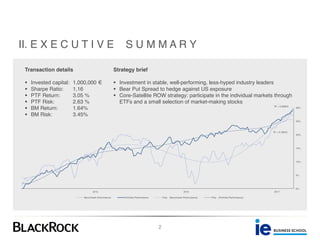

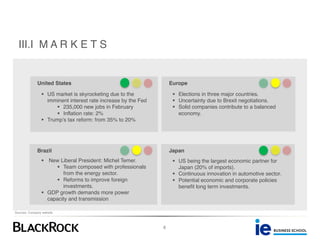

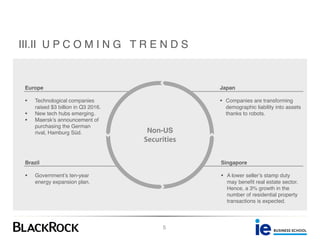

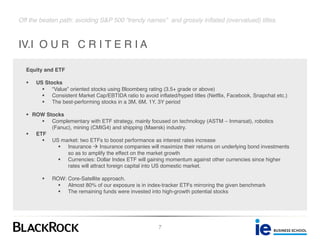

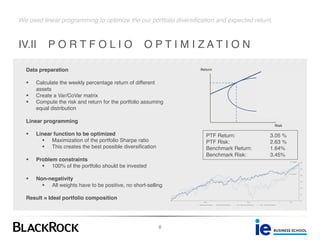

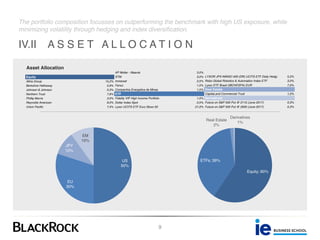

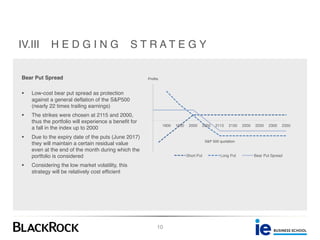

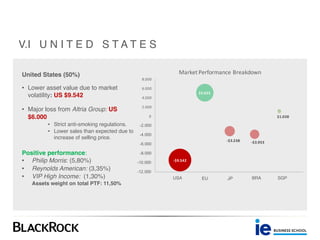

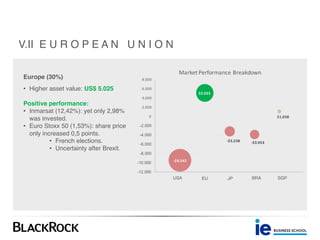

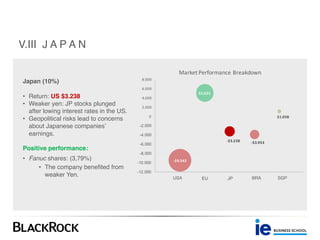

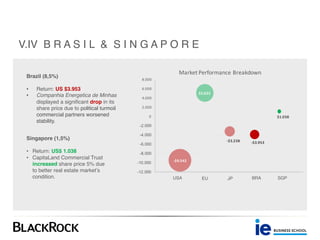

The document presents a detailed case study on a multi-asset investment strategy by a major asset management firm focused on long-term growth through diversified and calculated risk allocation. It outlines investment criteria, portfolio composition, and performance metrics, revealing both successes and losses across various market sectors, especially highlighting their hedging strategies against market volatility. The firm emphasizes fiduciary responsibility, innovation, and a commitment to outperforming benchmark returns while careful of overvaluation risks.