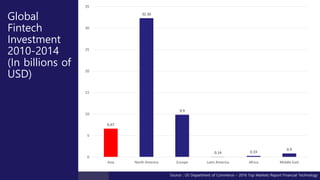

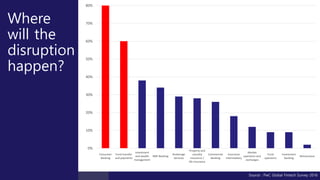

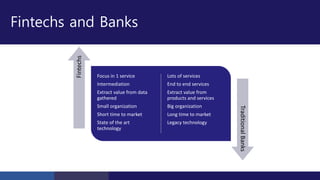

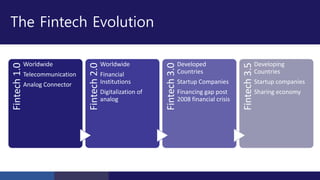

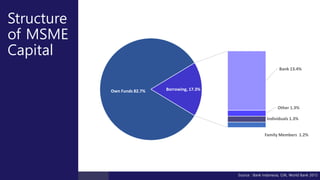

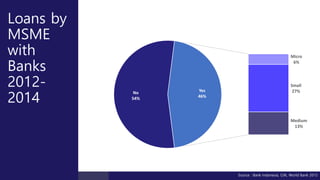

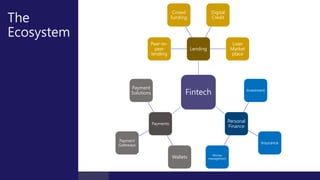

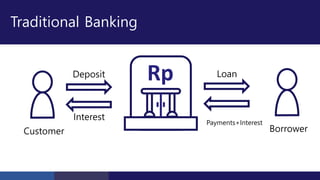

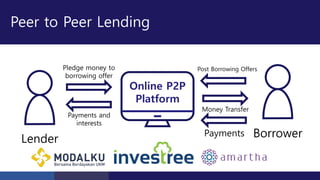

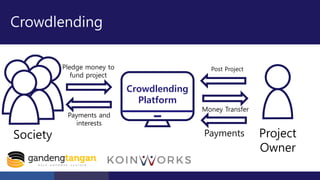

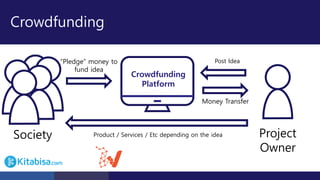

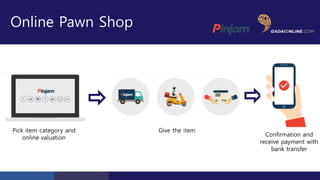

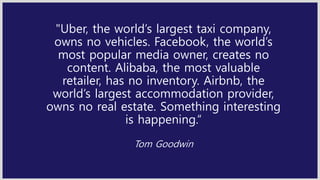

Fintech refers to technology-enabled innovation in financial services that could disrupt traditional models. Global fintech investment has grown substantially since 2010, led by North America. Consumer banking and payments are seen as the areas most likely to experience disruption. Fintechs focus on single services and extract value from data, while traditional banks offer multiple services and extract value from products. This evolution may help address Indonesia's large financing gap, as over half of its population lacks bank accounts and most small businesses rely on own funds rather than loans. Emerging fintech models like peer-to-peer lending, crowdlending, and online marketplaces could help connect borrowers and lenders in new ways.