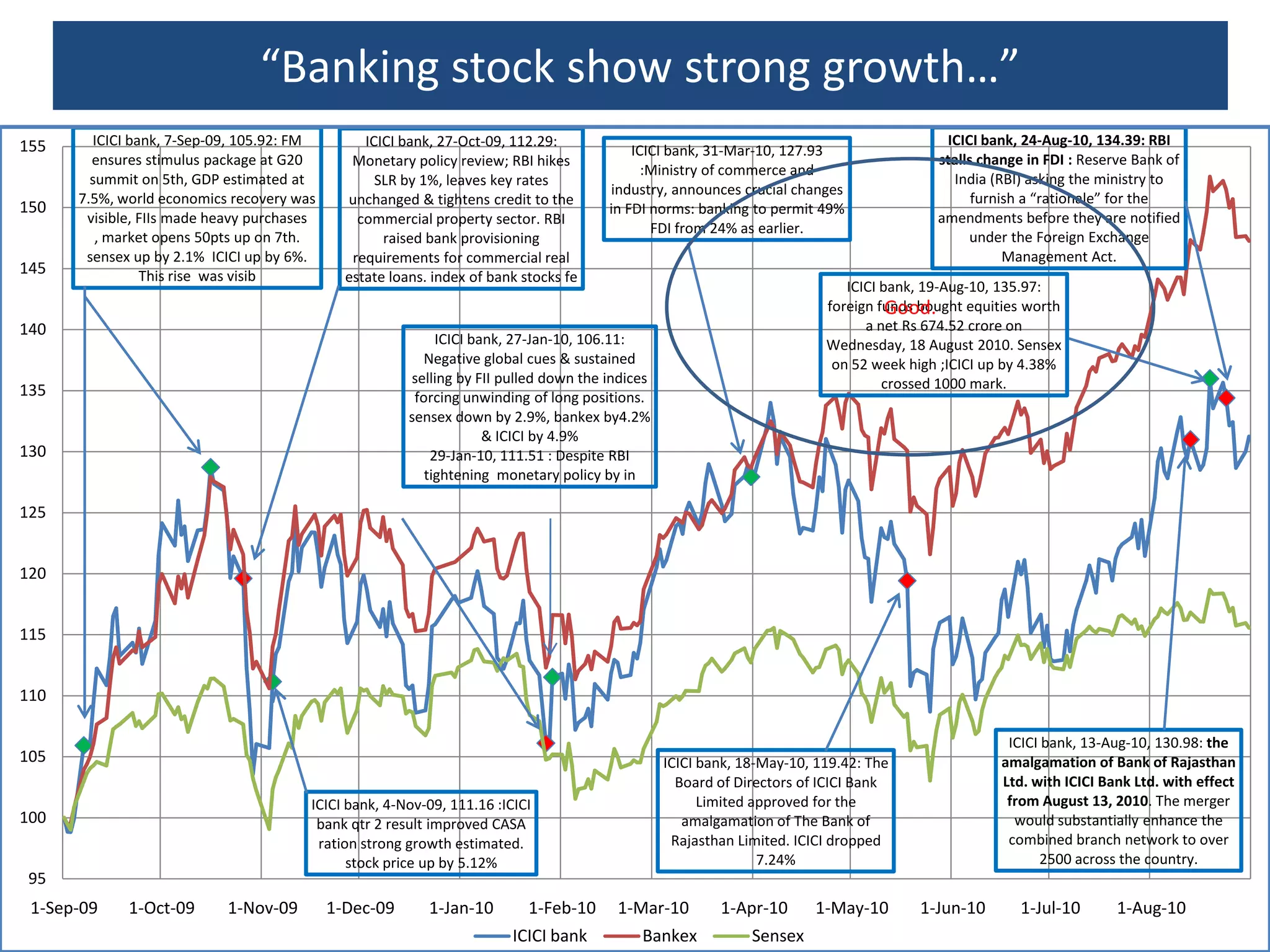

The document provides an overview of the Indian banking industry and an analysis of ICICI Bank. It discusses the structure and segmentation of the Indian banking sector, as well as growth drivers and regulations. For ICICI Bank, the summary discusses the company's business segments, history, financial performance across segments from 2006-2010, and strategies for retail and SME banking. ICICI Bank is focusing on stabilizing underperforming segments and harnessing potential in current segments like SME lending and rural banking.