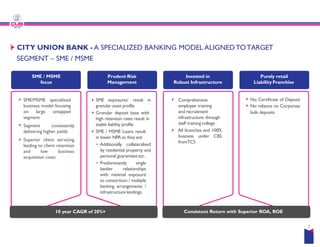

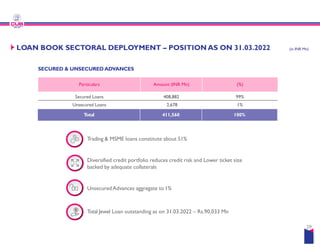

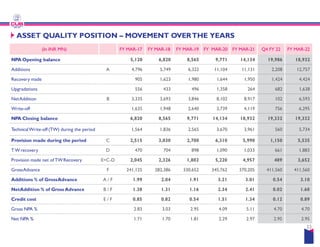

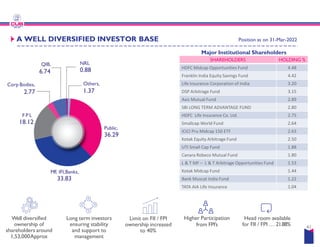

City Union Bank reported strong financial performance for FY 2022. Deposits grew 7% to INR 476,897 million and advances grew 11% to INR 411,560 million. Net profit increased 28% to INR 7,602 million compared to the previous year. Key ratios showed improvement with return on assets at 1.35% compared to 1.15% last year and return on equity at 12.31% versus 10.73% in FY 2021. The bank continues to maintain a strong capital adequacy ratio of 20.85% and net NPA of 2.95%, indicating prudent risk management. Overall, City Union Bank delivered another year of profitable growth backed by its focus on MSME and retail lending.