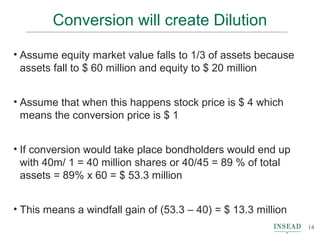

The document discusses the characteristics of ideal financial securities, emphasizing the advantages and disadvantages of debt and equity. It introduces coercive bond structures, such as Coco bonds and coerc, which aim to manage financial distress while avoiding wealth transfers during distress events. The analysis reveals how coerc mechanisms can provide discipline and mitigate risks for both bondholders and shareholders while improving corporate financial stability.