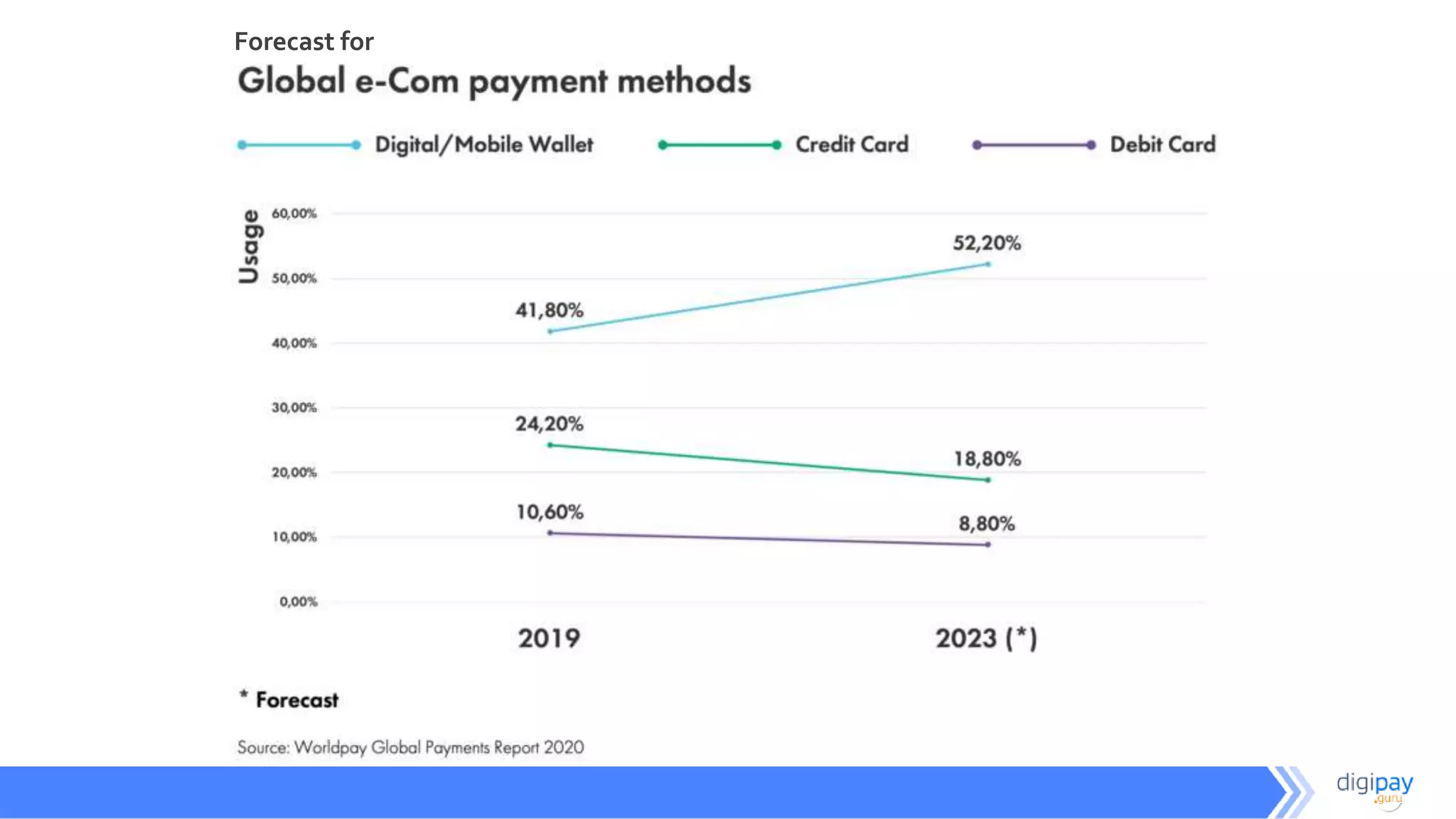

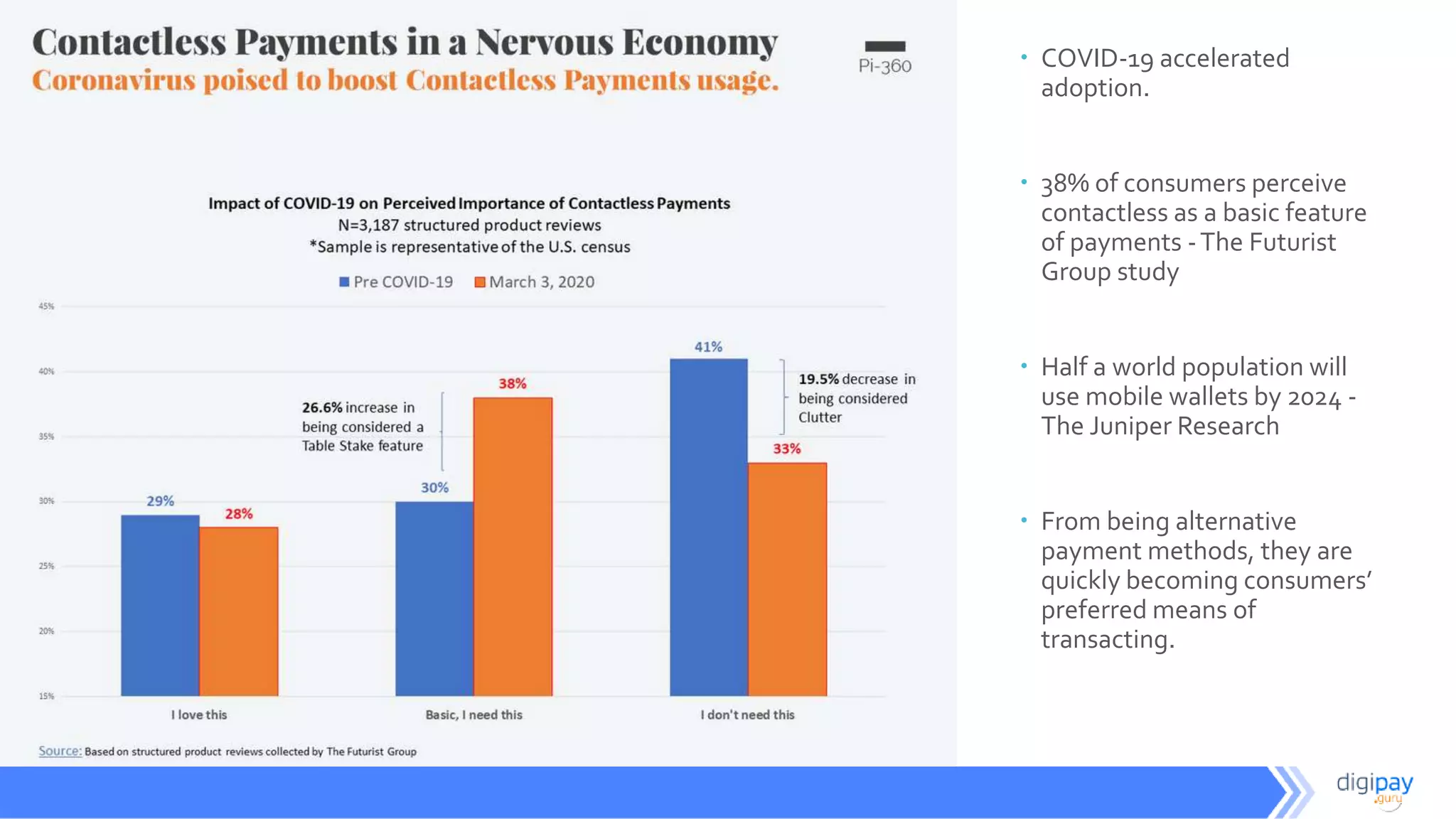

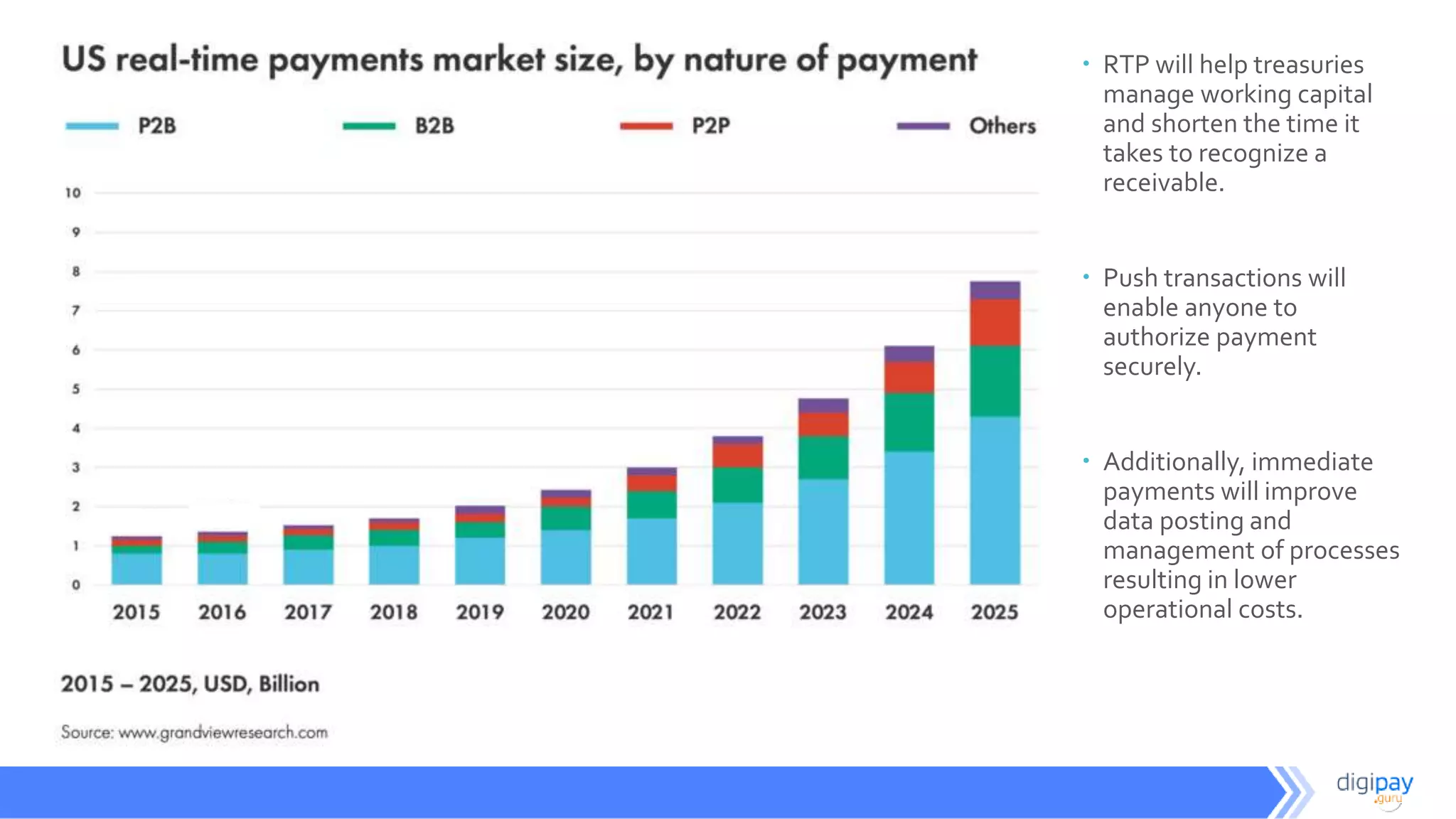

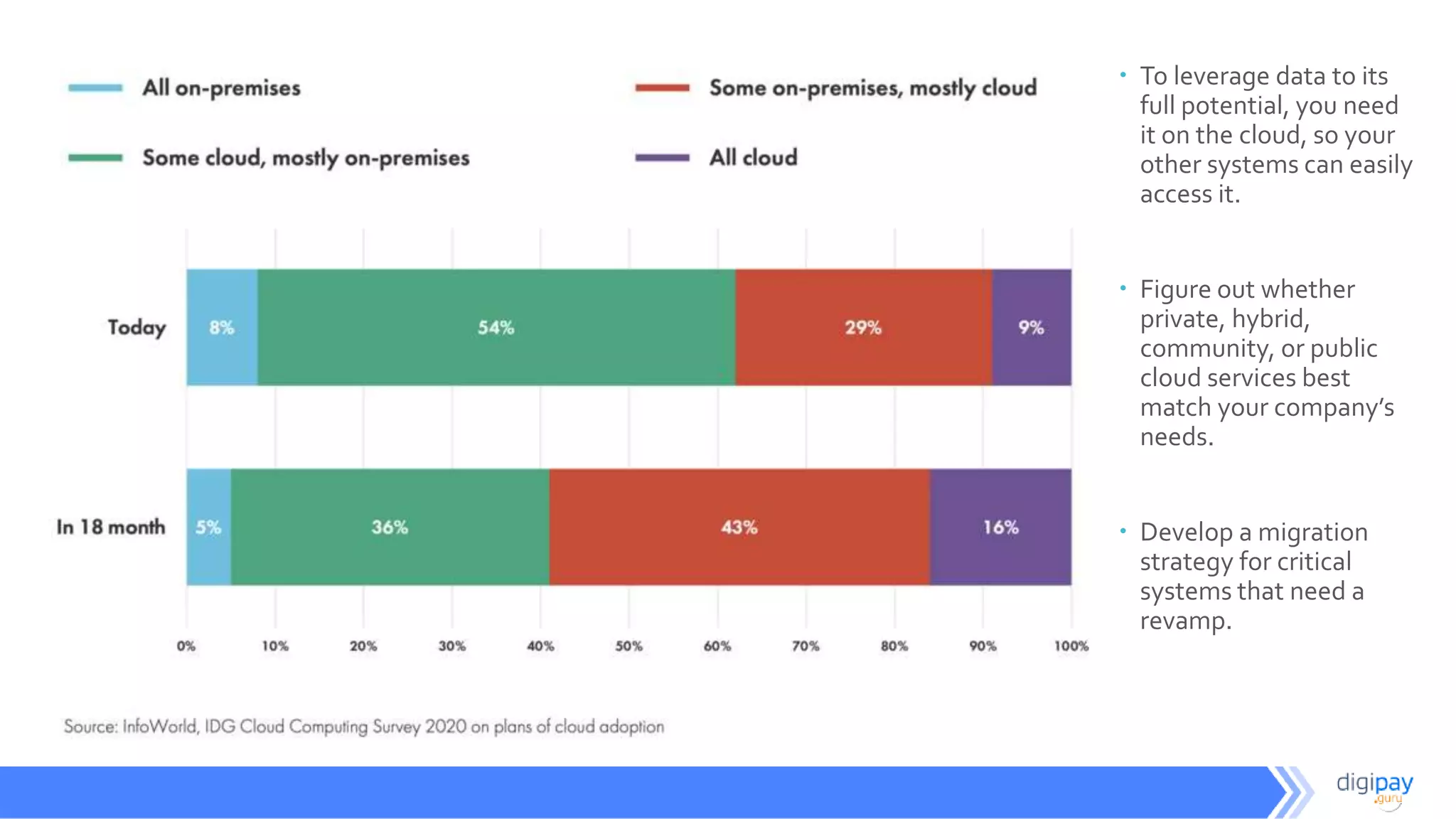

The document discusses key trends and dynamics in the payment industry in 2021, as presented by Rahul Patel and Srishti Dey. It notes the increased demand for frictionless experiences through mobile payments and digital wallets. It also discusses the growing adoption of real-time payments, the gains of AI/machine learning in payments, expanding mobile commerce, challenges of cross-border transactions, benefits of cloud migration, impacts of open banking and COVID-19 in accelerating digital payments usage, and the value of data in financial decision making. The closing lines emphasize catering to changing customer needs through convenient payment options and the need for industry players to evolve quickly.