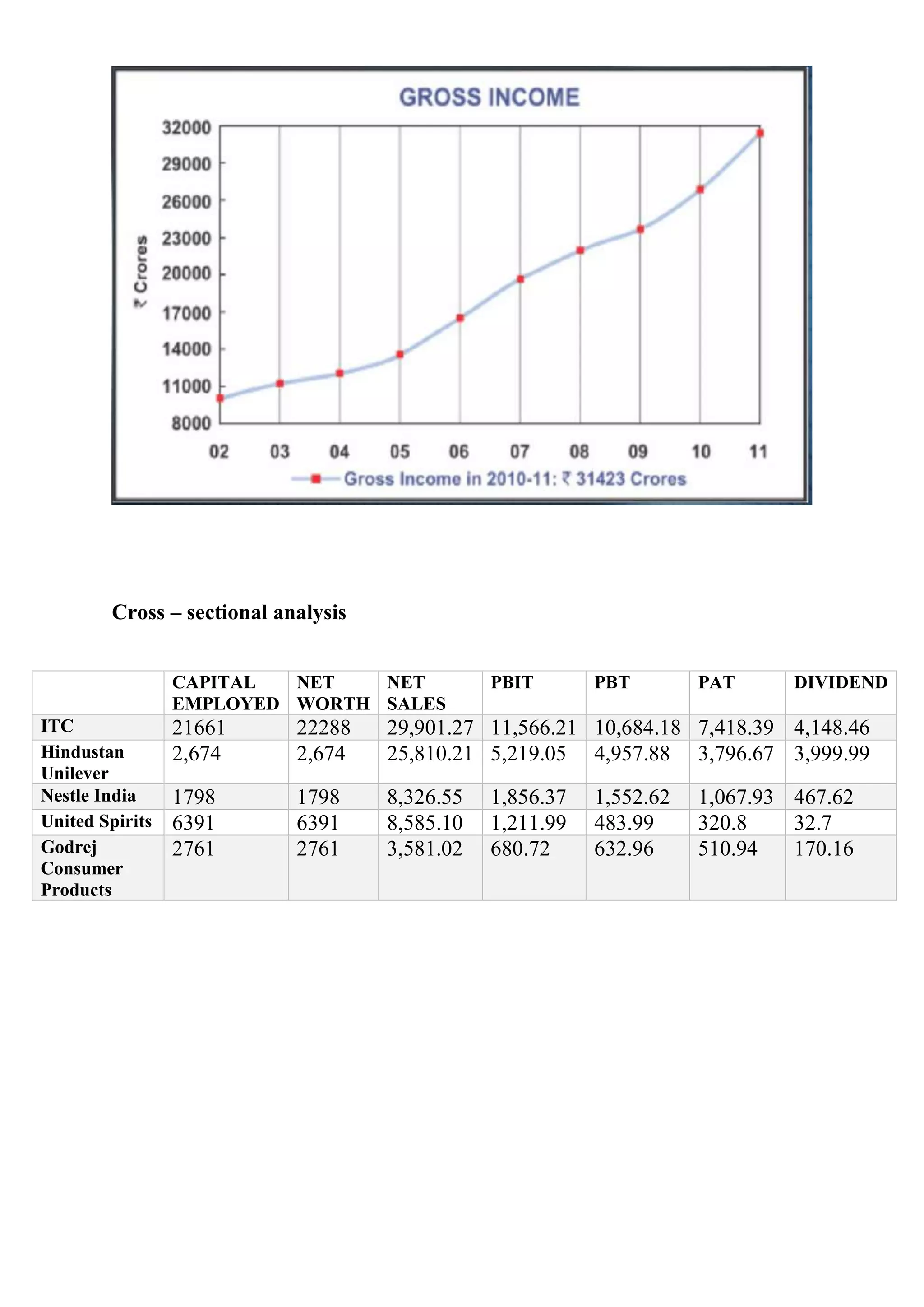

- ITC Limited is a large Indian conglomerate company headquartered in Kolkata, employing over 26,000 people across various businesses.

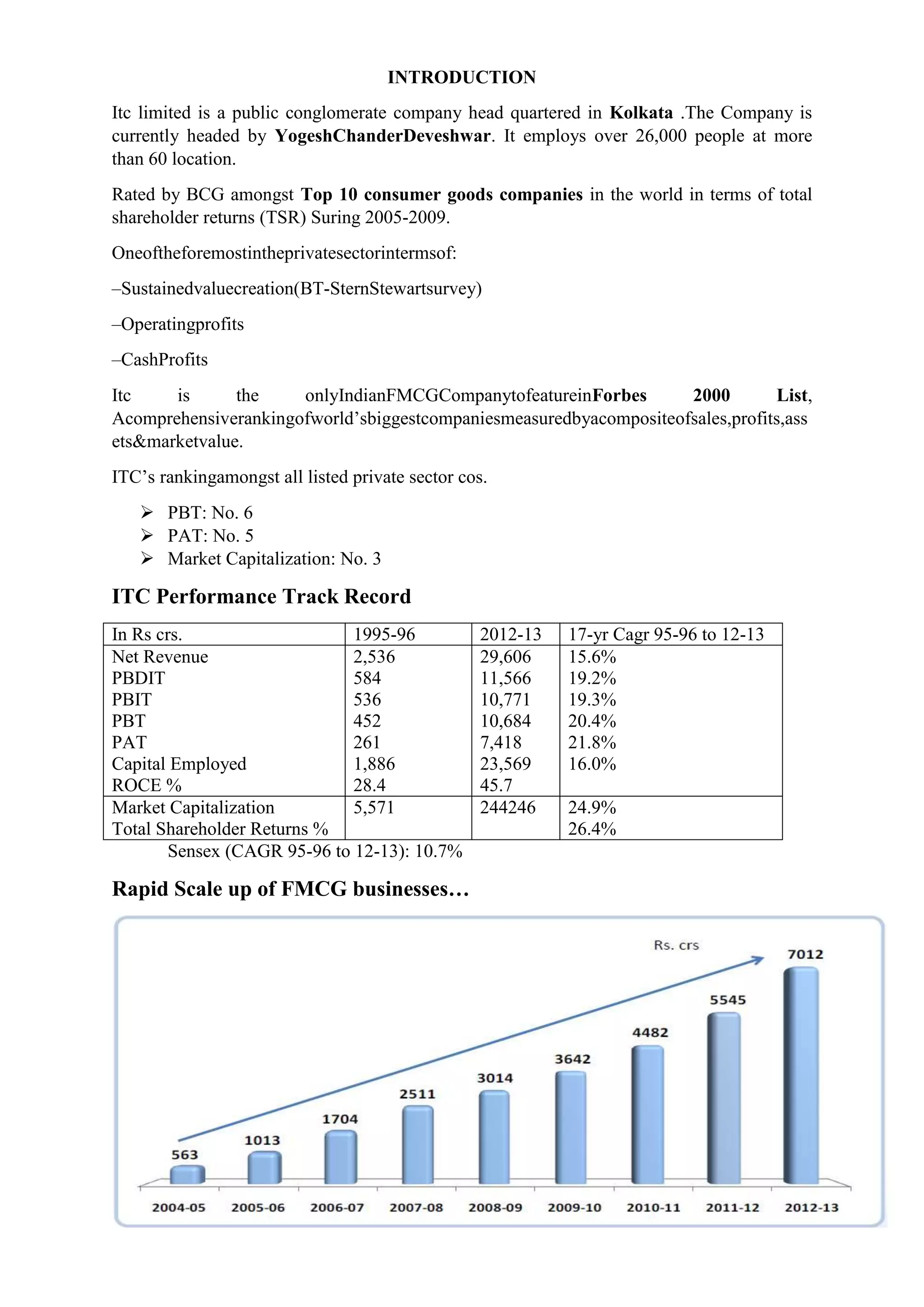

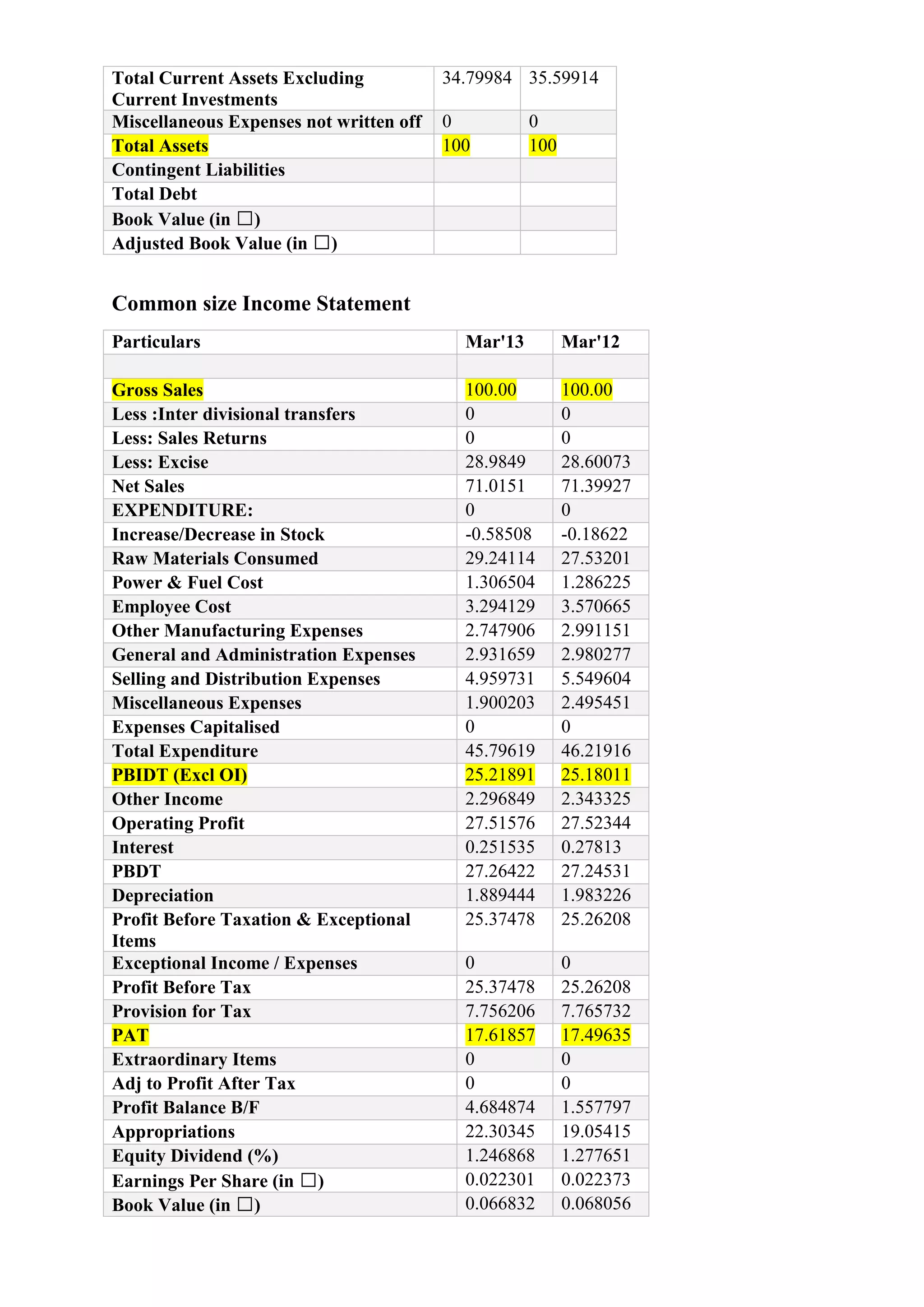

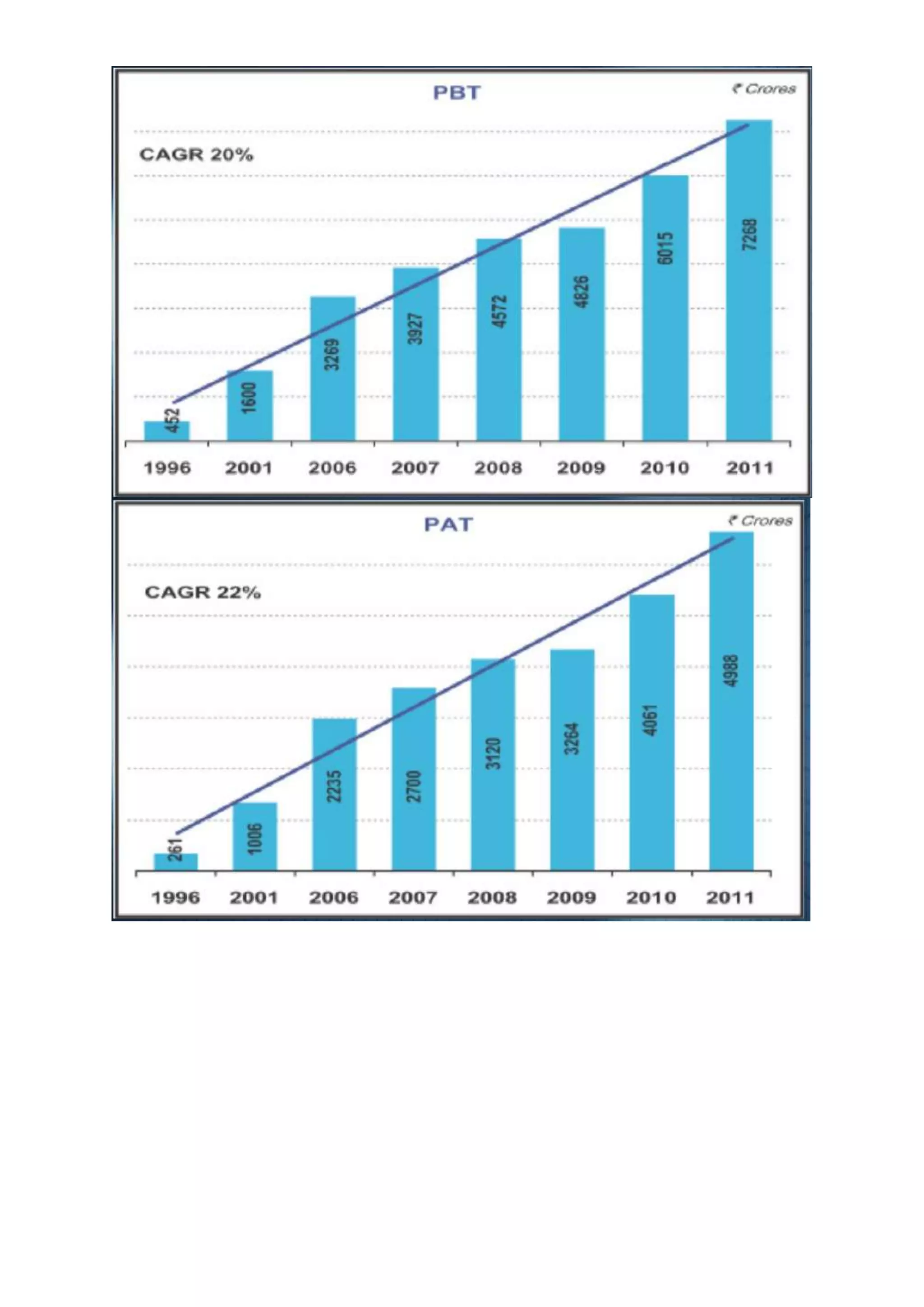

- Between 1995-96 and 2012-13, ITC saw rapid growth and scale-up of its FMCG businesses, with net revenue increasing from Rs. 2,536 crores to Rs. 29,606 crores - a 17-year CAGR of 15.6%.

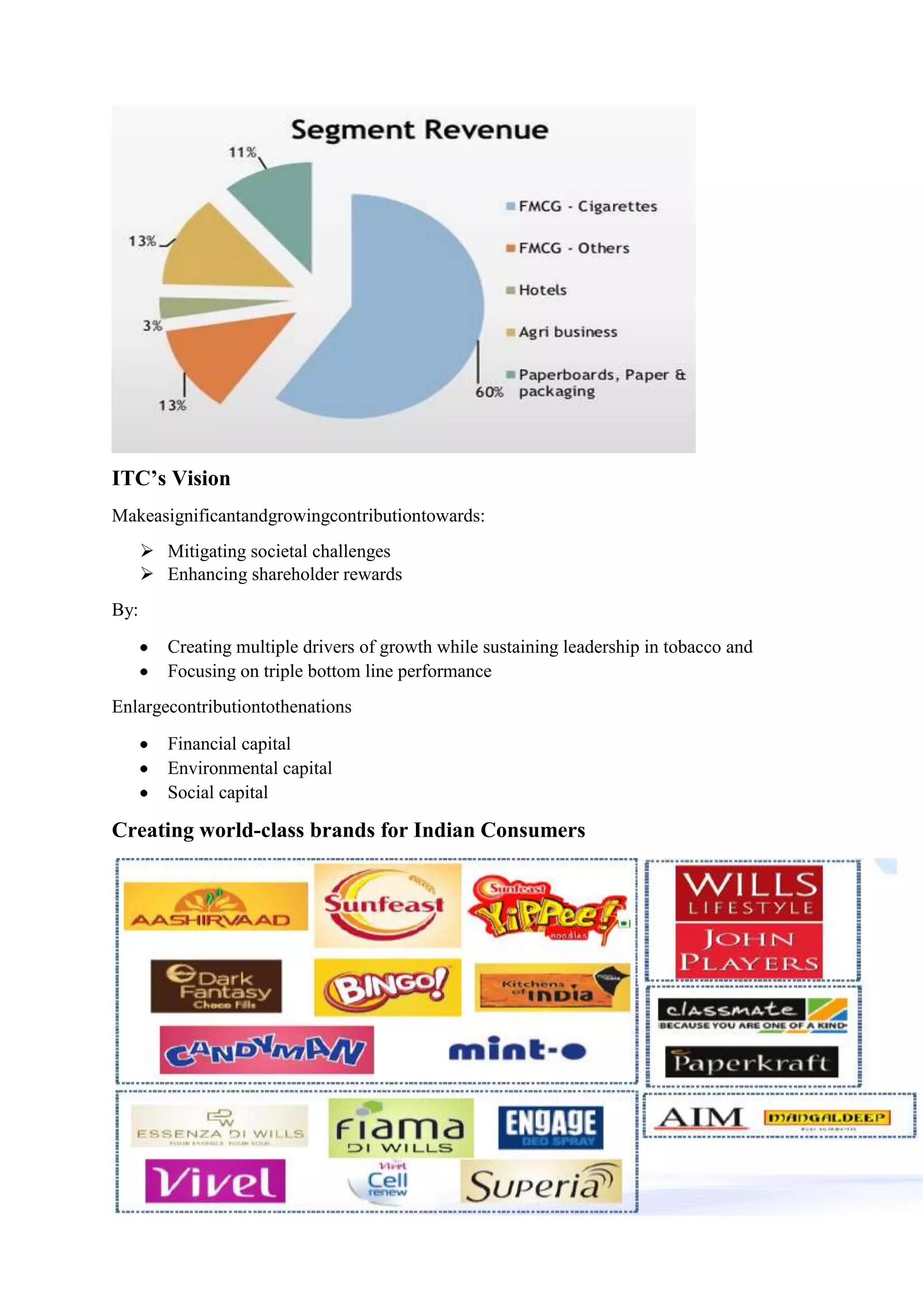

- ITC aims to make a significant contribution to India's financial, environmental, and social capital by creating multiple drivers of growth while sustaining leadership in tobacco and focusing on triple bottom line performance.