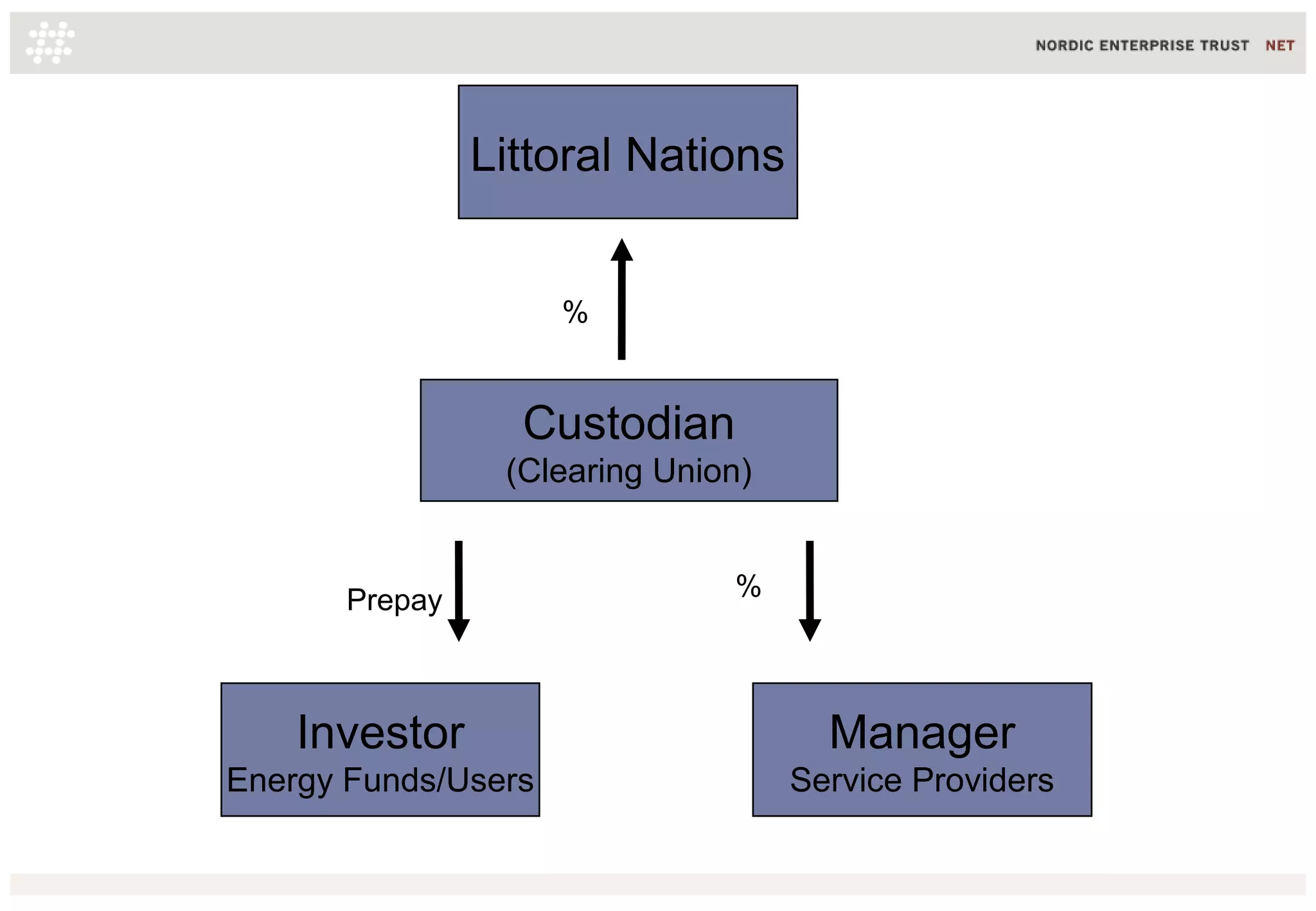

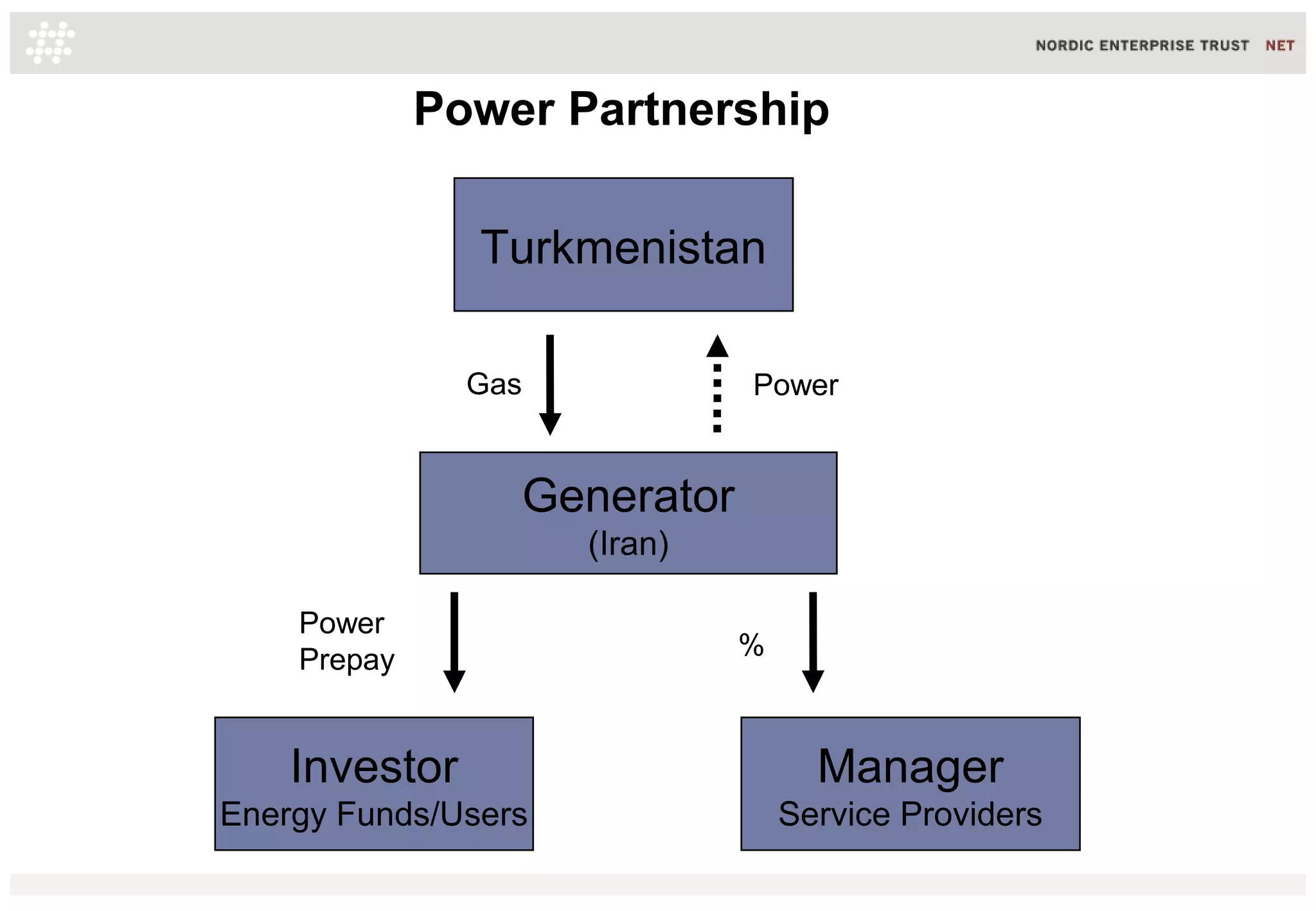

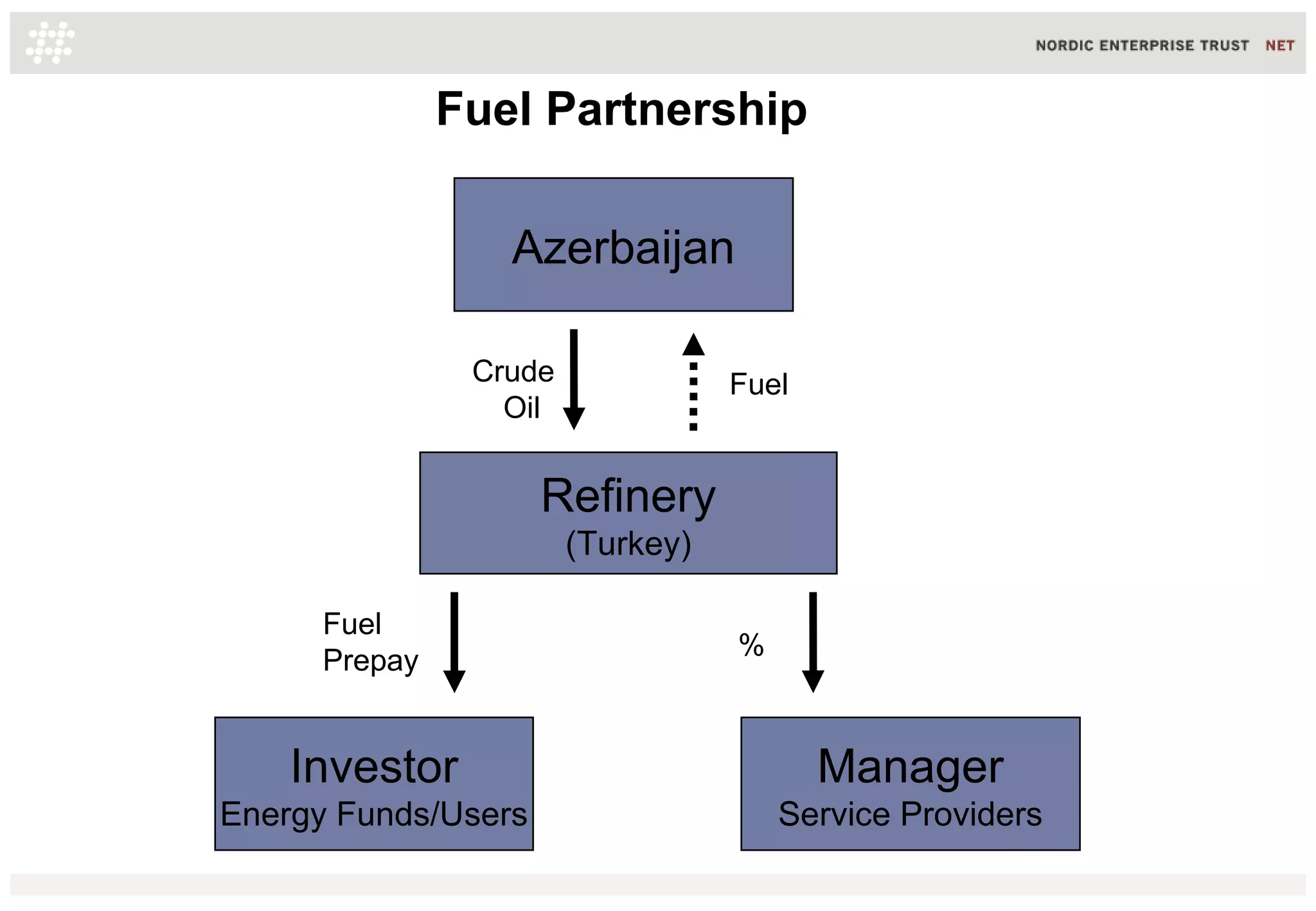

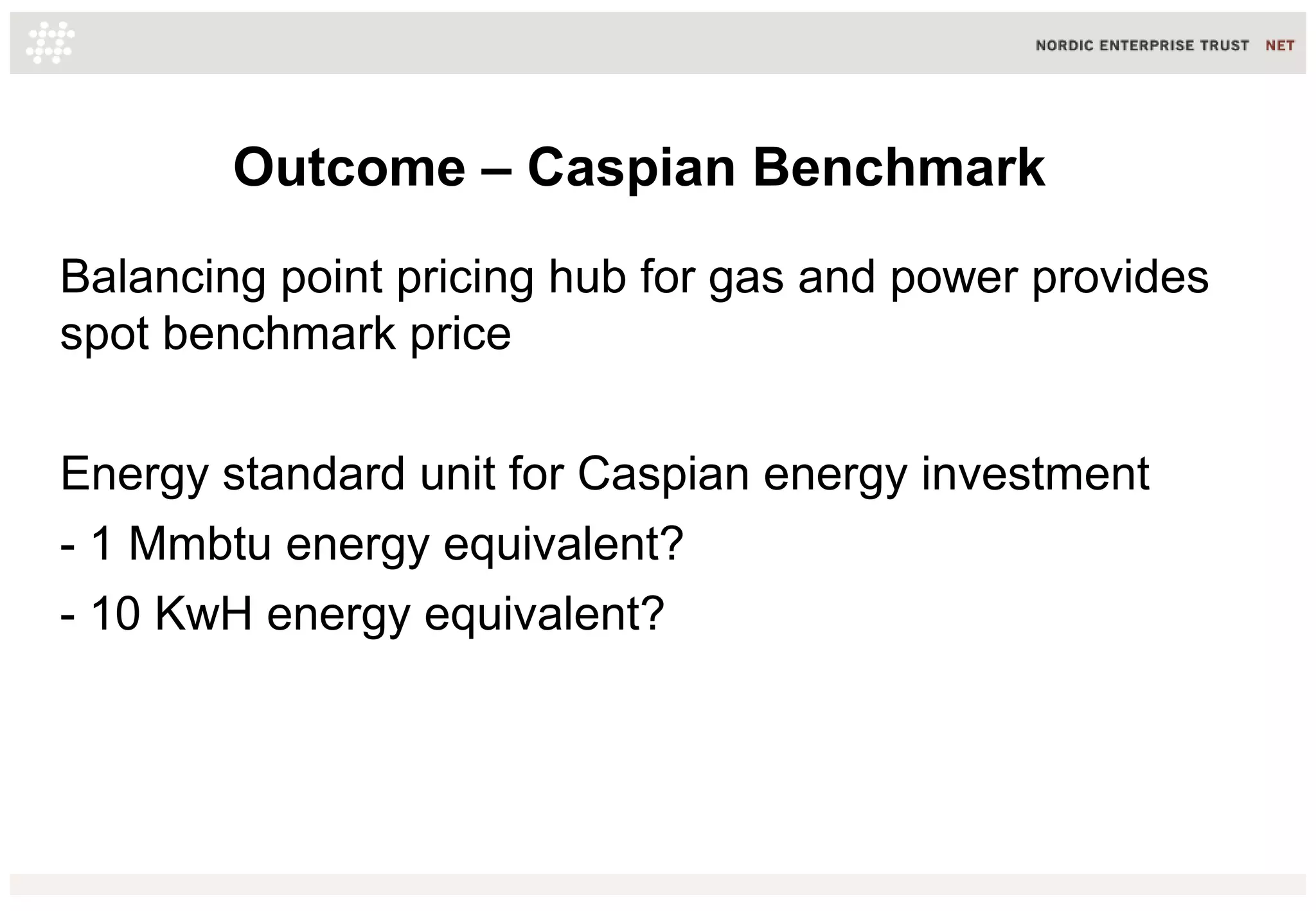

This document discusses a proposed transition to a "Natural Grid" energy system through the establishment of a Caspian Capital Partnership and use of "Prepay" energy financial instruments. It proposes a neutral framework to facilitate regional energy cooperation among Caspian nations based on collaborative agreements between stakeholders. Through this system, energy producers could issue prepaid energy credits that are purchased by investors and returned against future energy supply, providing investment in renewable infrastructure development and transition to a lower carbon economy. The goal is a more distributed, resilient and equitable energy sharing system without any single stakeholder having dominant control.