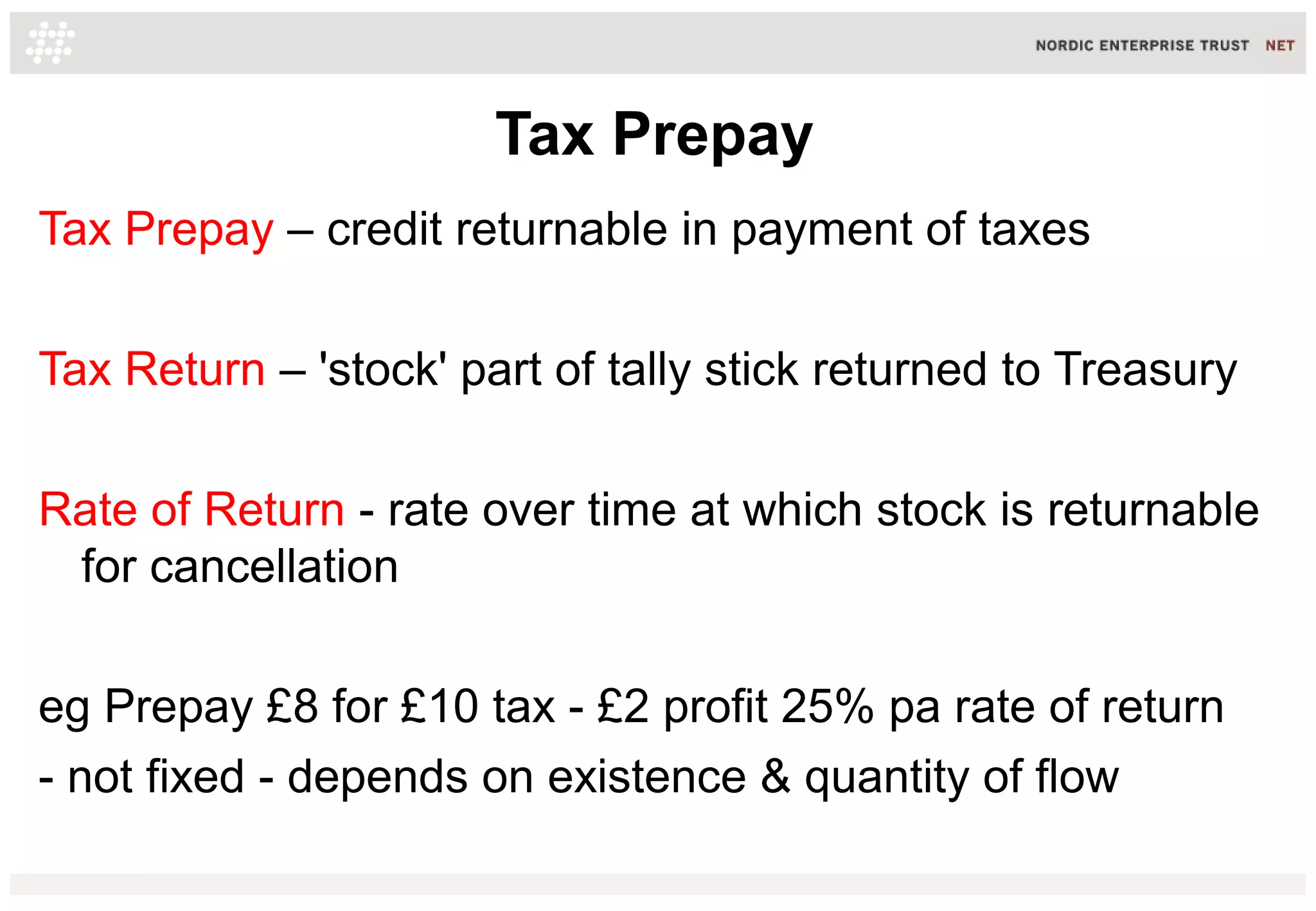

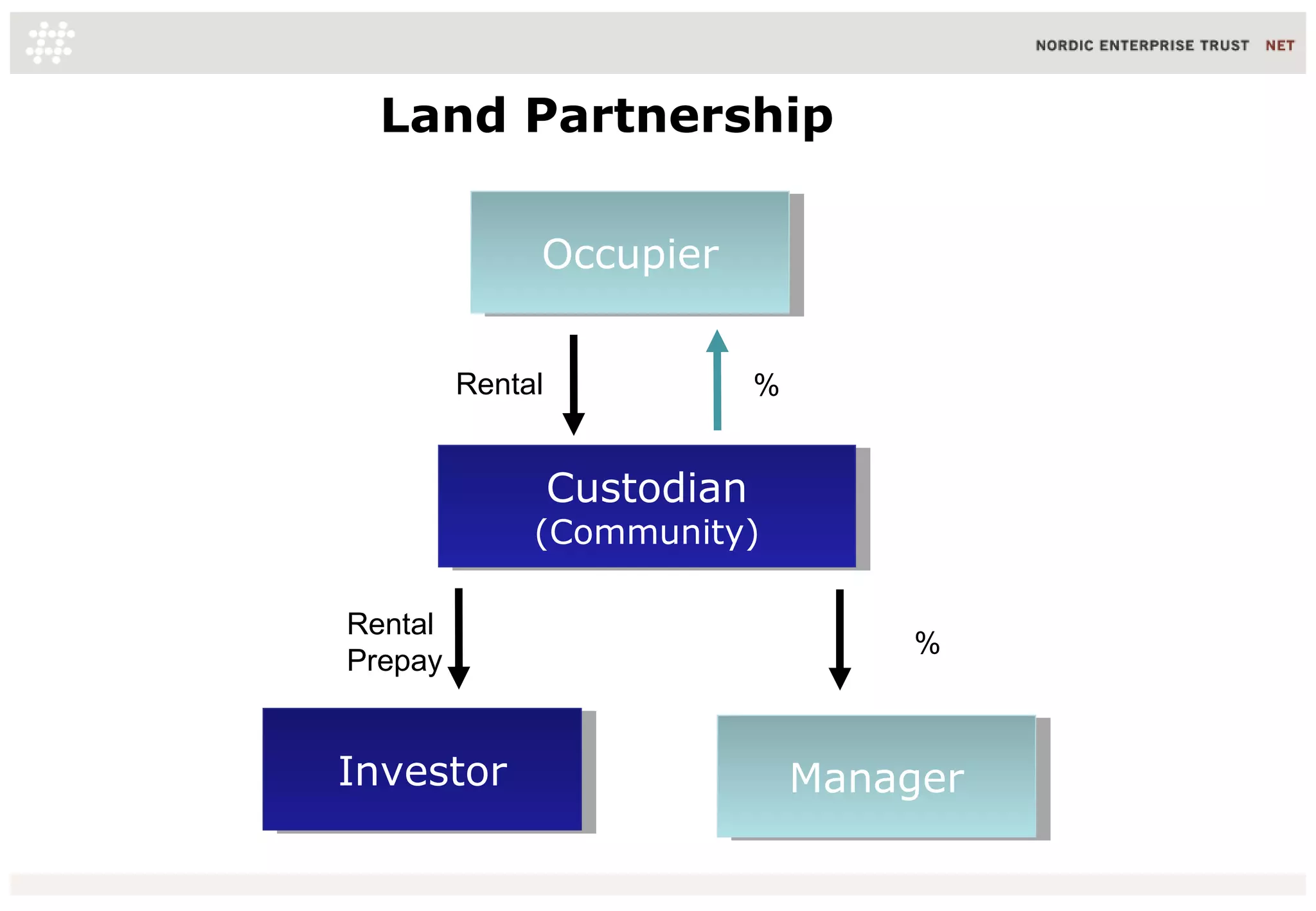

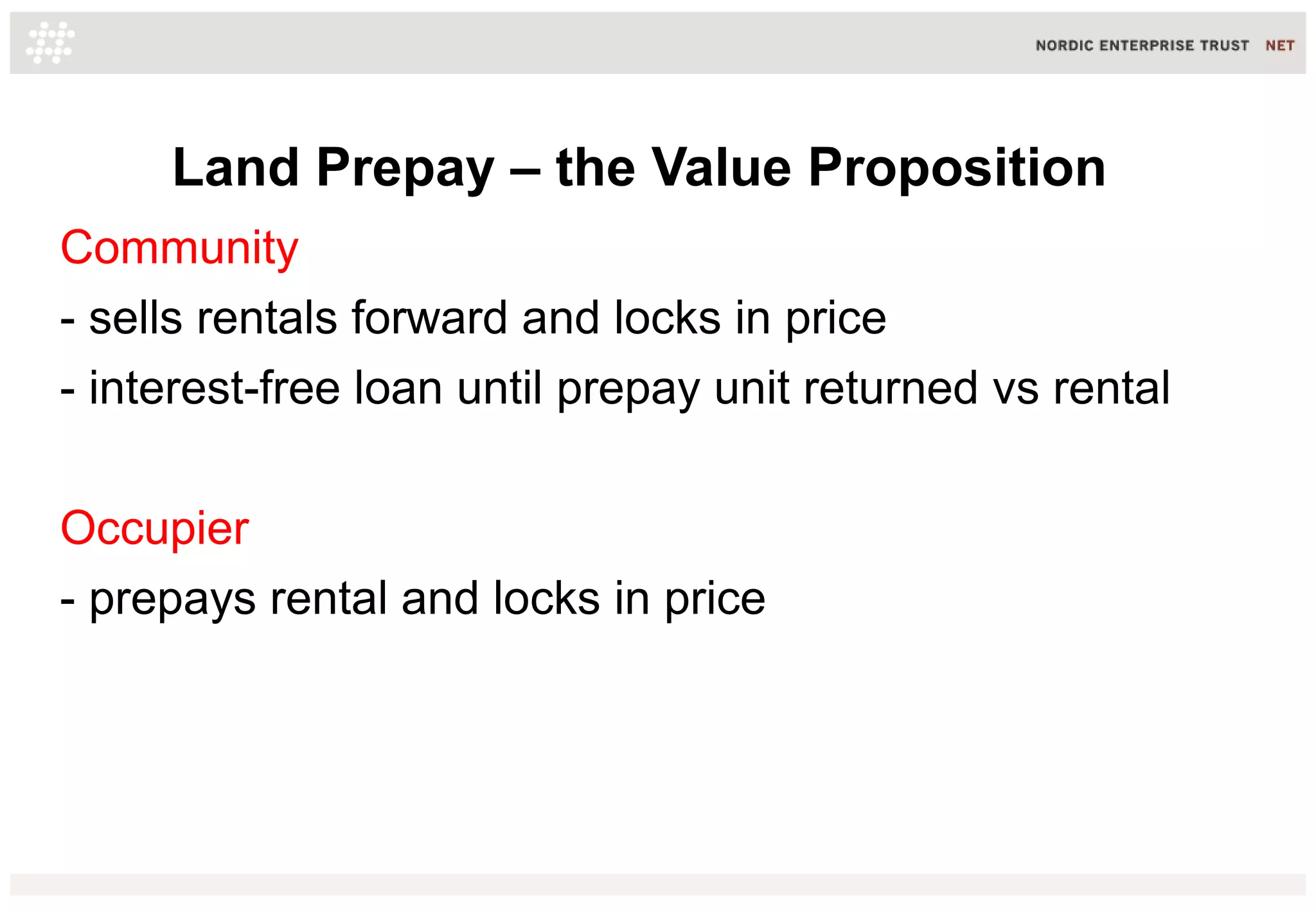

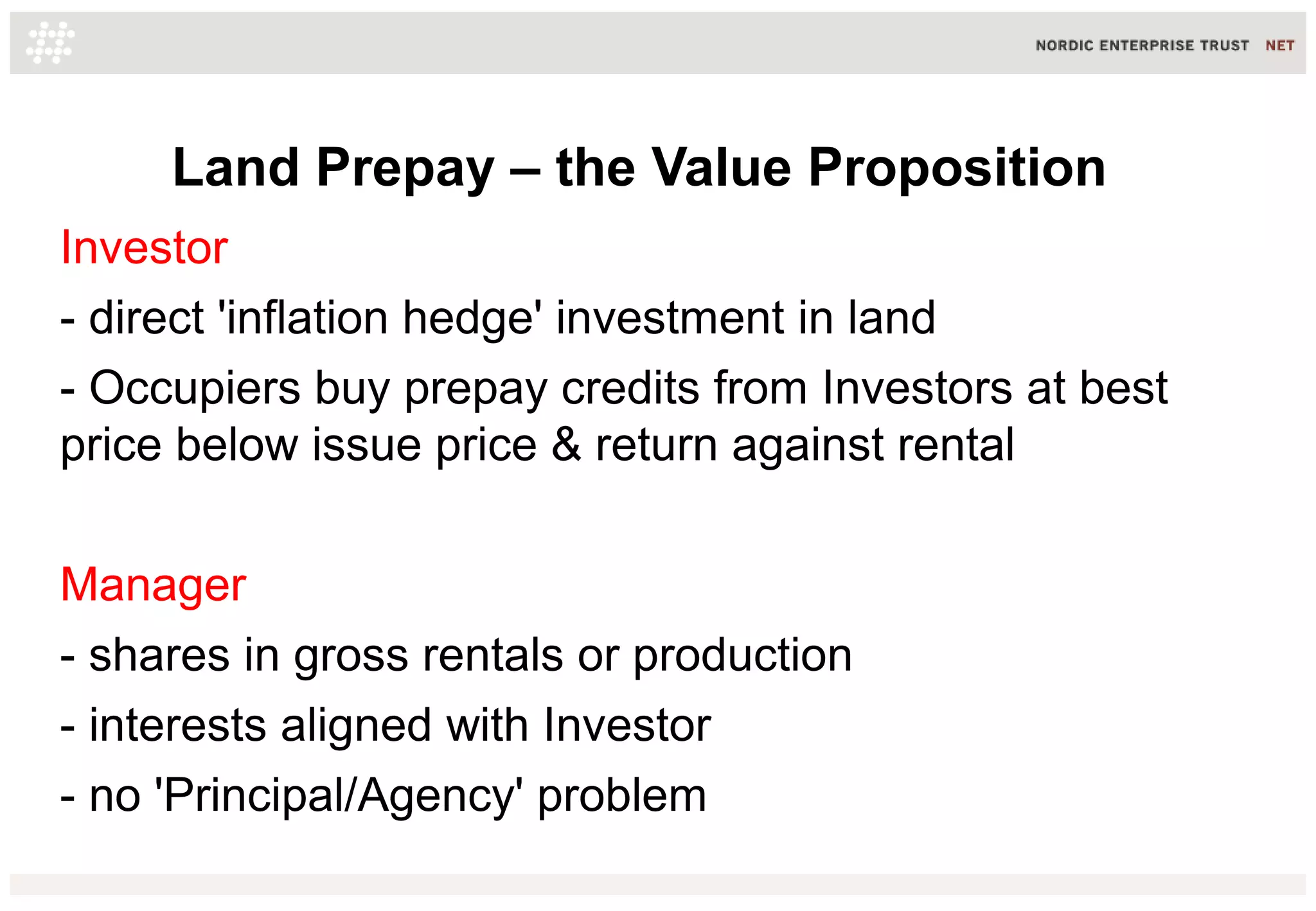

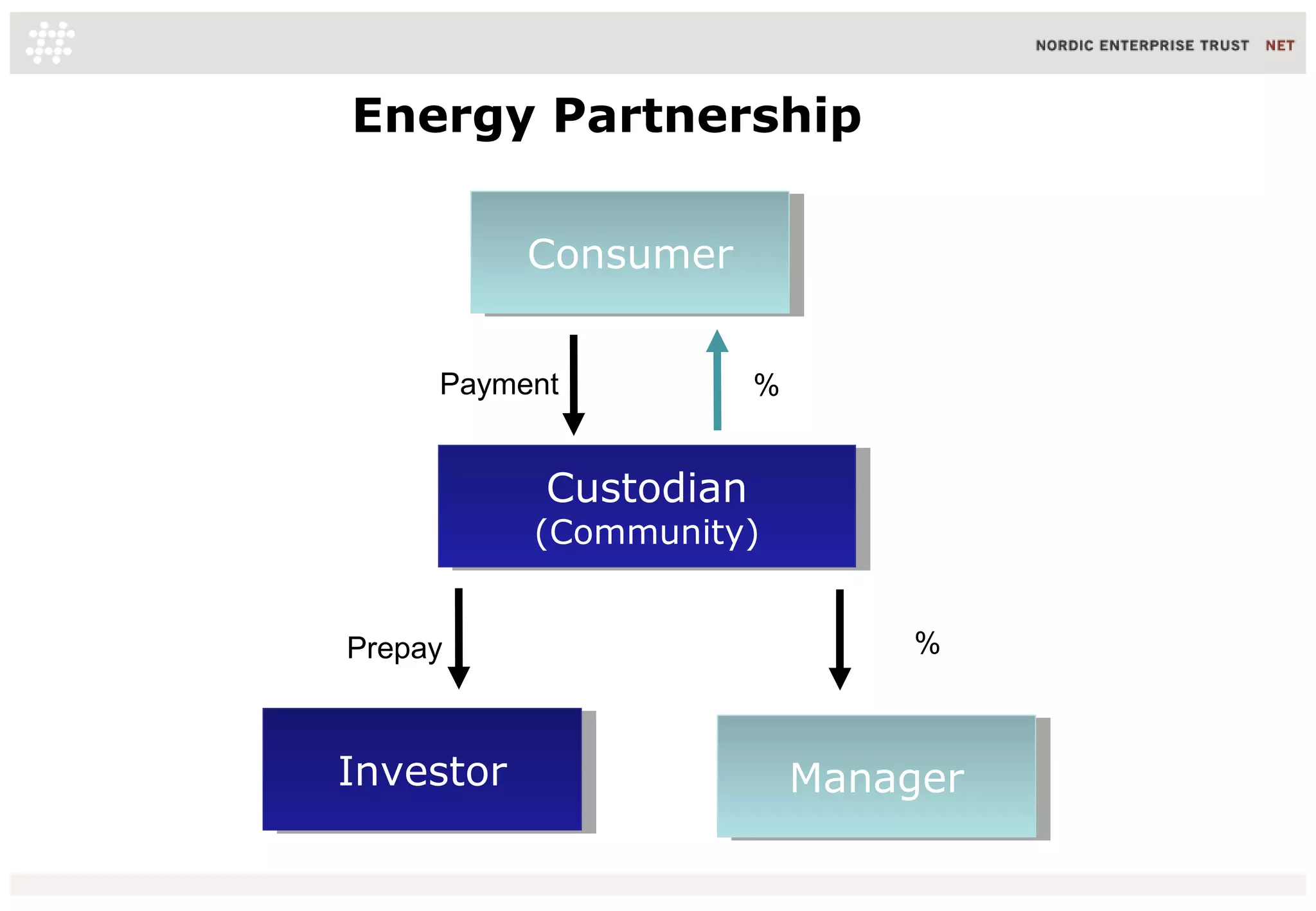

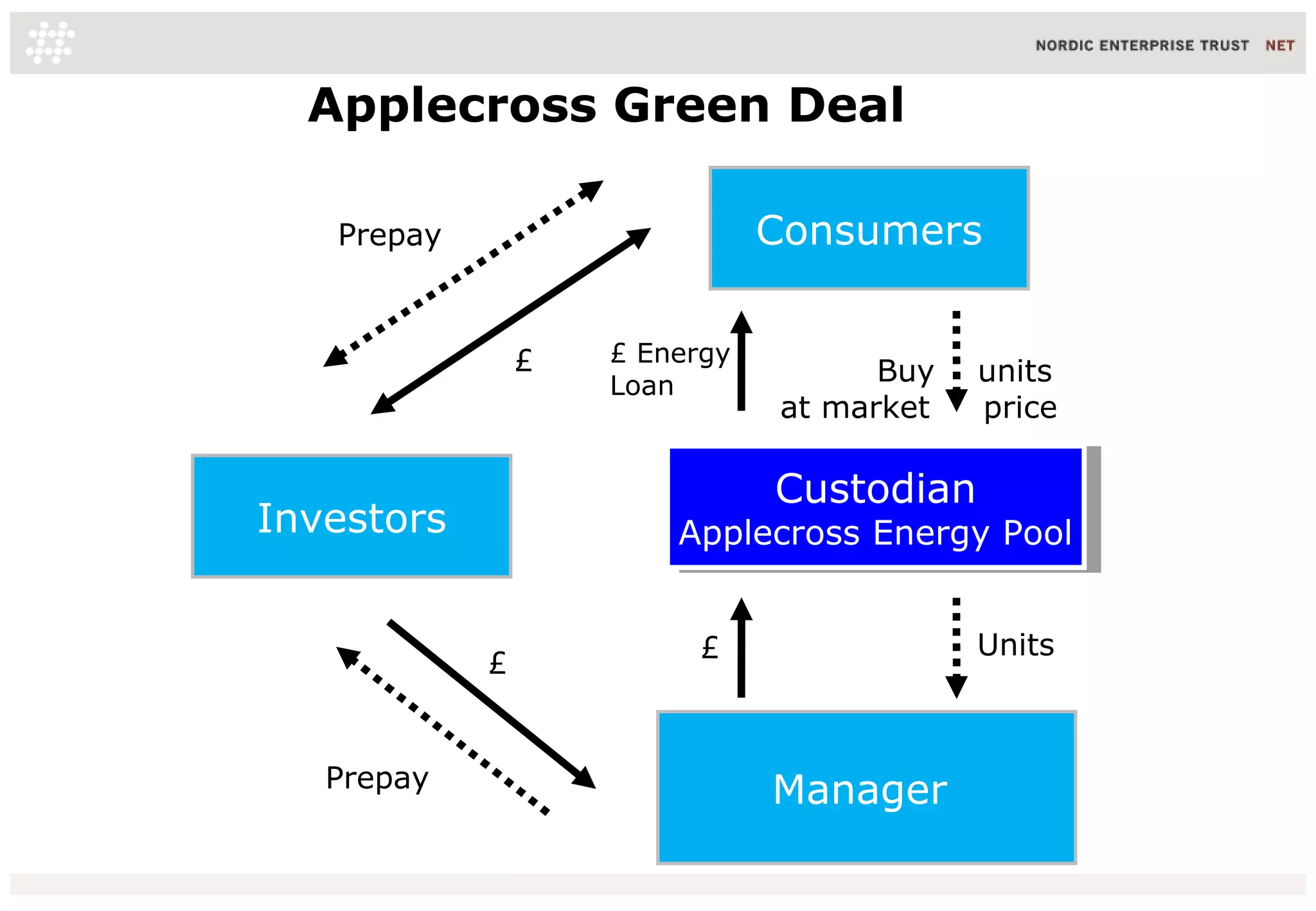

This document proposes a Natural Grid and Open Capital approach to achieve resilient Market 3.0. It discusses how Denmark achieved resource resilience through a Natural Grid policy focusing on least energy cost over time. This decentralized their energy system and led to energy security. It also proposes a prepay model for land and energy where consumers prepay for future access in exchange for an interest-free loan, aligning stakeholder interests sustainably over time. An Applecross Green Deal is outlined using this approach through an energy pool investing in community projects repaid via consumer energy prebuys.