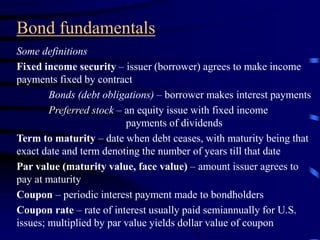

This document provides an overview of different types of fixed-income securities including:

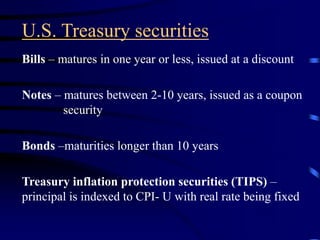

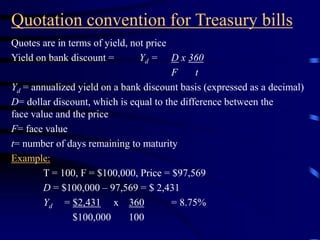

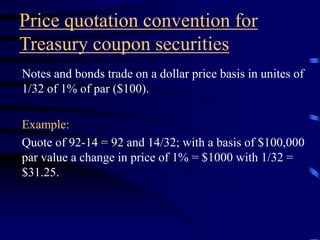

- Bonds issued by the U.S. Treasury including bills, notes, bonds, and TIPS

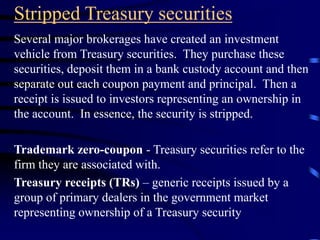

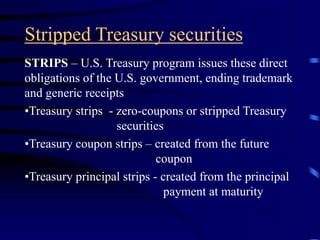

- Stripped Treasury securities including STRIPS and Treasury strips/coupons

- Federal agency securities including those from government-sponsored enterprises and federally related institutions

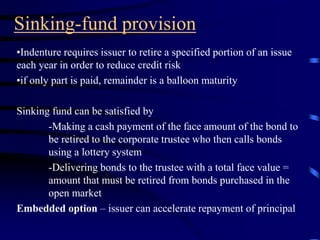

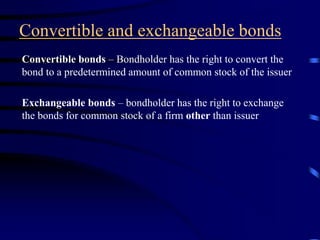

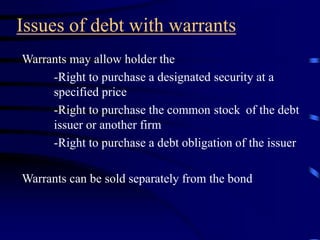

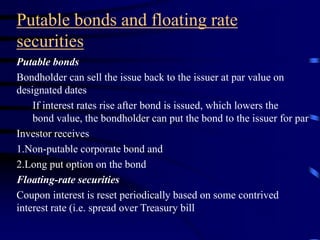

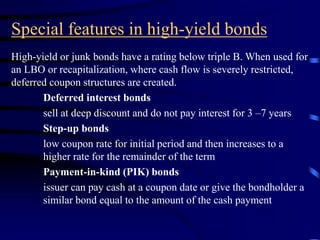

- Corporate bonds including features like call provisions, sinking funds, convertibles, and high-yield bonds

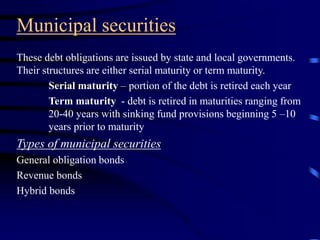

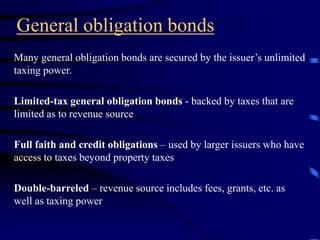

- Municipal bonds including general obligation bonds backed by taxing power and revenue bonds backed by fees/grants

- Credit ratings and their application to fixed-income security issues