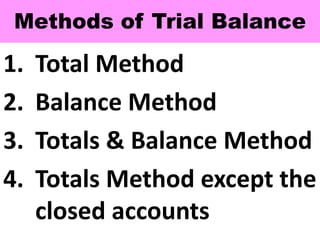

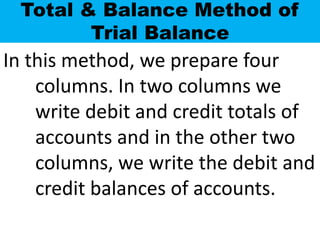

The document discusses accounting processes and trial balances. It explains that accounting involves recording financial transactions, which are then classified, identified, summarized, and analyzed to facilitate financial and managerial decision making. A trial balance is a worksheet that compiles account balances from the general ledger into debit and credit columns, where totals must be equal. Trial balances serve several purposes, including checking arithmetic accuracy and the application of double-entry principles. The document outlines different methods for preparing a trial balance, such as the total method, balance method, totals and balance method, and totals method excluding closed accounts.