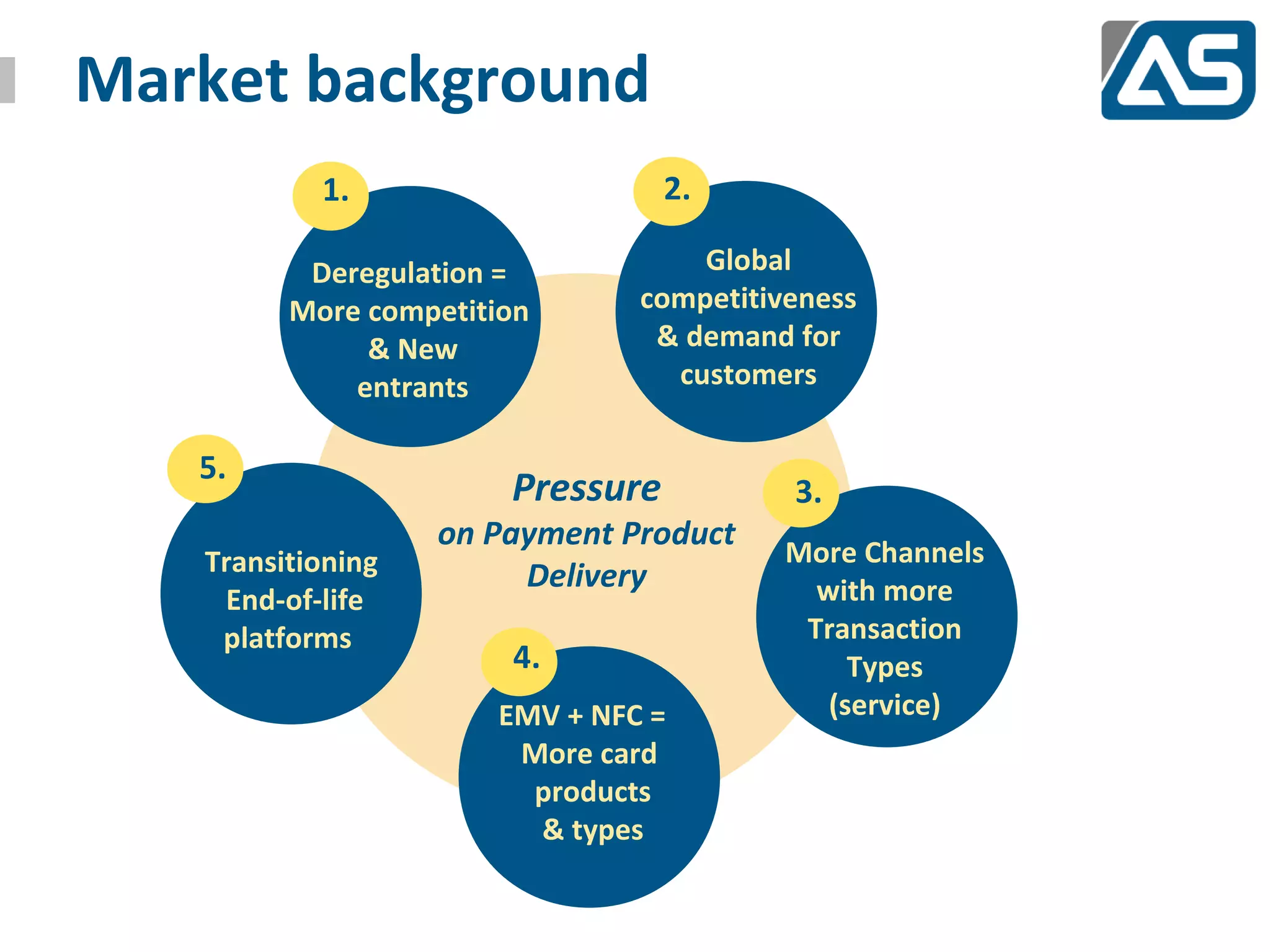

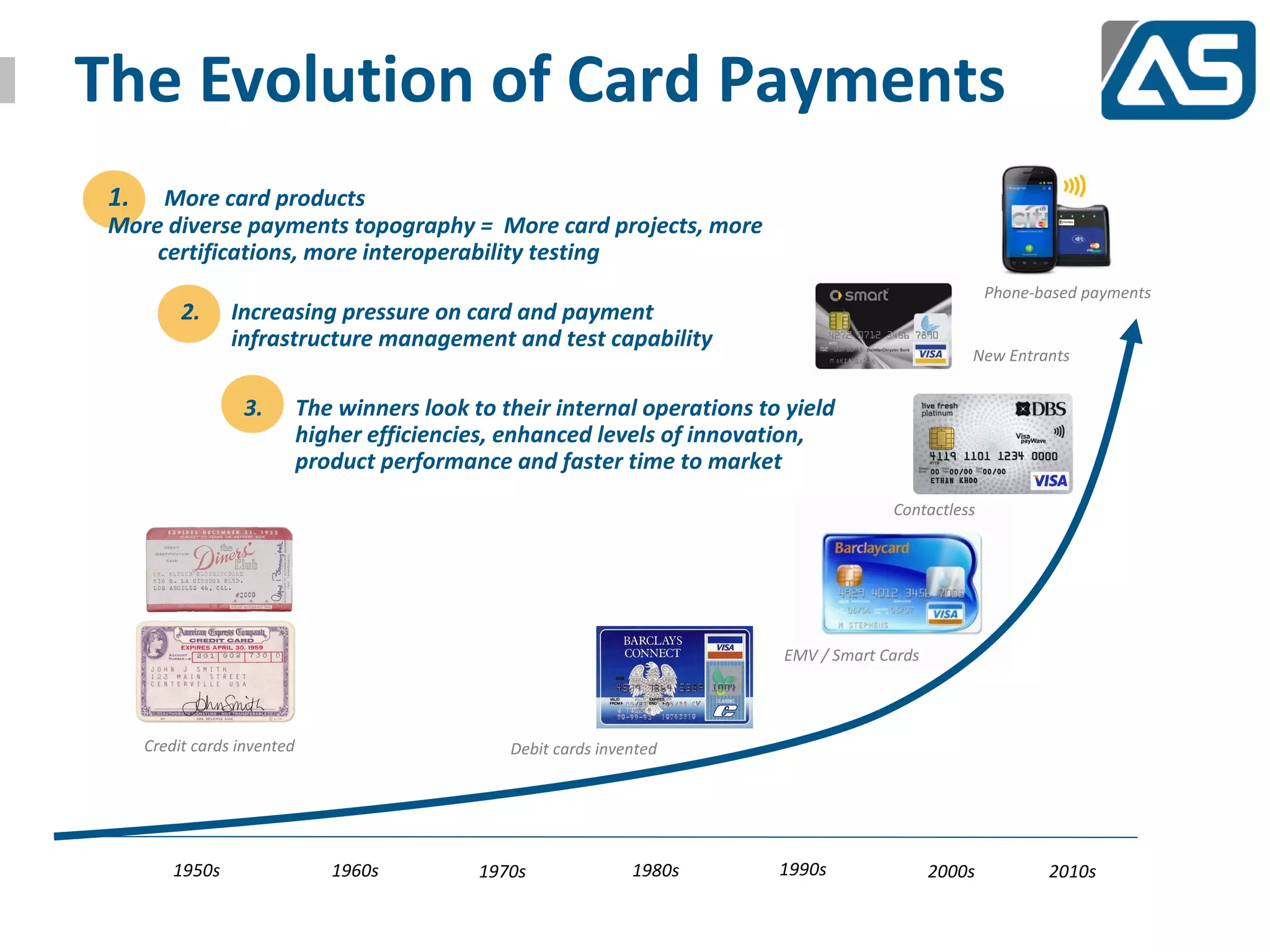

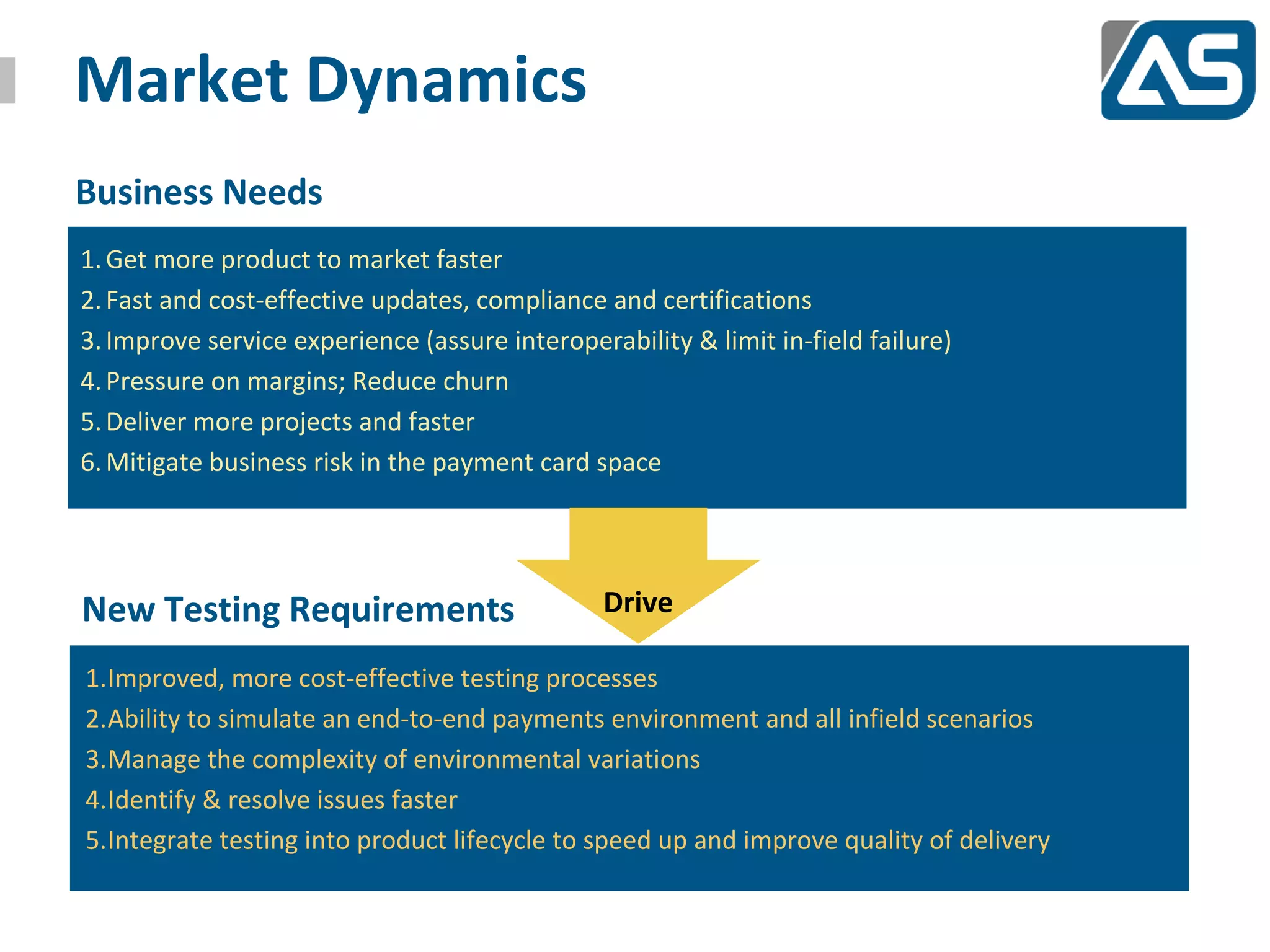

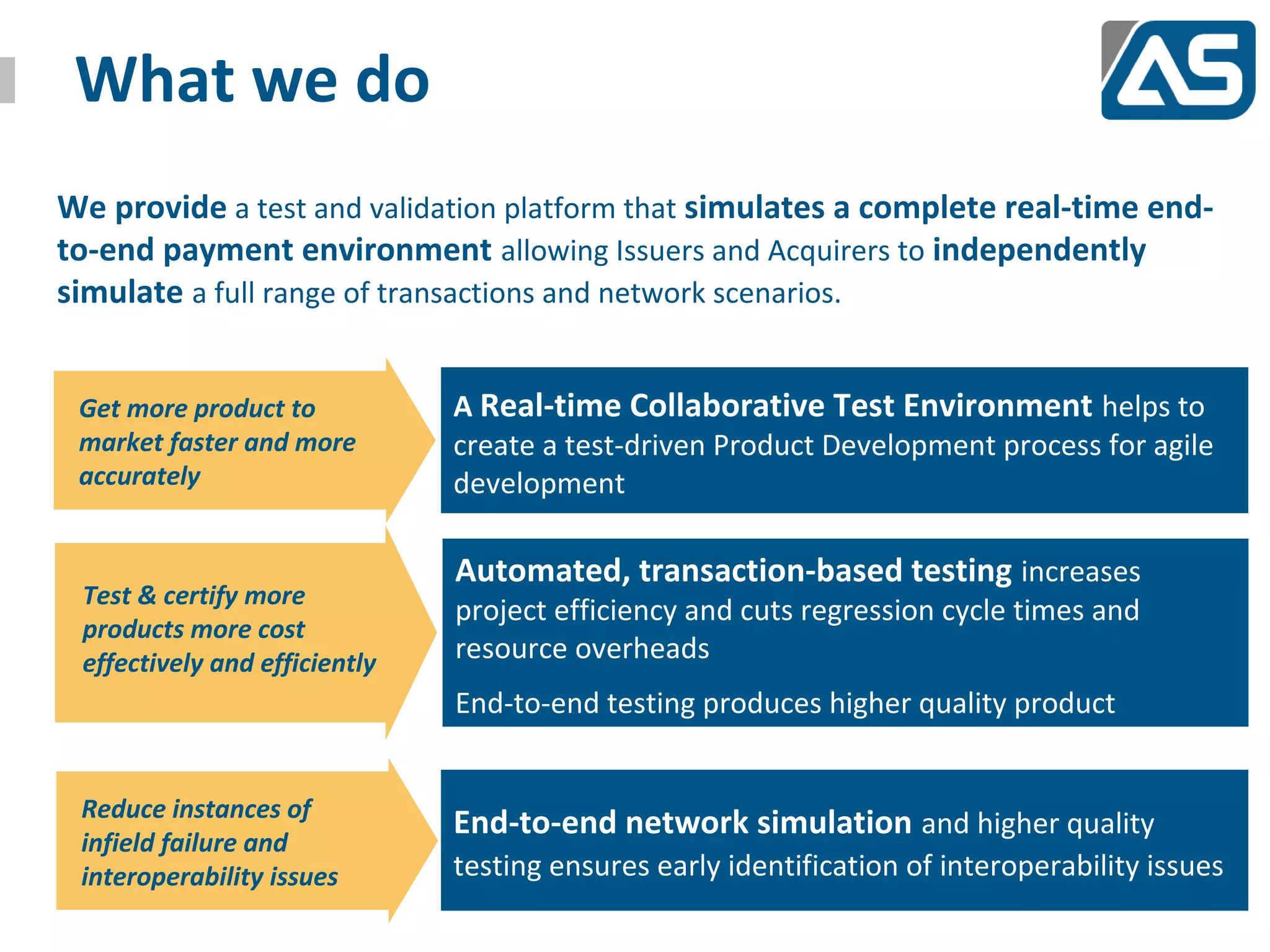

Acquirer Systems is a global leader in testing and validation solutions for complex payment environments, helping clients enhance product efficiency and compliance. The document discusses market dynamics in payment systems, emphasizing the need for improved testing capabilities and faster product delivery in response to evolving customer demands and emerging technologies. Acquirer Systems offers a comprehensive testing platform that streamlines the product lifecycle and mitigates risks associated with payment processing.