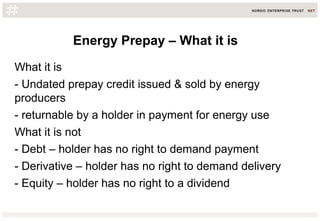

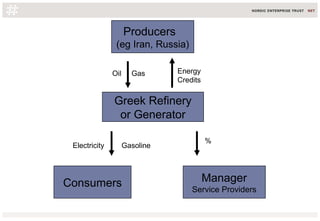

This document discusses how prepaying for energy through the sale of energy credits can help fund investment in renewable energy infrastructure. It proposes that energy producers sell undated credits to investors, which can then be used to prepay for future energy needs. This locks in prices for both producers and consumers and provides capital for producers. The document argues this model could help transition economies to low carbon solutions while providing returns to investors. It even presents a thought experiment where Greece issues energy credits as a dividend to citizens to help resolve its fiscal issues through taxes on land and carbon fuels.