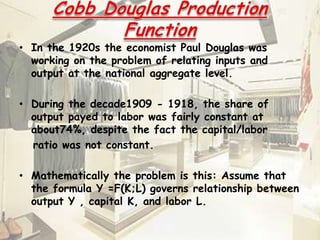

This document discusses the Cobb-Douglas production function, which is used to model the relationship between inputs like capital and labor, and total output of production. It defines key terms like elasticity of labor and capital, and describes different methodologies for calculating elasticity. It also discusses how increasing a company's capital stock through investment can lead to economic growth by enabling increased profits and efficiency through new machinery and projects.