More Related Content

Similar to Financial Innovation Event Discusses Corporate Financing Options

Similar to Financial Innovation Event Discusses Corporate Financing Options (20)

More from Vlerick_Alumni (20)

Financial Innovation Event Discusses Corporate Financing Options

- 1. 1

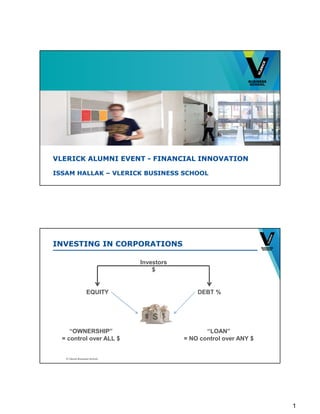

VLERICK ALUMNI EVENT - FINANCIAL INNOVATION

ISSAM HALLAK – VLERICK BUSINESS SCHOOL

© Vlerick Business School

Investors

$

DEBT %EQUITY

“OWNERSHIP”

= control over ALL $

“LOAN”

= NO control over ANY $

INVESTING IN CORPORATIONS

- 2. 2

© Vlerick Business School

SIMILAR TO RENTING A CAR

Rent a car: car value $50,000

Contract:

Driver gives deposit $5,000

Limited liability: driver won’t pay more

© Vlerick Business School

SIMILAR TO RENTING A CAR

If car accident

Cost of repair: $10,000

New car value: $40,000

Car rental company:

Keeps deposit ($5,000)

Adds $5,000 for repair (total: $10,000)

Driver: no payment

- 3. 3

© Vlerick Business School

SIMILAR TO RENTING A CAR

If driver works and increases value of car:

New car value: $60,000

Gain: +$10,000

Driver:

Sell car: $60,000; repay car rental company

Profit +$10,000; 200% profit

© Vlerick Business School

COST SHARING LIKE SAND LAYERING BOTTLE

$45,000

$5,000

Initial

$45,000

$7,500

Good work!

$45,000

$2,500

Small damage…

$35,000

$40,000

More damage!

(-5,000)

$0Driver’s $

Car rental

company’s $

- 4. 4

© Vlerick Business School

Debt %

Equity$

Assets Equity & Liabilities

$

Investors

CORPORATE FINANCING IS COMPARABLE

$45,000

$5,000

© Vlerick Business School

Non-cash

Assets

Debt %

Equity$$

Assets Equity & Liabilities

$

Investors

CORPORATE FINANCING IS COMPARABLE

- 5. 5

© Vlerick Business School

Non-cash

Assets

Debt %

Equity$

Assets Equity & Liabilities

$

$

$ $

$

%

$

$

$

Government

$

CORPORATE FINANCING IS COMPARABLE

$

$10

$5

© Vlerick Business School

FINANCIAL DEBT / ASSETS - USA

- 6. 6

© Vlerick Business School

FINANCIAL DEBT / ASSETS – WESTERN €-AREA

© Vlerick Business School

Investors

$

DEBT %EQUITY

ConcentratedDiffuse

Management

- Strategy

- Operations

- Risk level

Public markets Private Company

Decisions

Investor Basis

STRUCTURE OF OWNERSHIP MATTERS

- 7. 7

© Vlerick Business School

TRADEOFF : INVESTOR BASIS / CONTROL

Large and private

© Vlerick Business School

TRADEOFF: INVESTOR BASIS / CONTROL

Public but concentrated ownership

1961 Warren Buffett

- 8. 8

© Vlerick Business School

WEALTHIEST PEOPLE CONTROL THEIR FIRMS

© Vlerick Business School

Investors

$

DEBT %EQUITY

ConcentratedDiffuse ConcentratedDiffuse

Renegotiation

- Valuation

- Information

- Cross-business

Public markets Private equity Bond Banks

Decisions

Investor Basis Investor Basis

STRUCTURE OF DEBT-HOLDERS MATTERS

- 9. 9

© Vlerick Business School

Non-cash

Assets

Debt %

$60

Equity

$50

$60

Assets Equity & Liabilities

$

$

$ $

$

$

FINANCIAL CONSTRAINTS ARE COSTLY

$10

$5

Return = 10%

© Vlerick Business School

Non-cash

Assets

Debt %

$45

Equity

$40

$35

Assets Equity & Liabilities

$

$

$ $

$

$

LOWER FINANCIAL CONSTRAINTS

$10

$6

Return = 15%

Reduce Cash

-$25

- $10 equity

- $15 Debt

(pay less %)

- 10. 10

© Vlerick Business School

CASH-HOLDING AND FINANCIAL CONSTRAINTS

© Vlerick Business School

BANKS REDUCE FINANCIAL CONSTRAINTS

Relationship lender is special lender of a company

We find that relationship Lending reduces financial constraints

Uncertainty ++ Cash

High Prospects ++ Cash

Relationship Lending -- Cash

& Uncertainty -- Cash

& High prospects -- Cash

- 11. 11

© Vlerick Business School

DOES INNOVATION REDUCE CONSTRAINTS?

For companies

Lines of credit

Trade related credit, Factoring.

Derivative Instruments

Microcredit

Credit Derivatives and Securitization

Convertible debt

Structured products

…

© Vlerick Business School

FINANCIAL INNOVATION AND GROWTH

“I wish that somebody would give me some shred of neutral

evidence about the relationship between financial innovation

recently and the growth of the economy.”

Paul Volker (Former Fed Chairman)

A long-run consideration of financial development suggests

that financial innovation is essential for growth.

Ross Levine

- 12. 12

© Vlerick Business School

BANKS INNOVATION IS HINDERED

Today factors against innovation

After crisis “shock” inside bank

State ownership

Tighter regulation rules

Tighter supervisory control

© Vlerick Business School

OUTSTANDING CORPORATE BANK LOANS

Source: ECB

- 13. 13

© Vlerick Business School

CORPORATIONS SECURITIES ISSUANCE

Equity securities issuance Debt securities issuance

© Vlerick Business School

“OUTDOOR” INNOVATION IS BOOMING

Latest innovations

Crowdfunding

Peer-lending

SME bonds

New payment system

Bitcoin

CoCo and COERC

- 14. 14

© Vlerick Business School

EXAMPLE OF ‘OUTDOOR’ INNOVATION

Public-Private Partnerships (PPP)

New banking liquidity regulation

Long-term loans are far more costly

⇒Banks ‘unable’ to finance PPP (or higher %)

⇒New financial constraint

© Vlerick Business School

PUBLIC-PRIVATE PARTNERSHIP (PPP)

=> Need for financial innovations to reduce financial constraints

- 15. 15

© Vlerick Business School

PPP – BANKS ARE INNOVATING

Matching interests between banks and insurance/pension funds

opposite regulatory and risk management requirements

Risk valuation is key hurdle

First phase: permits, constructions

Second phase: operation & maintenance

Banks stay as key players

Finance first phase

Institutionals take over: loan or bond

© Vlerick Business School

PRIVATE PUBLIC PARTNERSHIP BONDS

7

16

24

17

11 12

1 1

18

0%

1%

2%

3%

2005 2006 2007 2008 2009 2010 2011 2012 2013

Figure 3 - Share of bonds in European PPP transactions

The number of tranches invloving bond issuance is indicated above the charts.

Compiled from the Infrastructure Journal databse.