Embed presentation

Downloaded 39 times

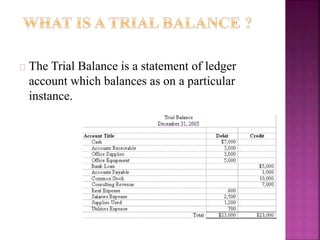

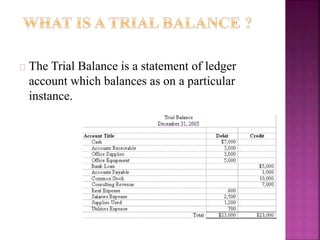

The document discusses the trial balance, which is a statement that balances ledger accounts as of a particular date. A trial balance is generally prepared at the end of the year to check the arithmetical accuracy of accounts and ensure debits equal credits. Errors can be classified as those disclosed or not disclosed by the trial balance, and include errors of omission, commission, principle, calculation, posting, and amounts. Suspense accounts and correcting entries are used to fix errors, while computerized packages like Tally and SAP have been introduced for accounting.