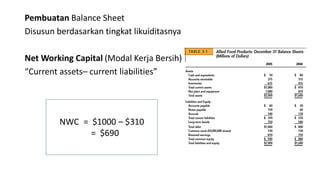

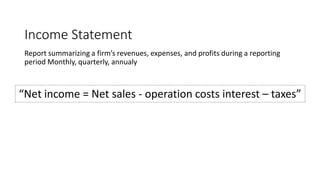

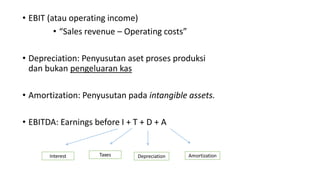

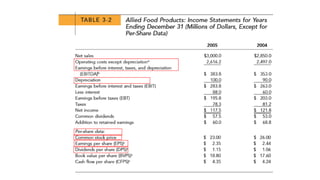

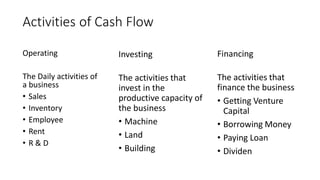

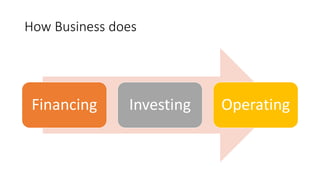

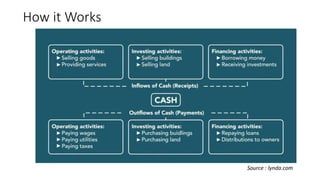

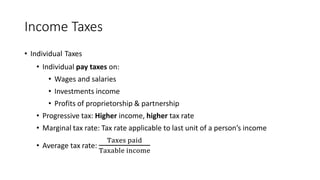

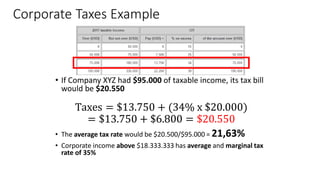

This document provides an introduction to key financial concepts including financial statements, cash flows, and taxes. It is presented in three sections. Section I discusses financial statements such as the balance sheet and income statement. Section II covers the statement of cash flows and uses and limitations of financial statements. Section III explores free cash flow, MVA, EVA, and income taxes for both individuals and corporations. The presentation aims to equip attendees with an understanding of these important financial management topics.

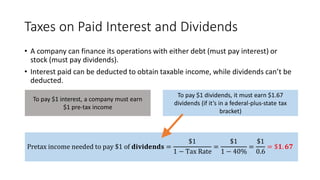

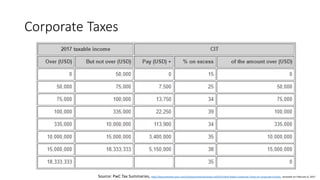

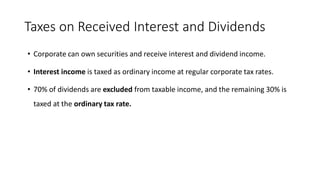

![Taxes on Bonds and Stock

A company had $200.000 to invest. If it could buy bonds that

paid 8% interest, or $16.000 per year, or stock that paid 7% in

dividends, or $14.000. This company is in the 40% federal-

plus-state tax bracket.

Its tax would be:

Bonds: 40% x $16.000 = $5.600,

so its after-tax income would be

$16.000 - $5.600 = $10.400

Stock: [30% x 40%] x $14.000 =

$1.680, so its after-tax income would

be $14.000 - $1.680 = $12.320](https://image.slidesharecdn.com/chapter3-presentation-170207075748/85/Introduction-to-Financial-Management-39-320.jpg)