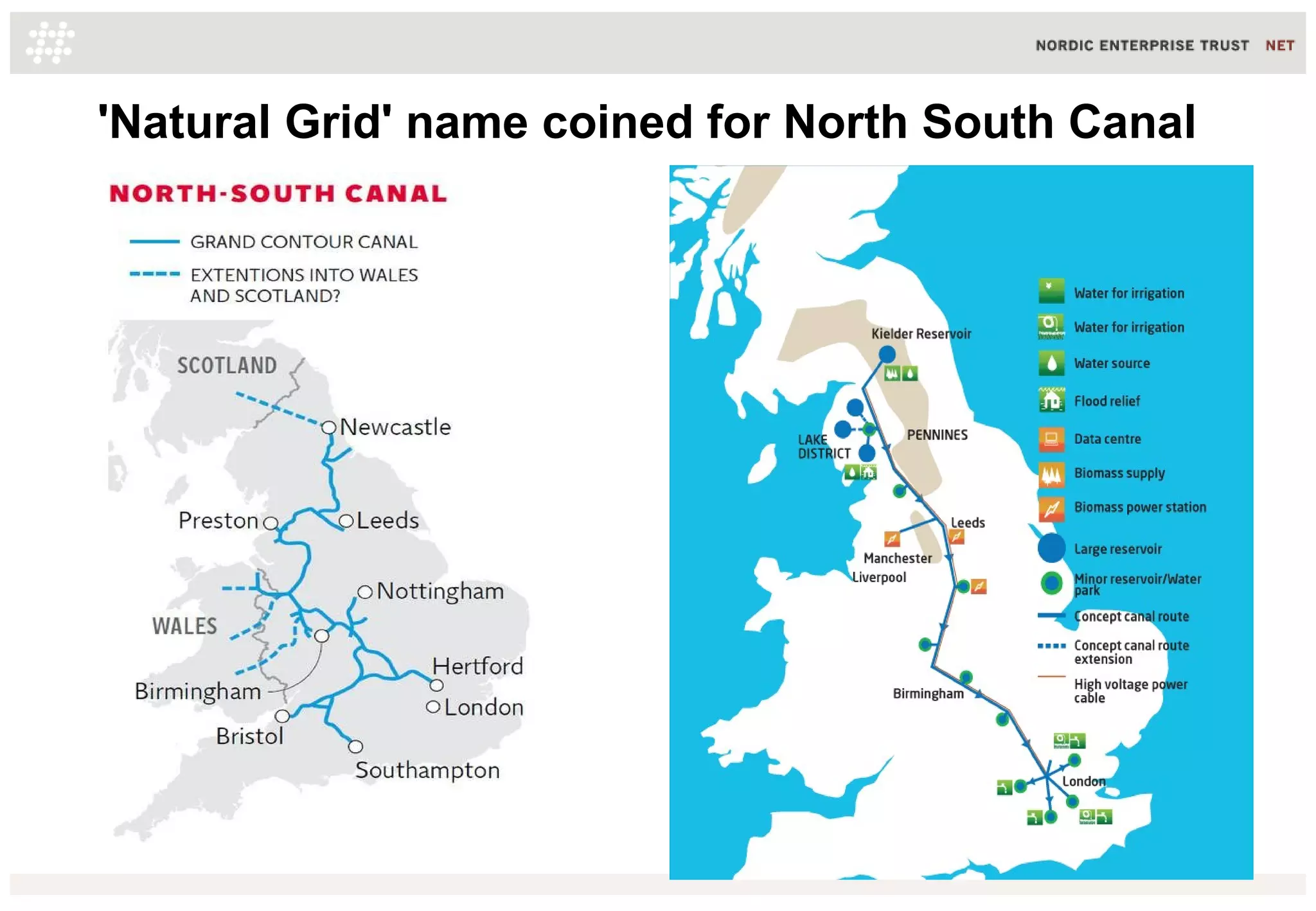

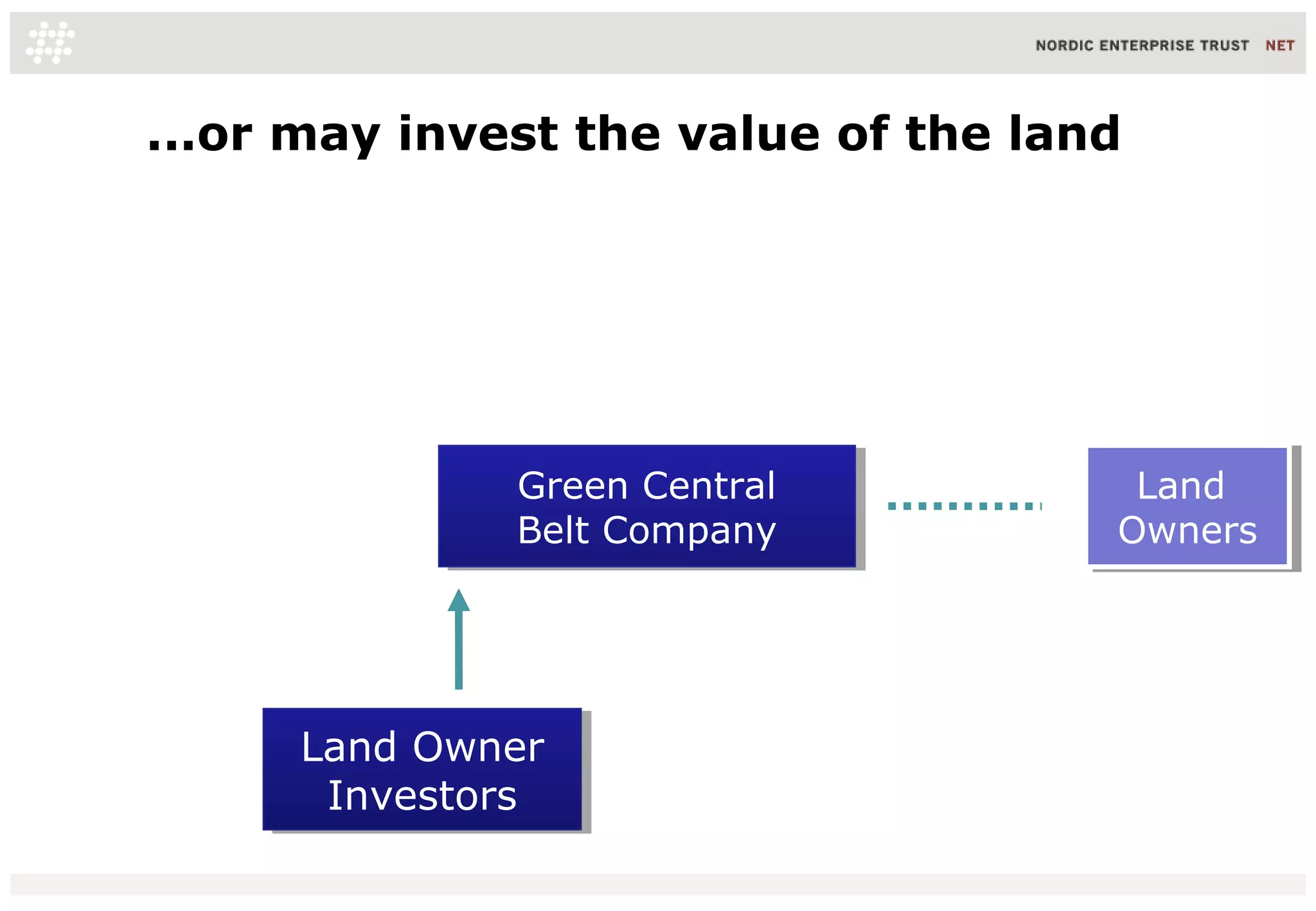

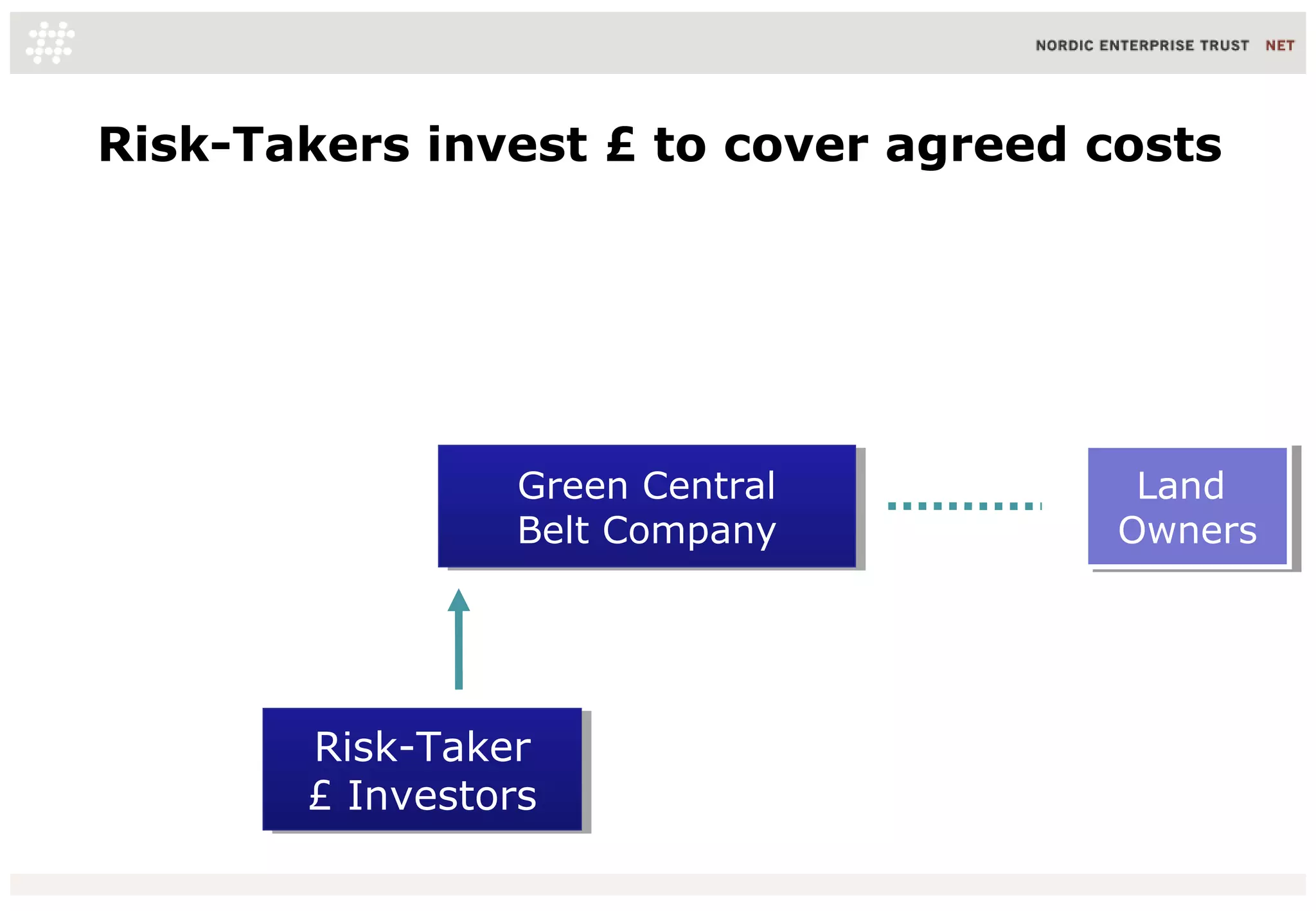

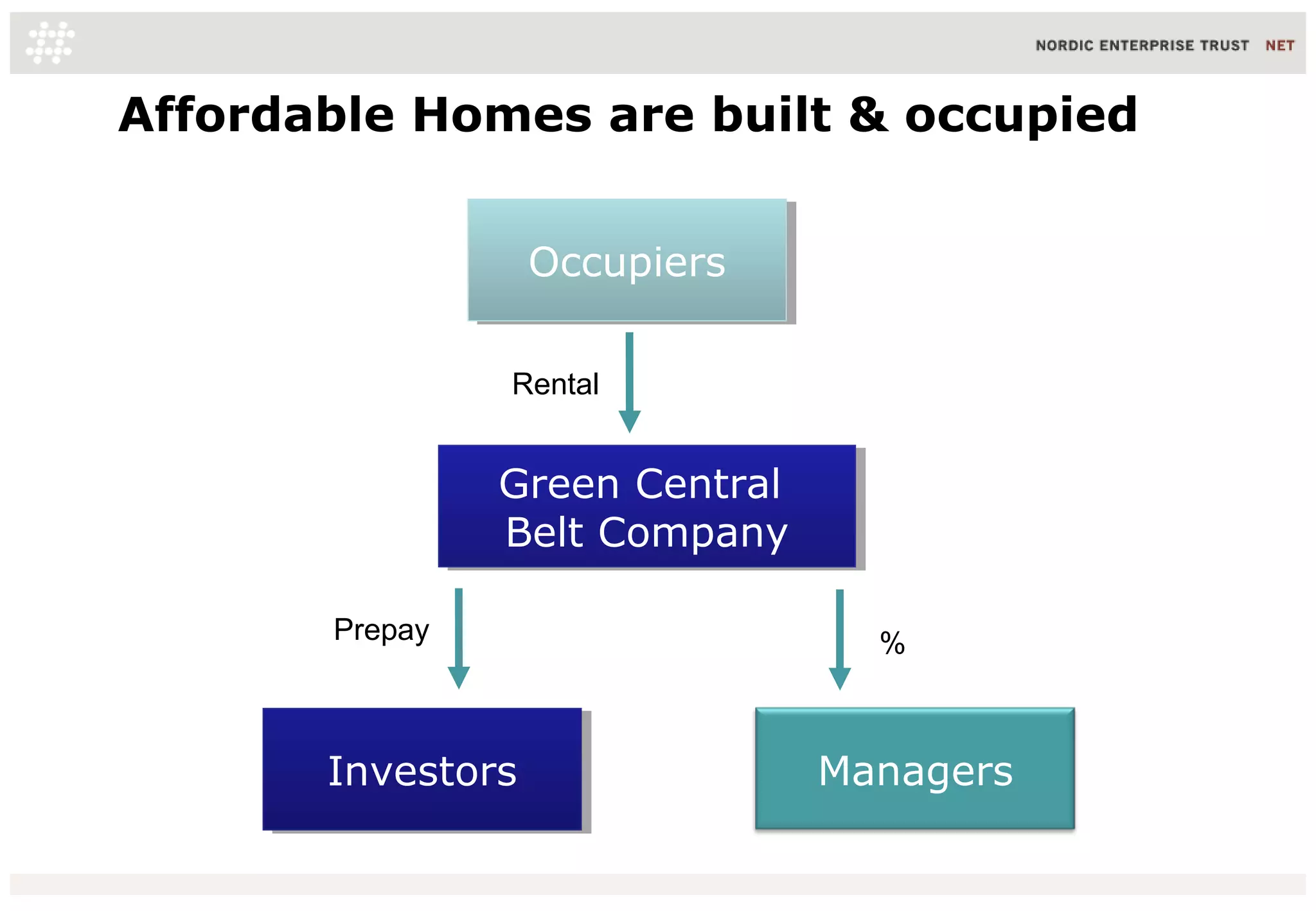

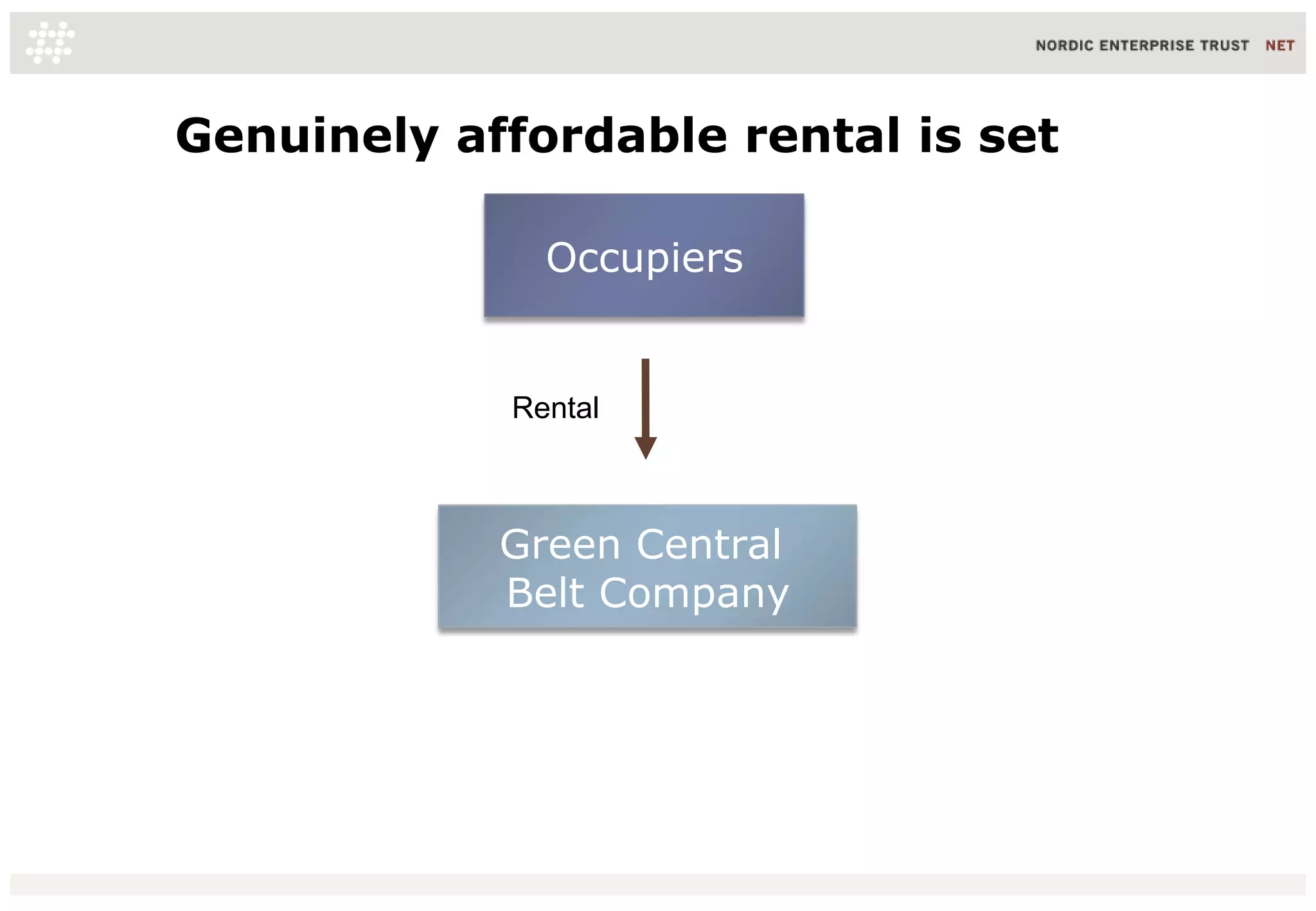

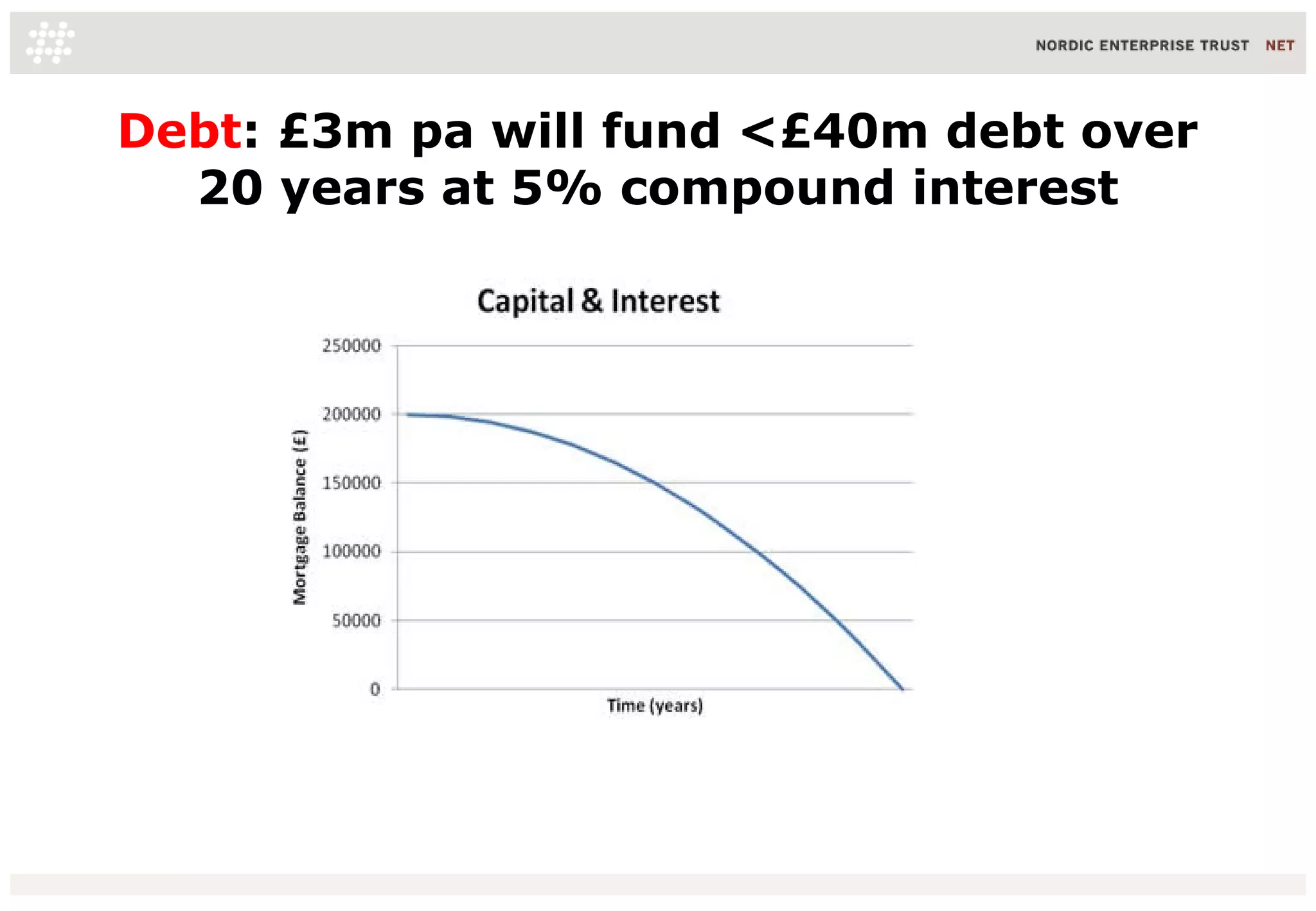

The document proposes creating a "Green Central Belt" development zone along canals in central Scotland, managed by a Green Central Belt Company. The company would use innovative financing like "prepay rental credits" to fund affordable, energy efficient housing in a sustainable way. Investors could invest in both short-term development and long-term affordable housing. Councils would set standards. The outcome would be regeneration along the canals through locally-controlled, low-carbon development and new financing options.