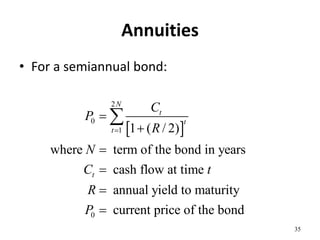

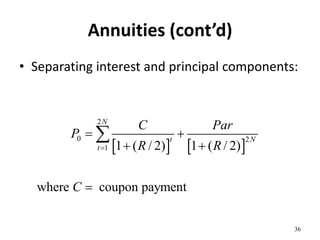

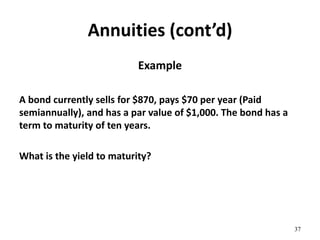

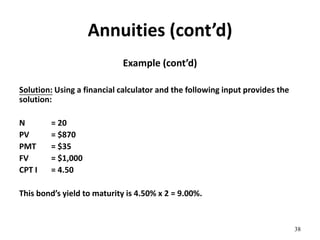

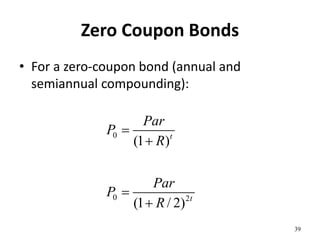

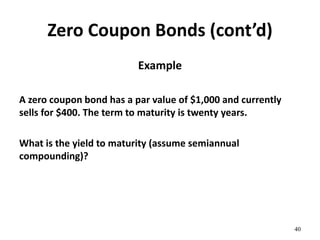

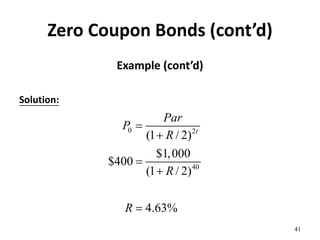

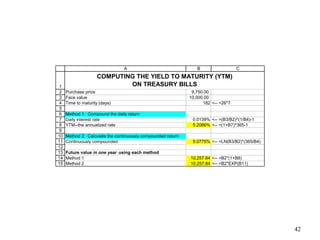

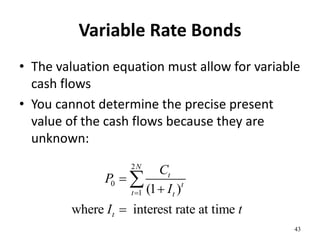

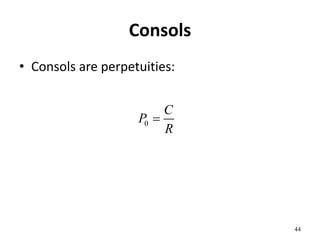

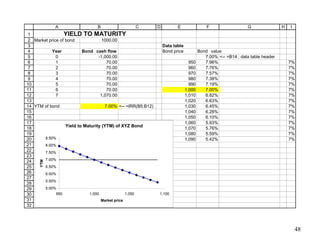

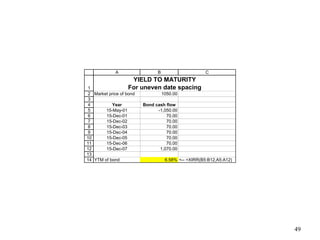

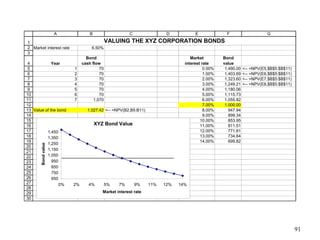

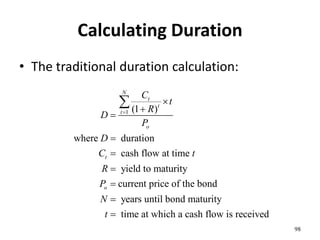

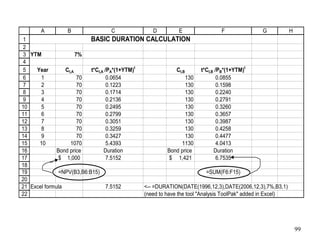

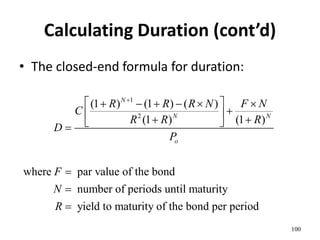

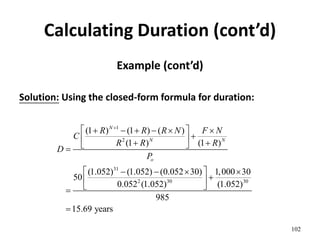

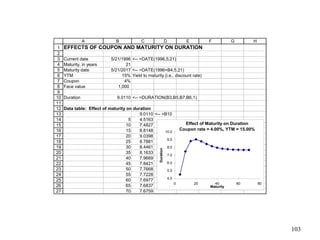

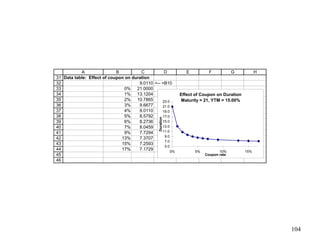

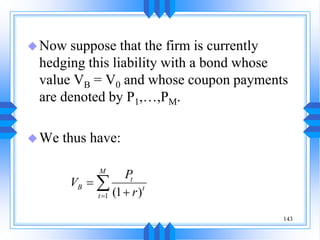

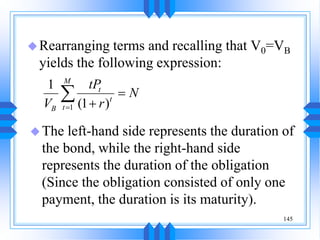

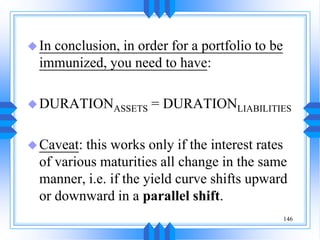

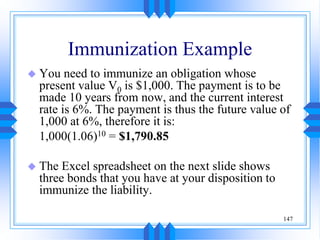

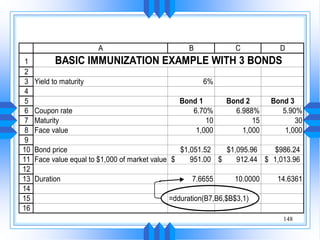

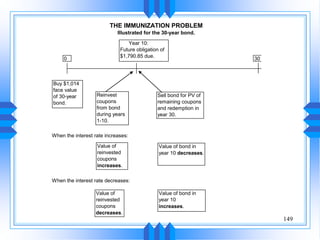

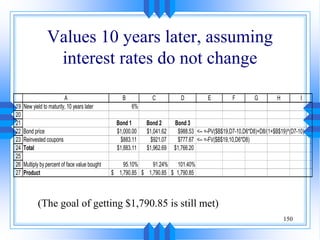

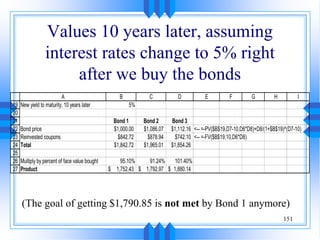

Bond prices are determined by evaluating the expected cash flows of the bond discounted at the yield to maturity. The yield to maturity incorporates the interest payments and expected capital gains or losses. Bonds with higher yields have higher risks. Duration is an important measure of bond risk as it indicates how sensitive the bond price will be to changes in interest rates. Investors must consider factors like bond type, yield, and duration when choosing bonds for their portfolio.