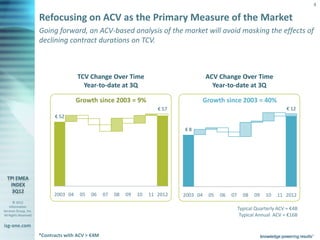

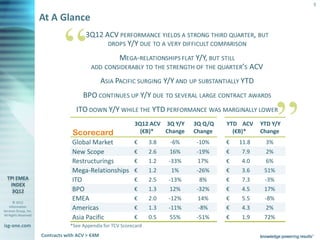

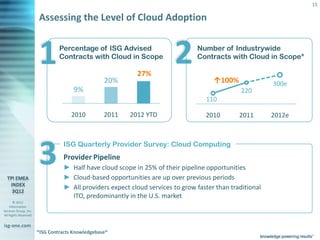

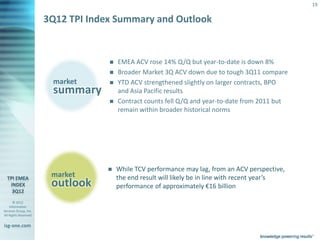

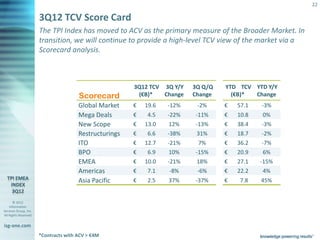

The document provides an overview of outsourcing market data and insights for the third quarter of 2012. Key points include:

- Global outsourcing market contract awards (ACV) were down 6% year-over-year but up 3% year-to-date.

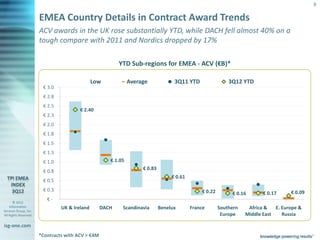

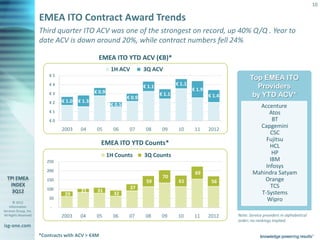

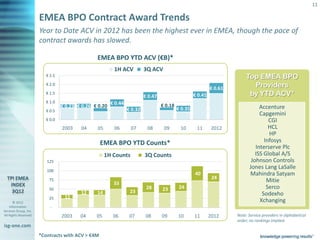

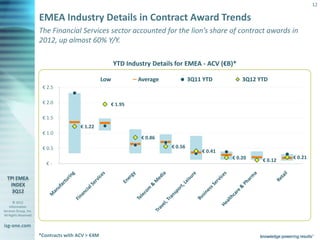

- EMEA outsourcing market contract awards were down 12% year-over-year and 8% year-to-date. Financial services was the top industry.

- The Americas outsourcing market contract awards were flat year-to-date, with the US market becoming predominantly restructuring-based.