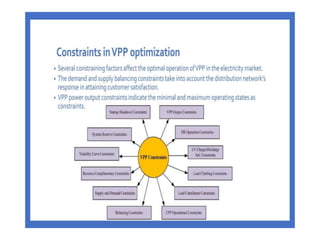

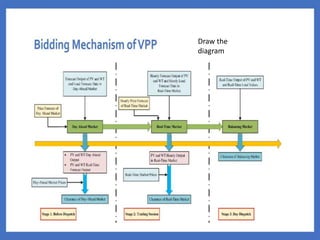

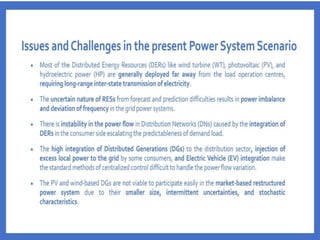

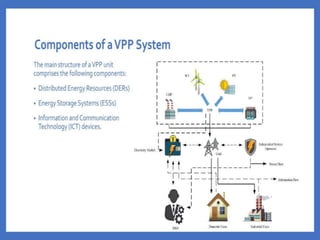

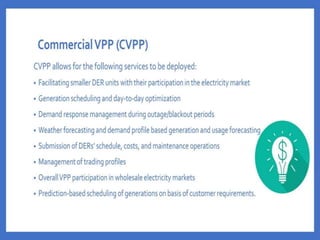

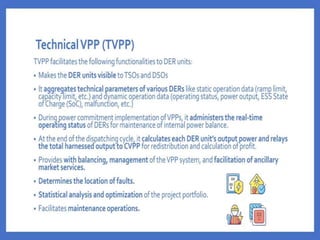

The document discusses virtual power plants (VPPs) and their key components and functions. VPPs aggregate distributed energy resources (DERs) like solar panels, wind turbines, and energy storage. A central control system manages energy generation, distribution, and demand response from DERs to optimize efficiency and grid stability. Research is exploring real-time market participation, decentralized energy sharing algorithms, and assessing the value of aggregated flexibility across multiple markets. Studies also aim to optimize VPP scheduling and communication topology while respecting distribution network constraints.