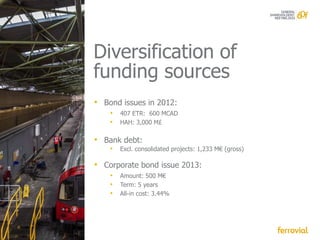

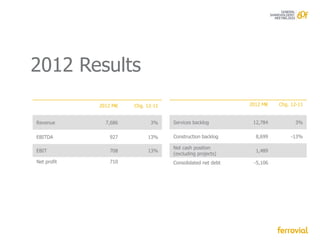

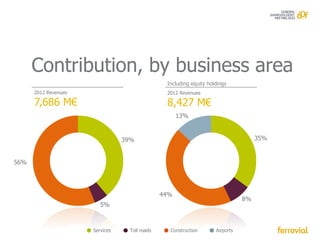

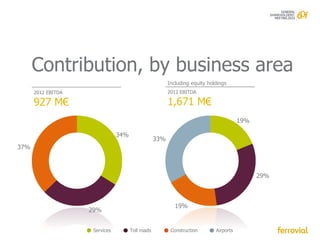

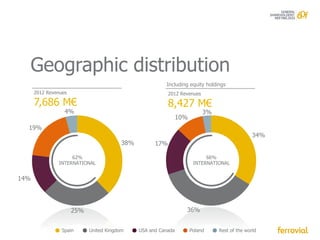

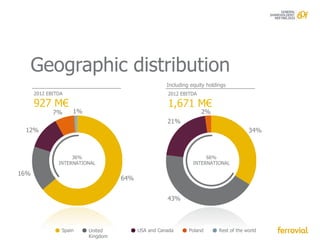

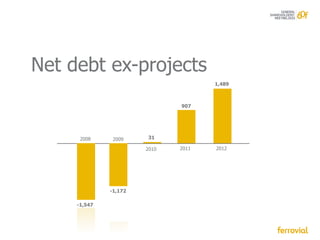

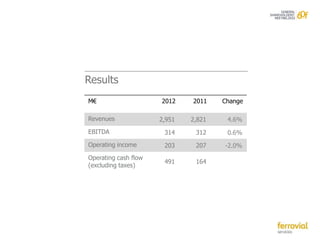

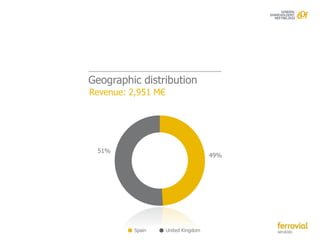

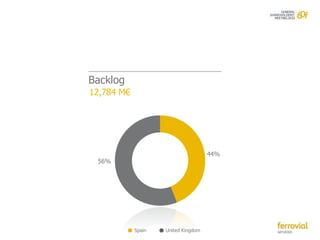

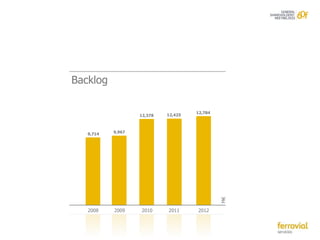

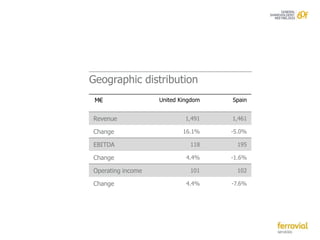

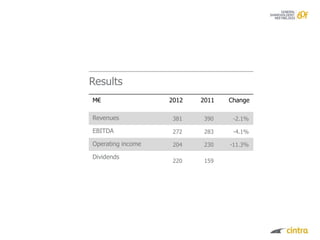

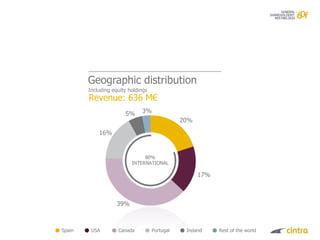

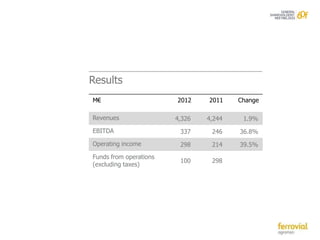

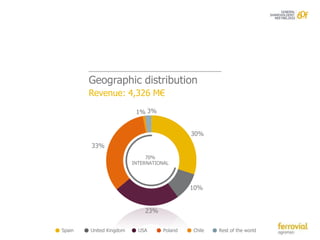

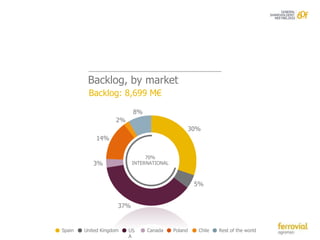

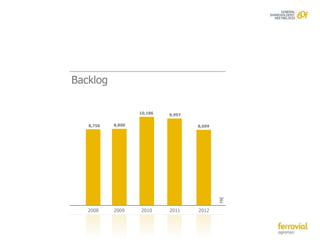

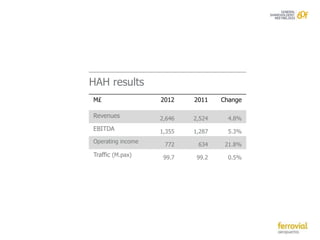

This document contains the agenda and notes from a Ferrovial shareholder meeting held on March 22, 2013 in Madrid. The agenda items included approval of financial statements, distribution of dividends, appointment of directors and auditors, and remuneration plans. The notes provided an overview of Ferrovial's financial position in 2012, including positive operating cash flow, divestments, backlog, and international expansion. Ferrovial reported improved financial metrics in 2012 with increased revenue, EBITDA, and net income compared to 2011.