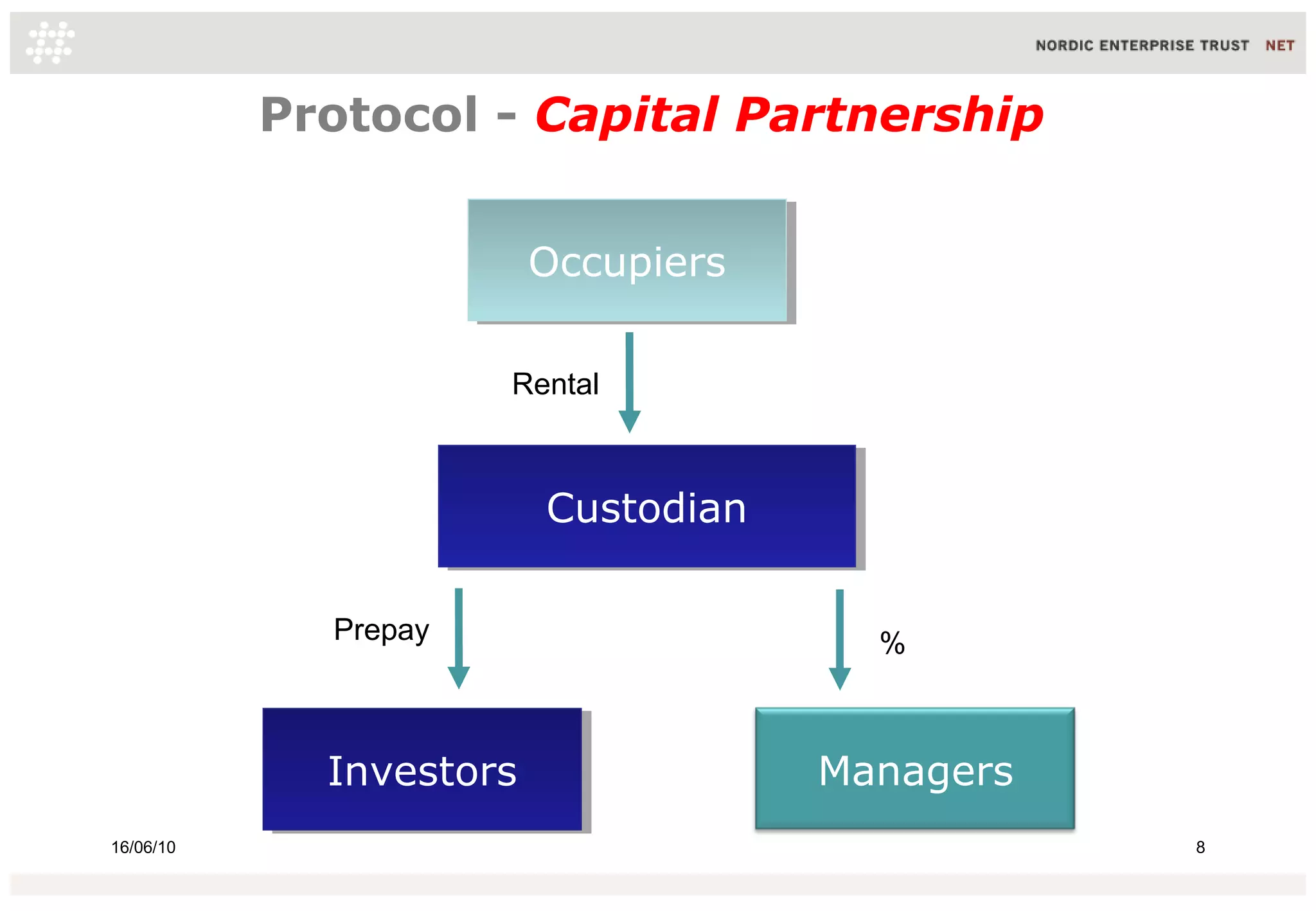

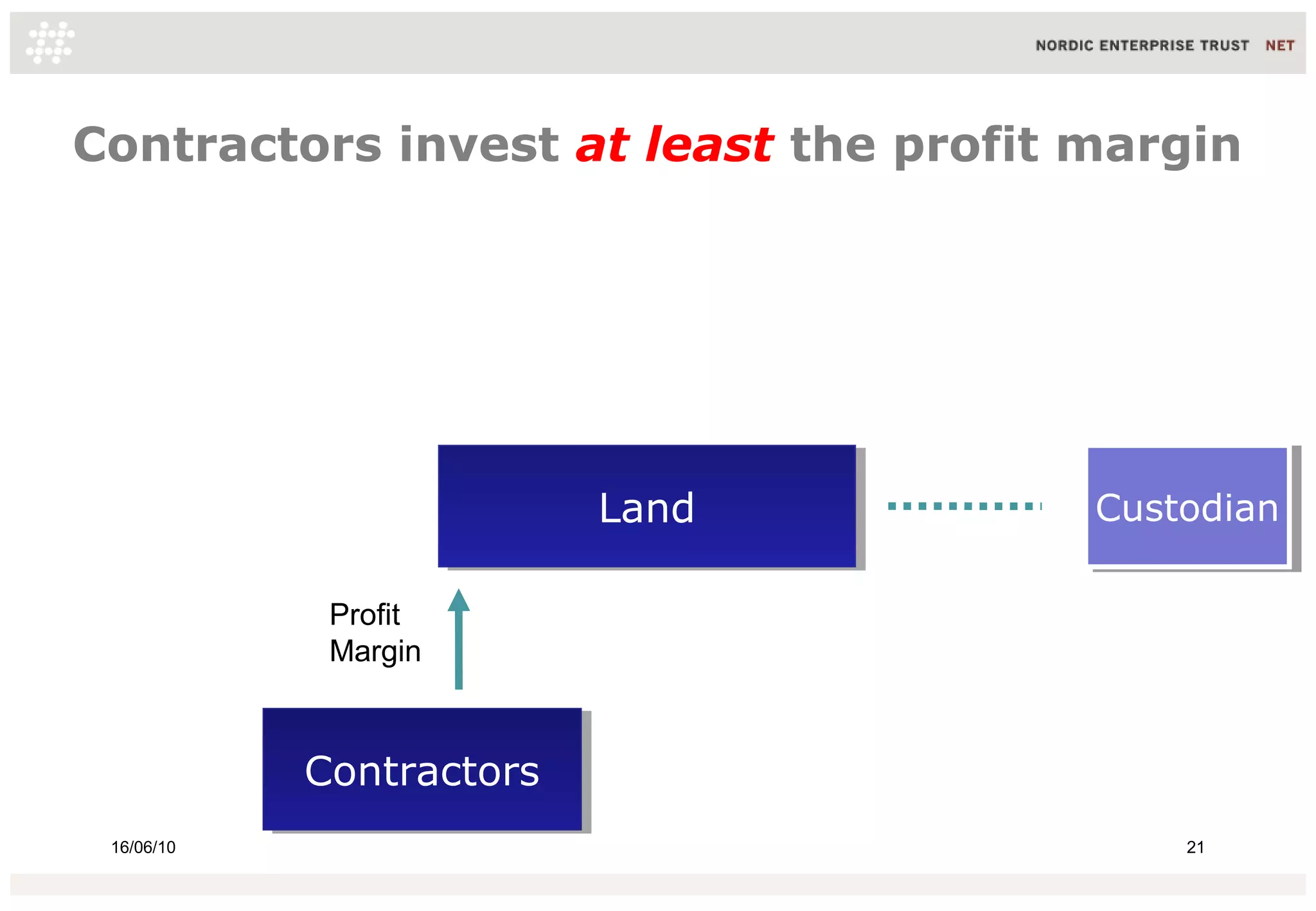

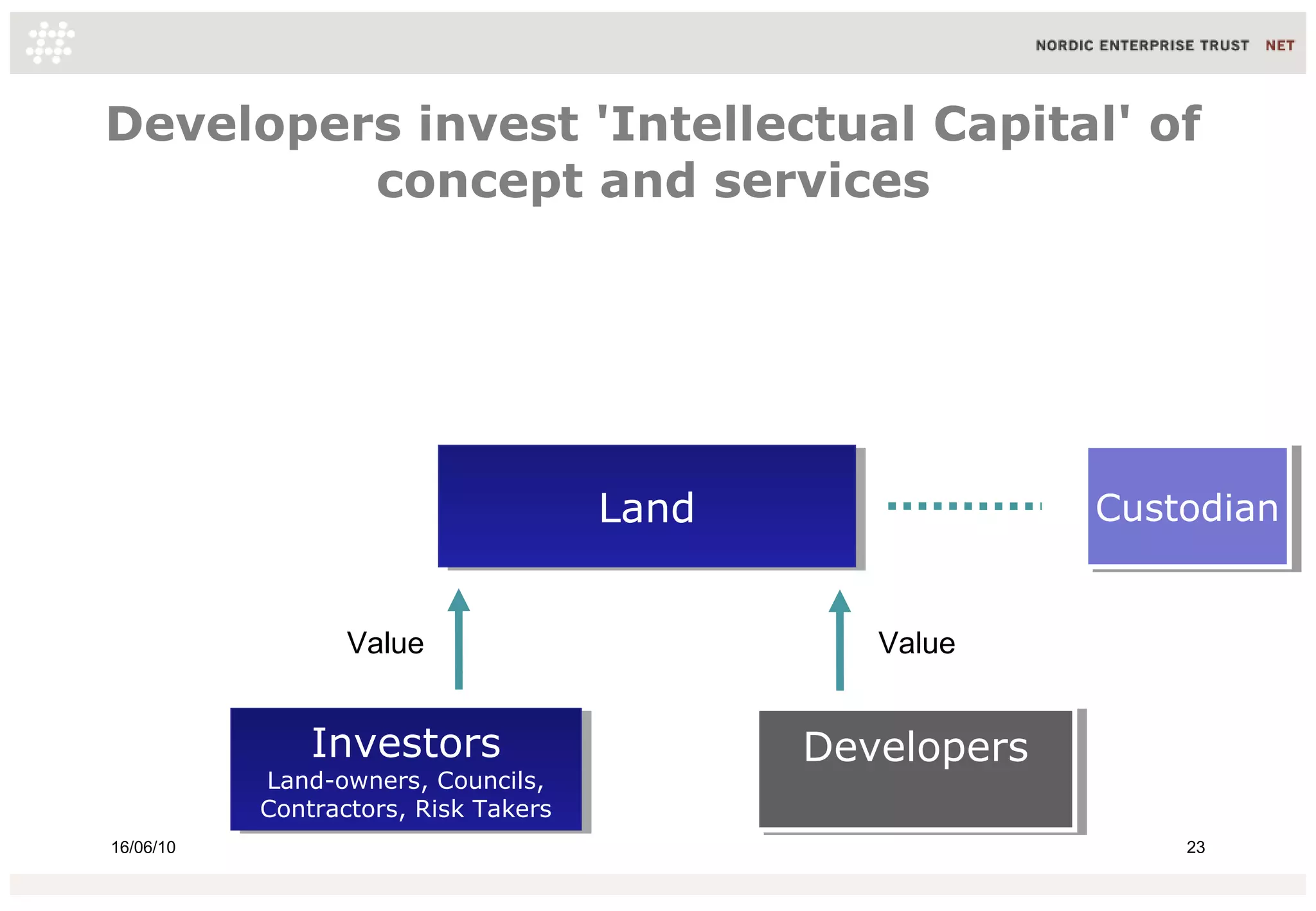

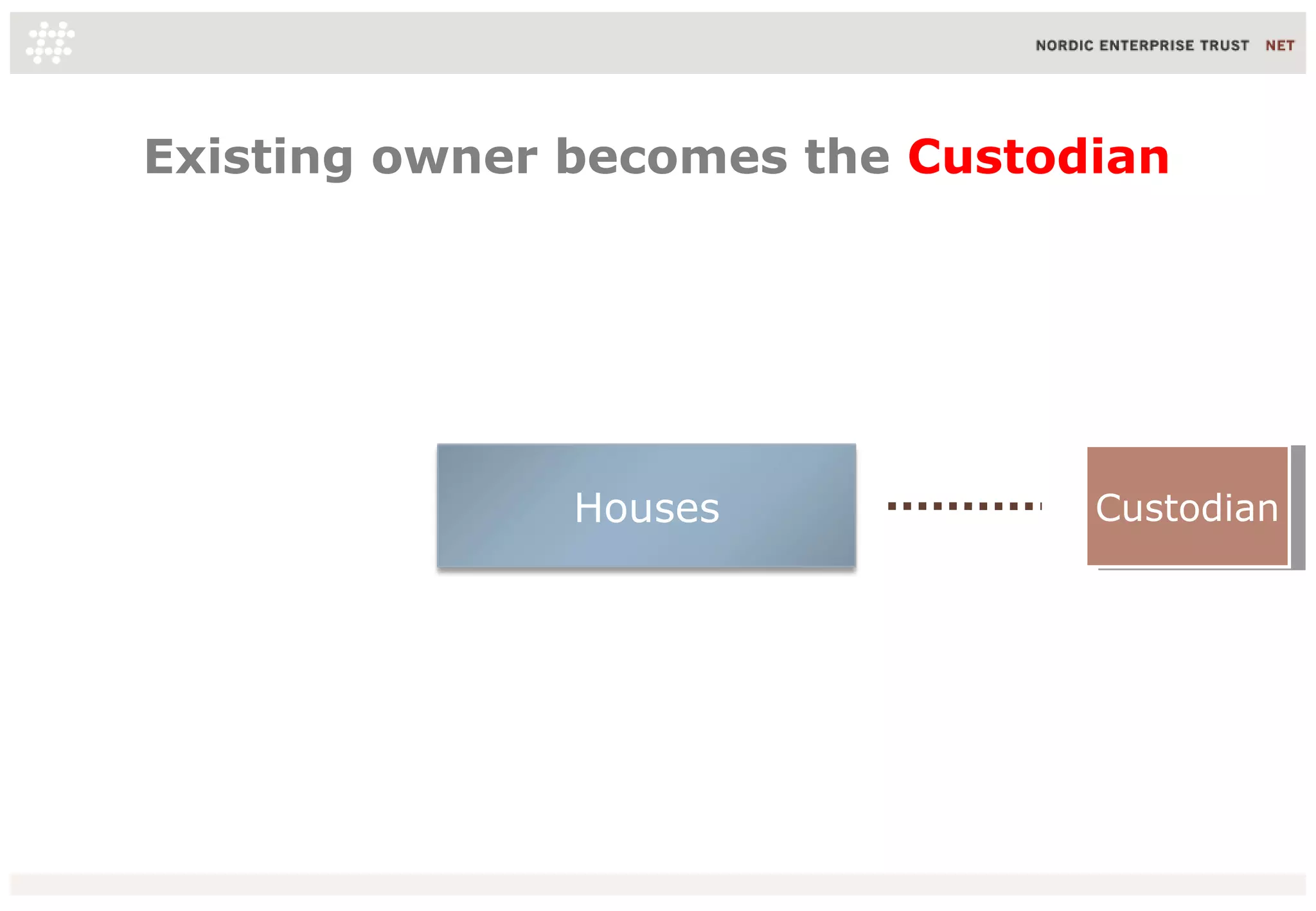

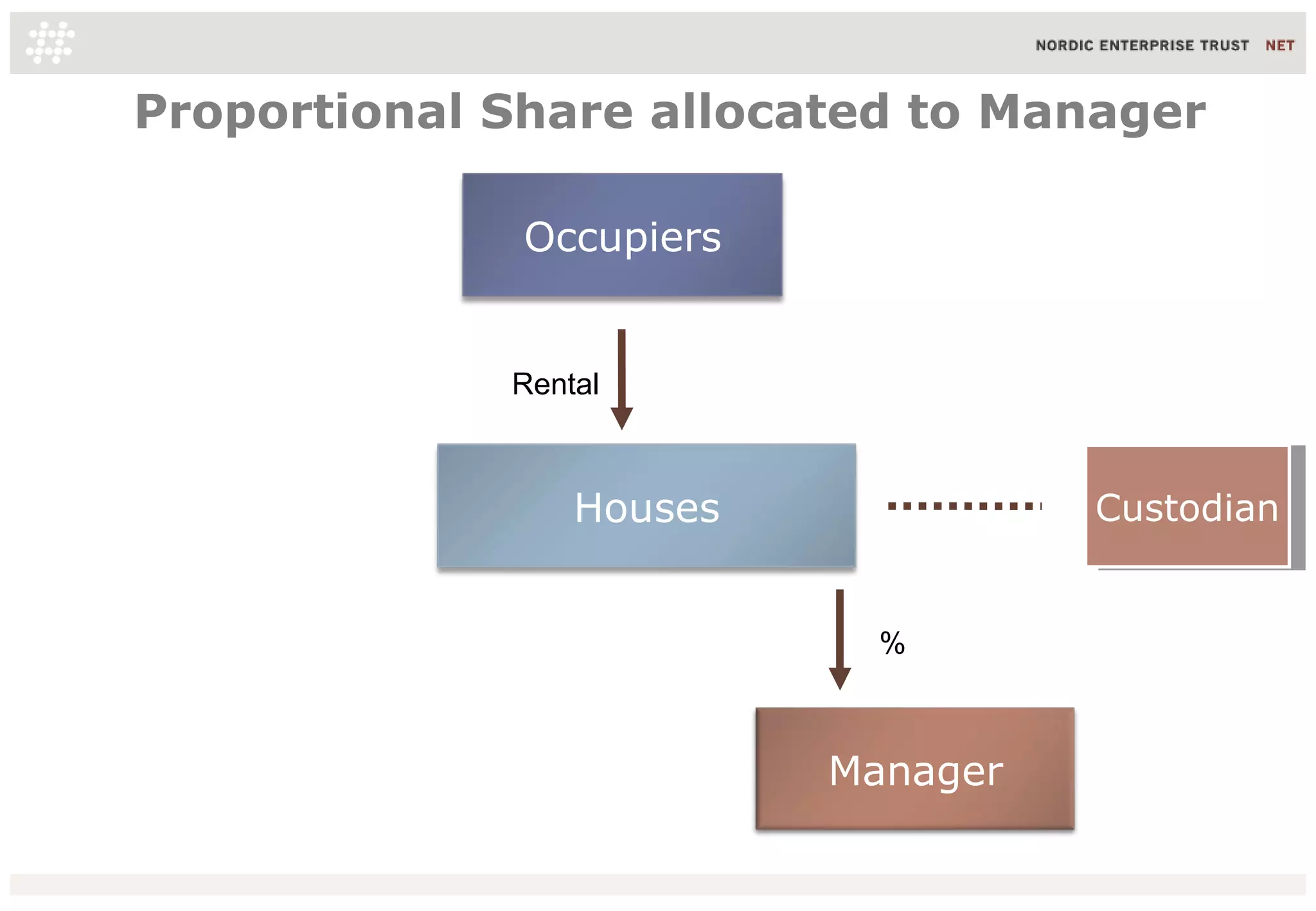

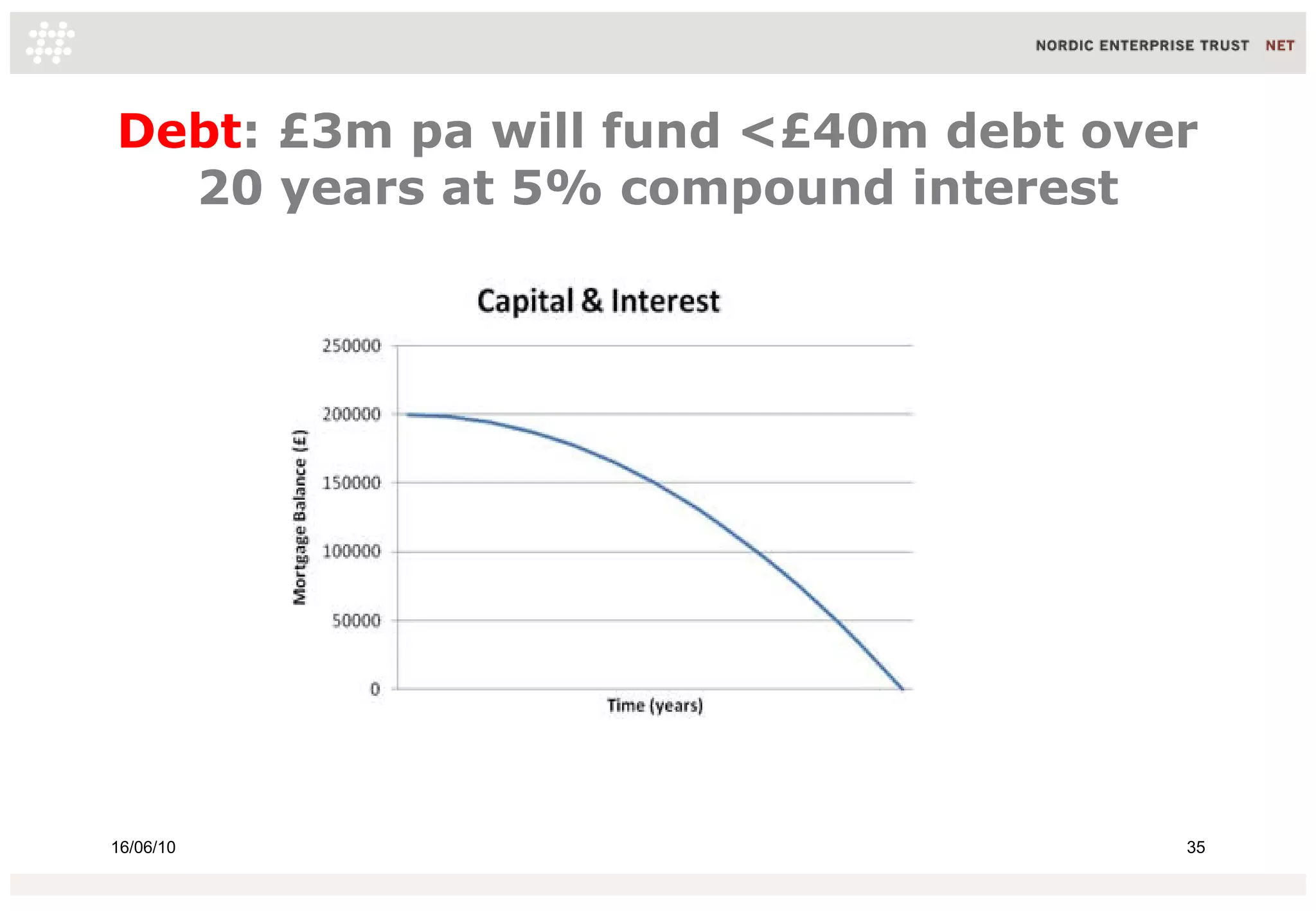

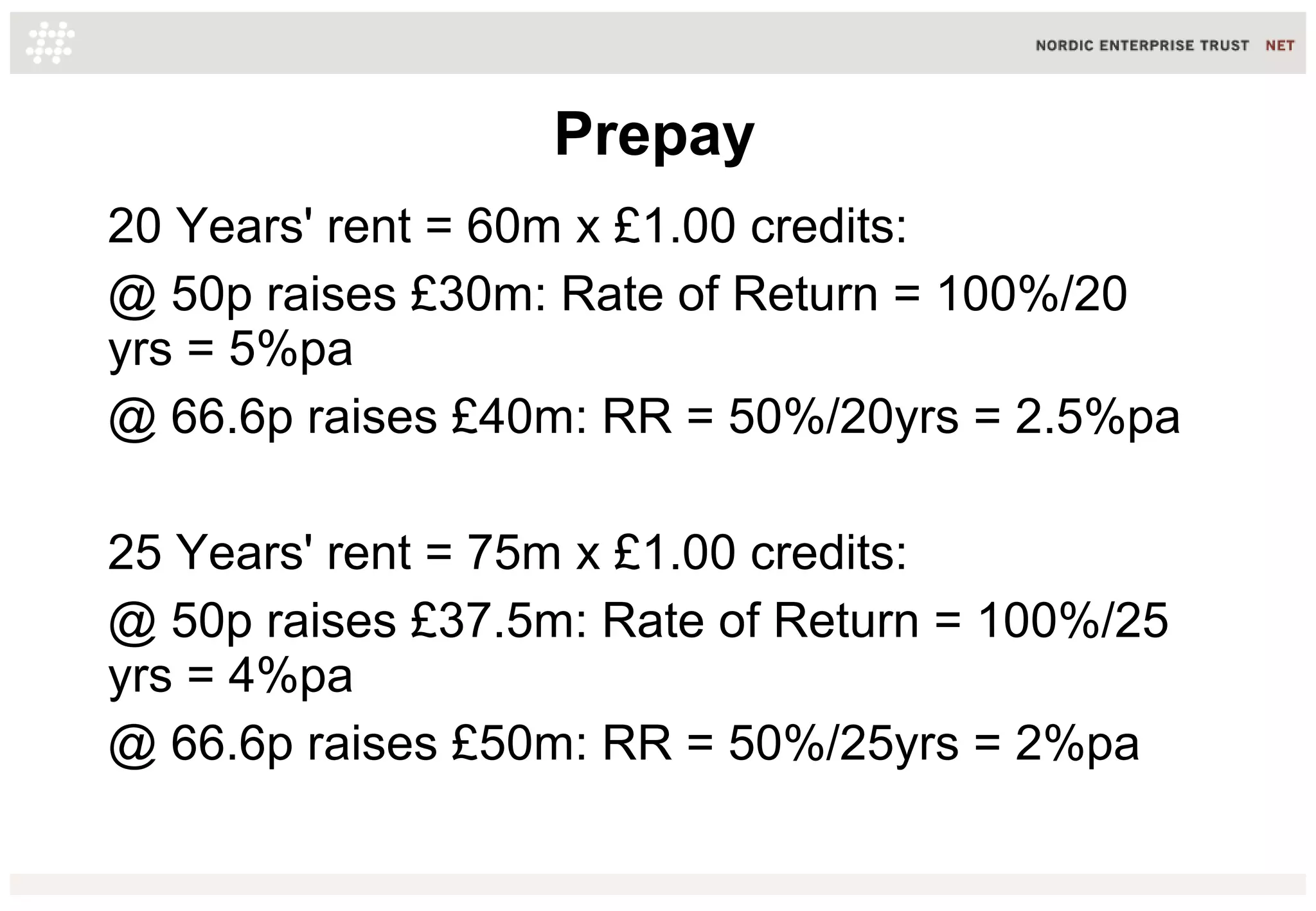

The document discusses funding regeneration through a system called Capital Partnership that uses prepay credits. It proposes that Capital Partnership is a new approach that can finance development and fund long-term use of assets through creating rental pools. Rental pools would establish affordable long-term rents and sell prepay credits returnable for rent, raising funds for development while providing income for investors. This system could help address 21st century problems by allowing different generations to directly invest in and benefit from assets like housing through exchange of rental credits, care, and intergenerational transfers of value.