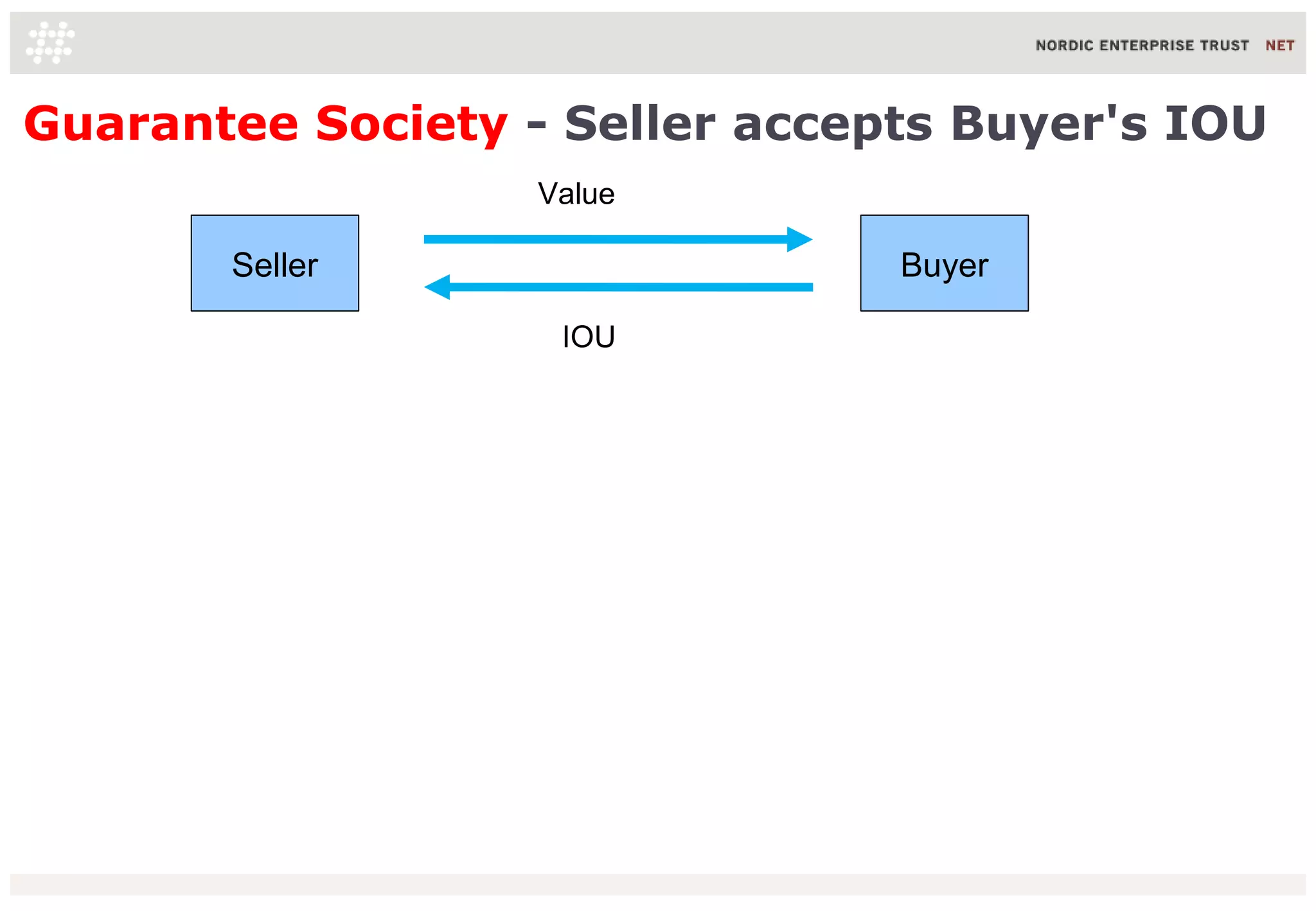

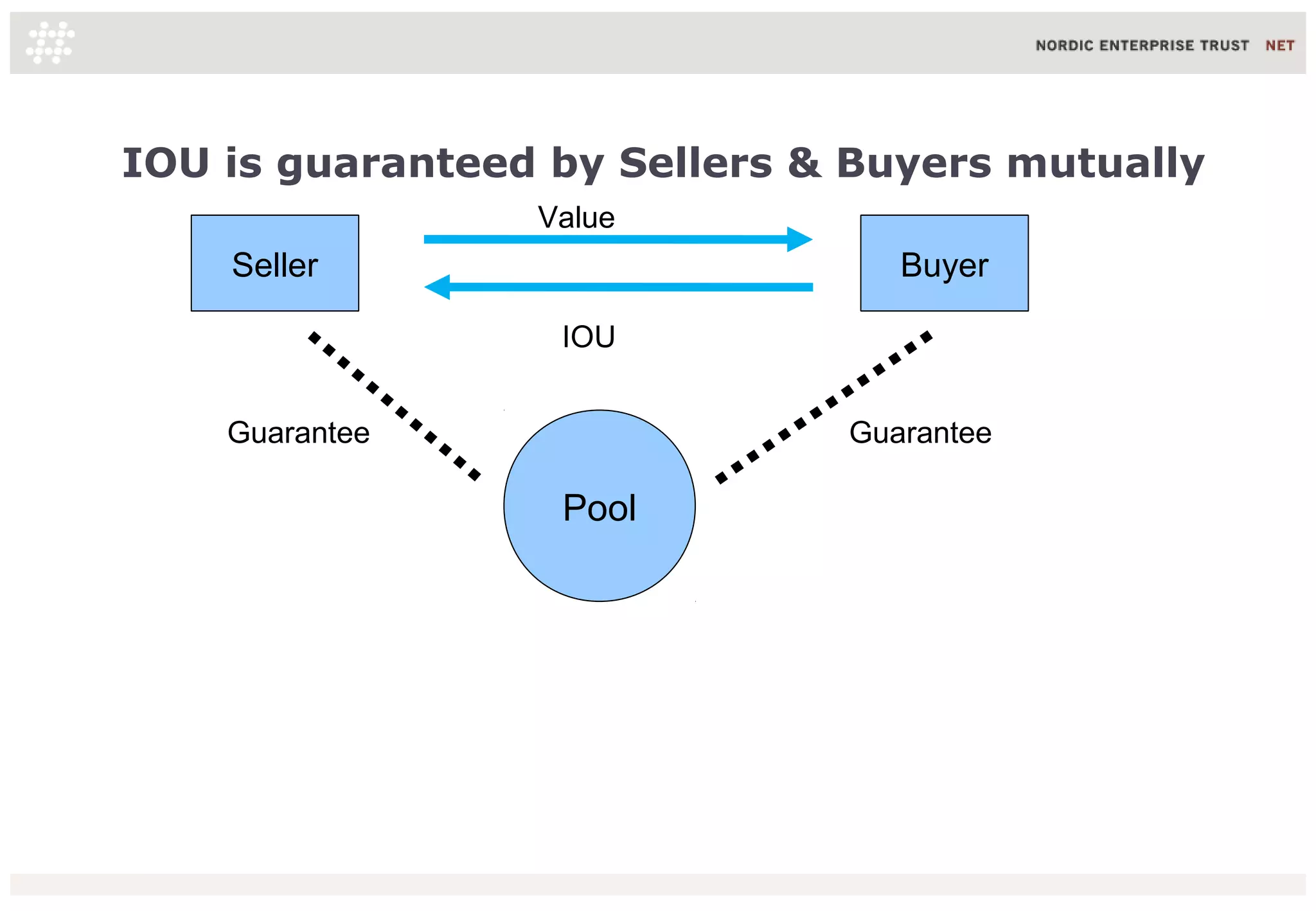

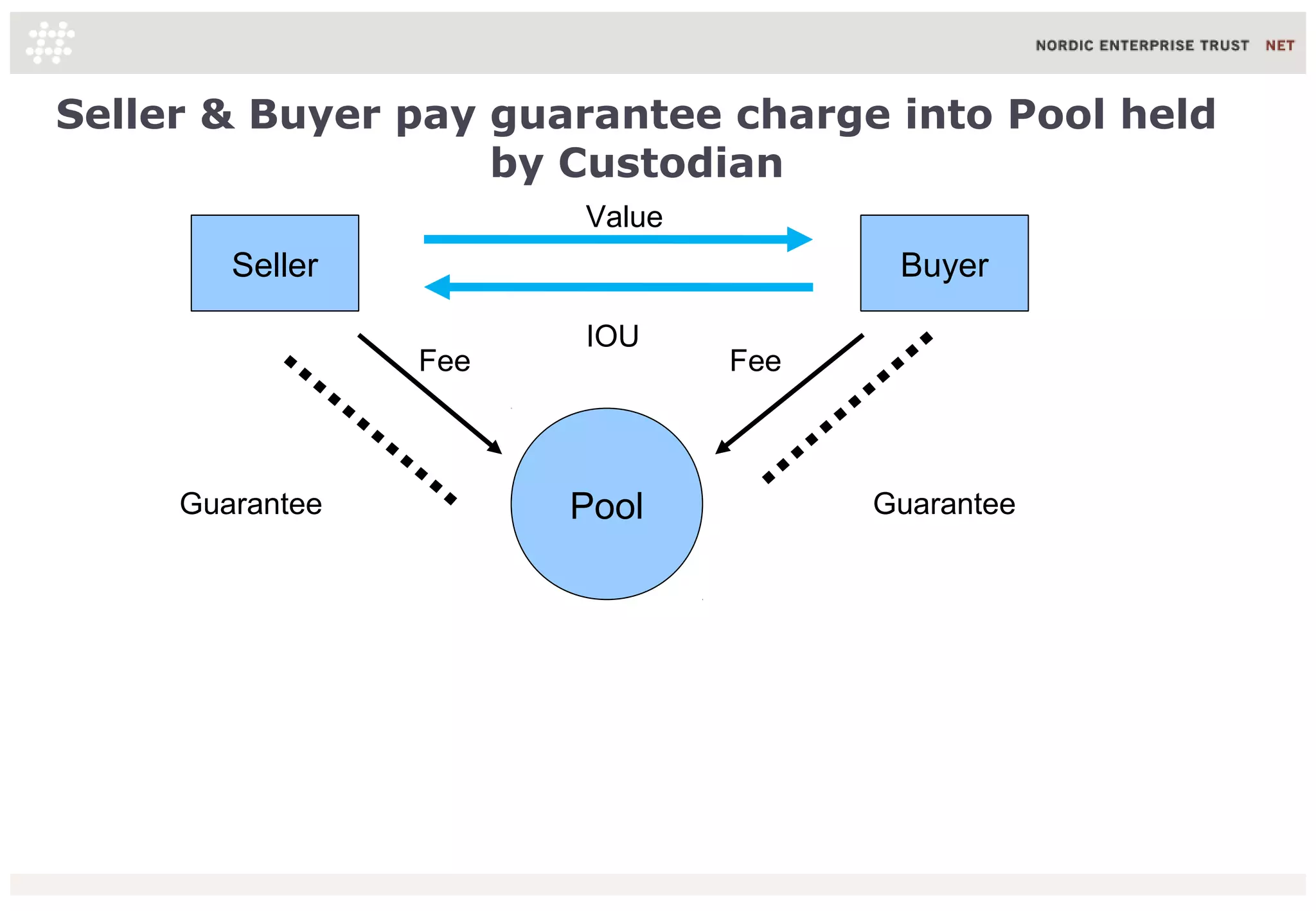

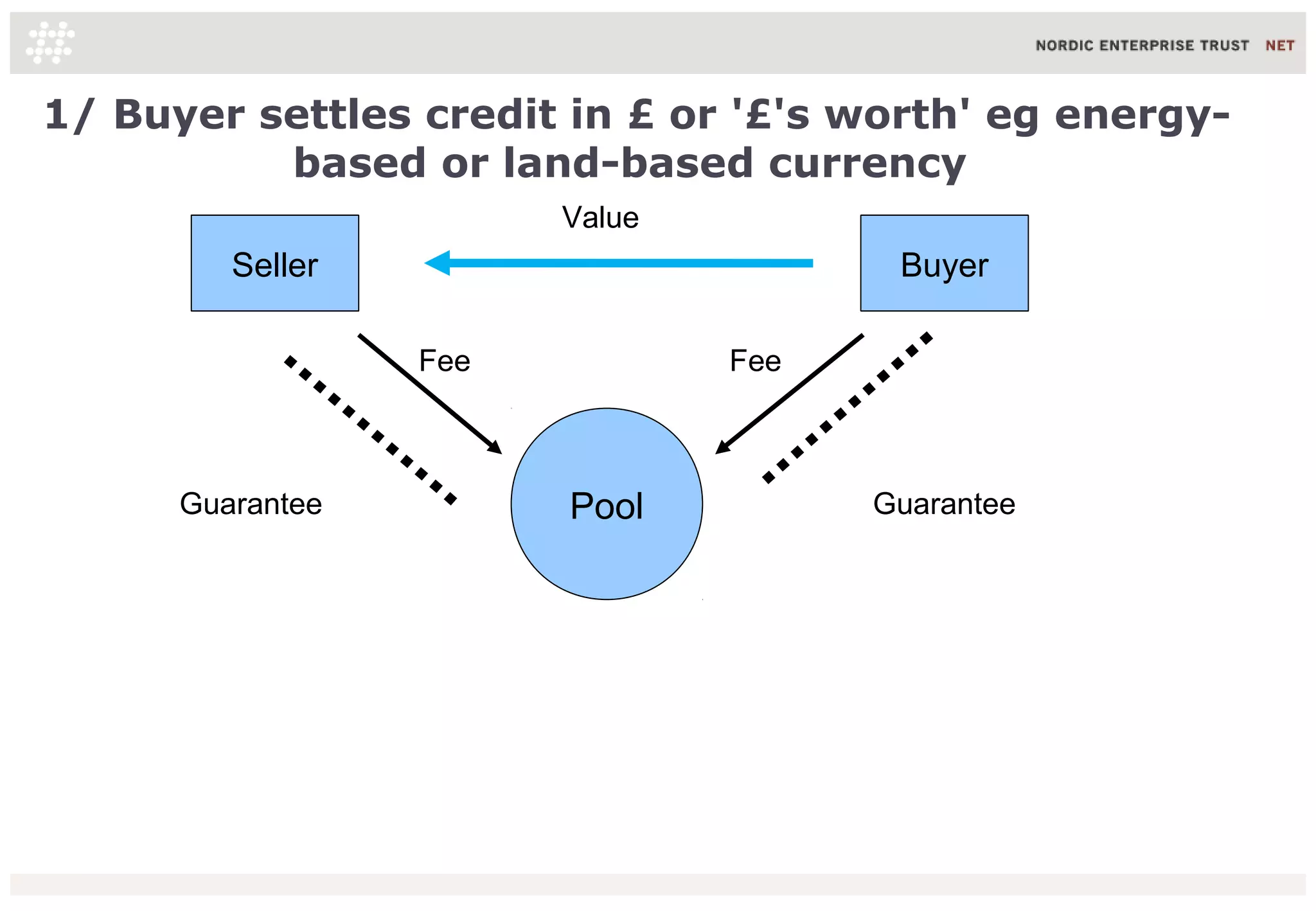

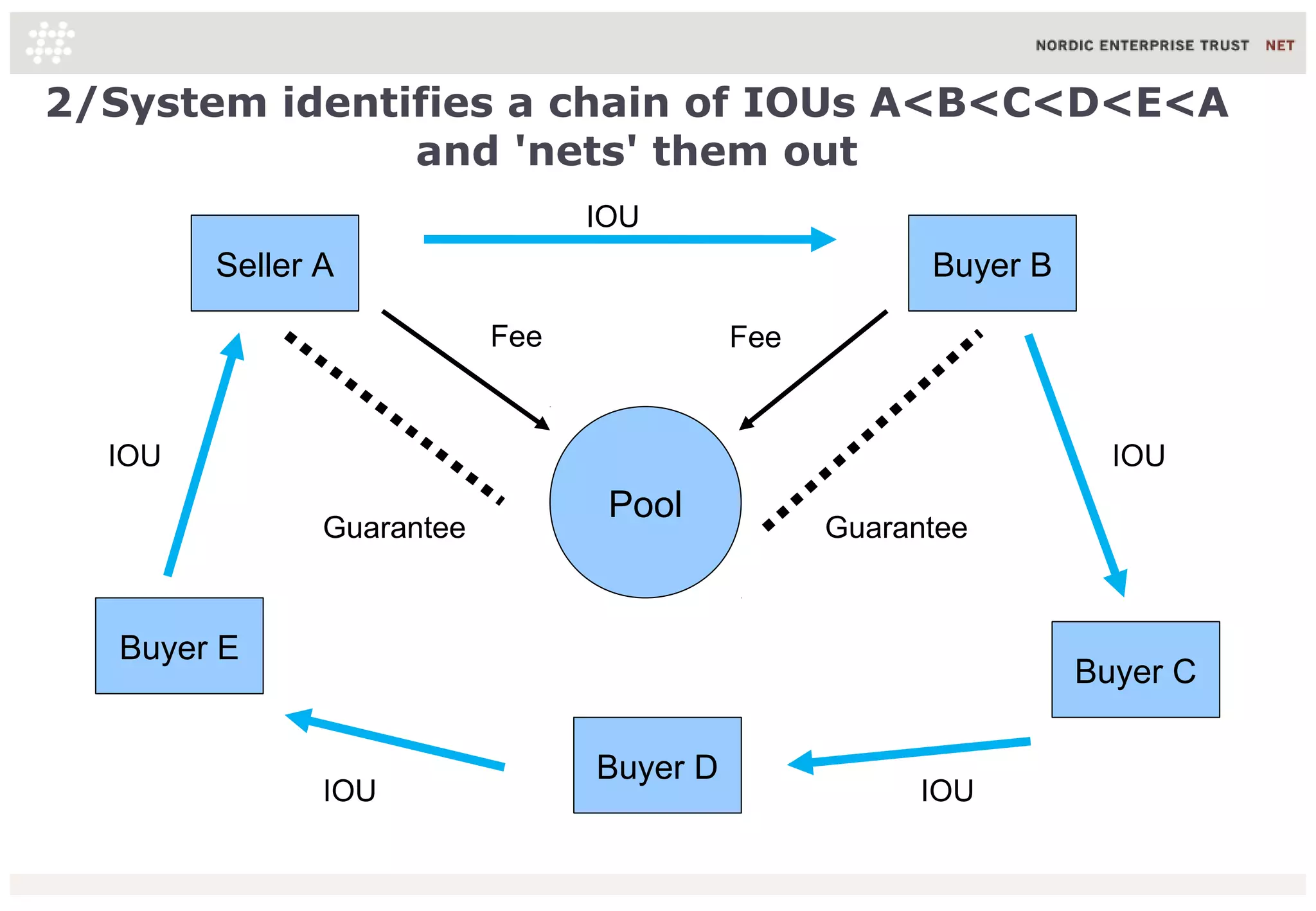

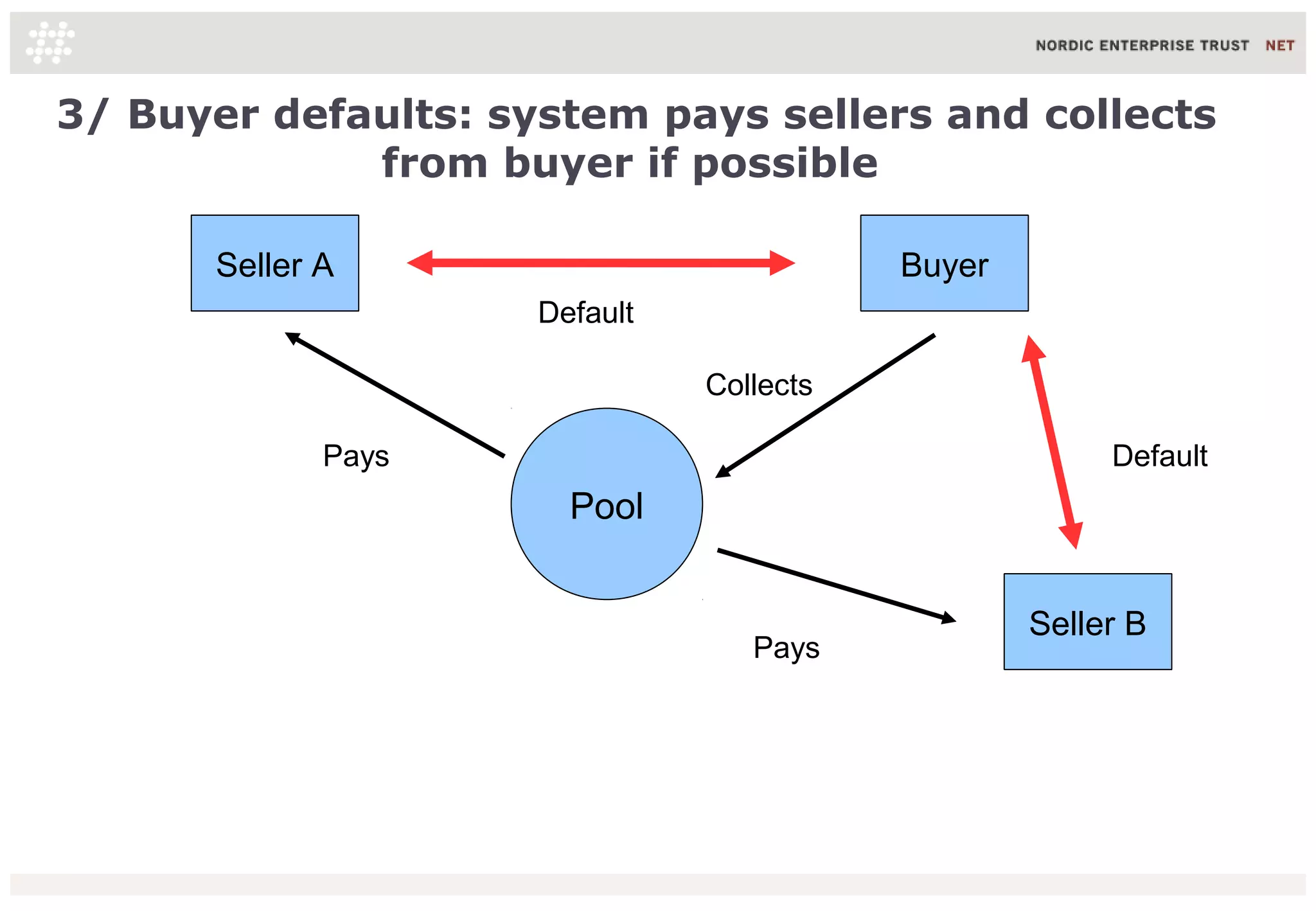

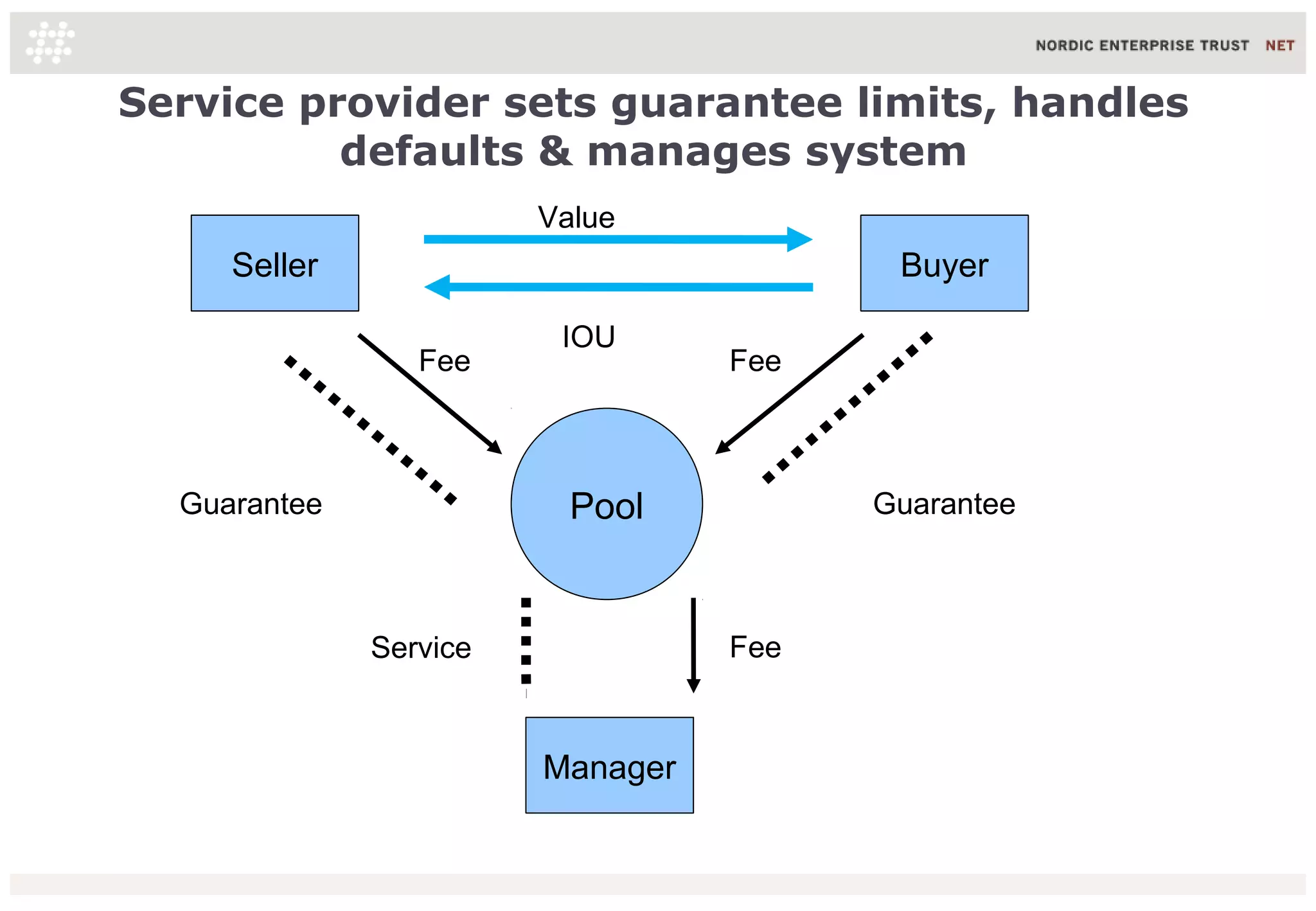

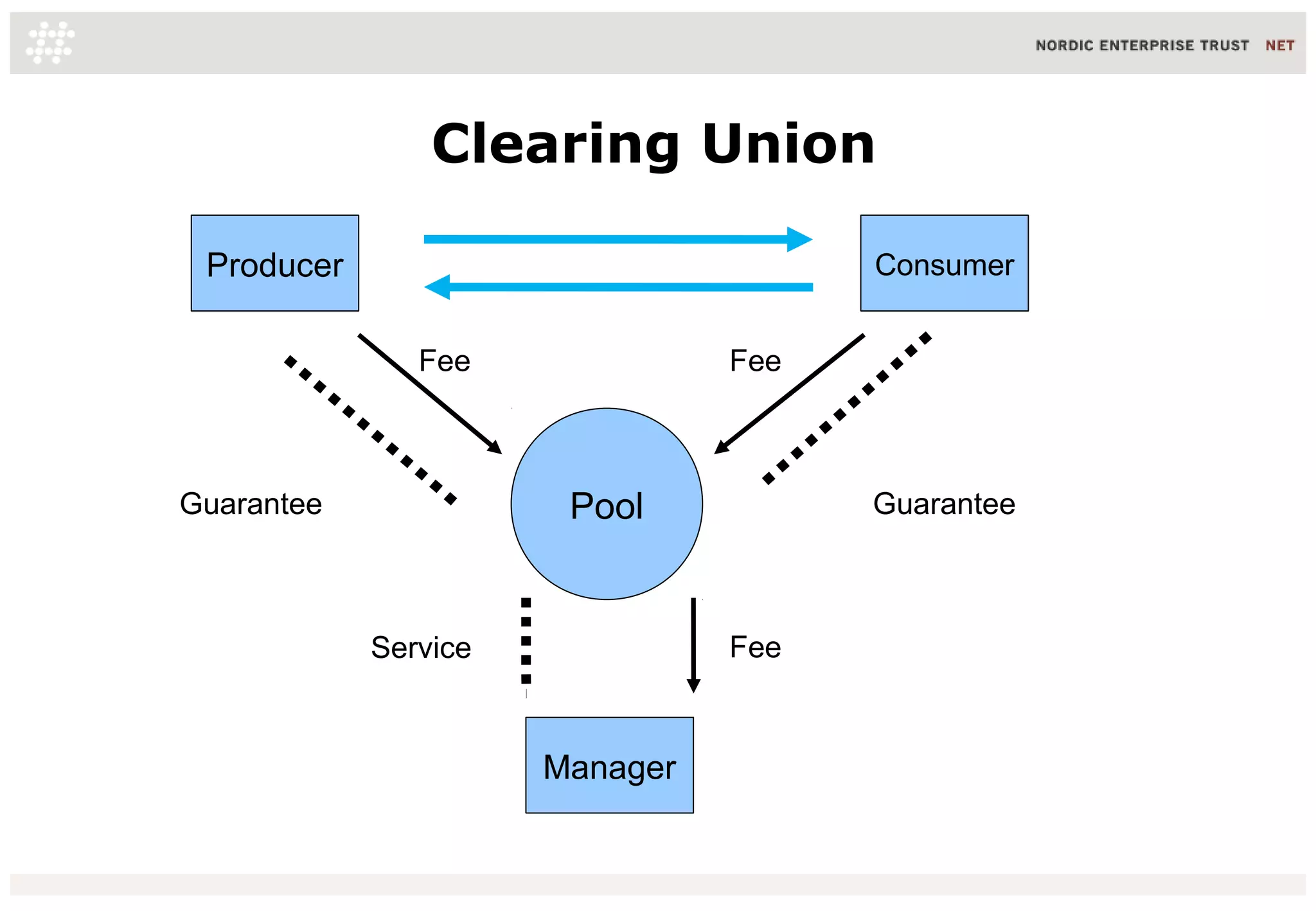

This document proposes a "Guarantee Society" approach to create a resilient Market 3.0 through open capital and financial resilience. It involves sellers accepting buyers' IOUs that are guaranteed by a pool funded by guarantee fees paid by both parties. Defaults are handled by collecting from buyers or paying sellers from the pool managed by a service provider. The model is based on Protection & Indemnity Clubs that have mutually guaranteed risks for over 140 years, showing 21st century problems can be solved through reviving pre-existing solutions rather than only 20th century approaches.