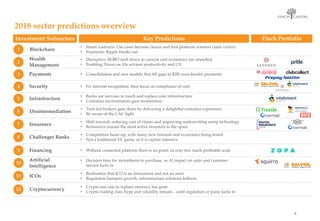

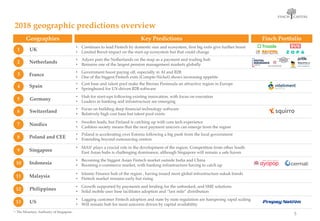

The document outlines Finch Capital's 2018 fintech predictions, reflecting on 2017's growth and developments in financial technology investments, focusing on blockchain and AI innovations. Key trends include the rise of Southeast Asia as a fintech hub and challenges in SME financing due to data consistency issues. It also highlights geographic predictions for fintech growth across various regions, emphasizing the importance of technology in transforming financial services.