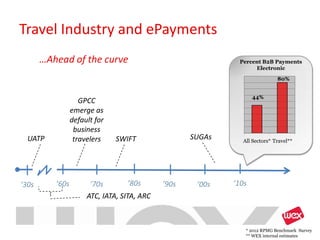

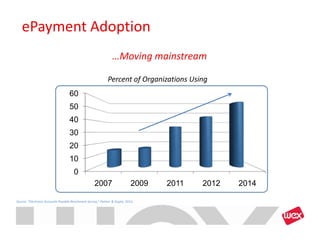

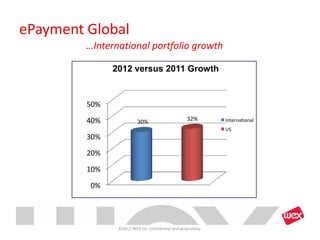

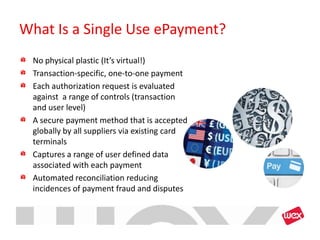

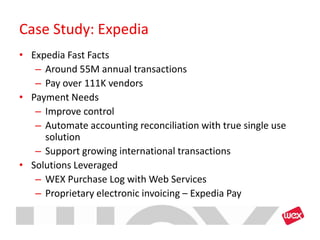

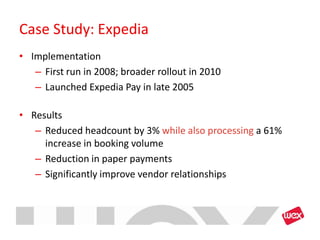

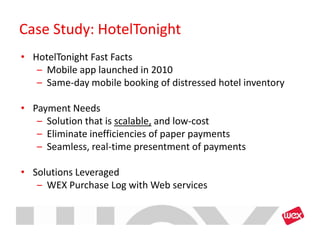

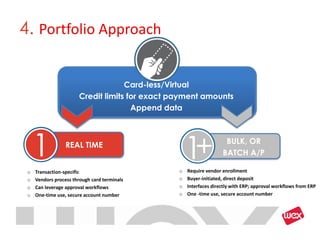

The webinar on January 30, 2013, discusses success stories related to electronic payments (epayments) in travel booking, featuring case studies from Expedia and HotelTonight. It highlights the growing adoption of epayments in the travel industry, their benefits, and best practices for implementation, including customized solutions and executive sponsorship. Key findings indicate that single-use epayments improve transaction control and vendor relationships while reducing inefficiencies and errors.