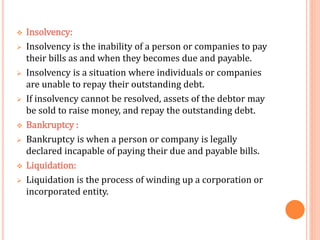

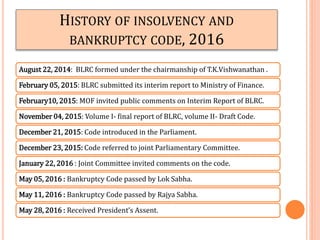

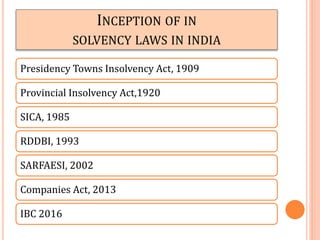

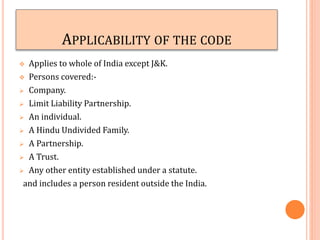

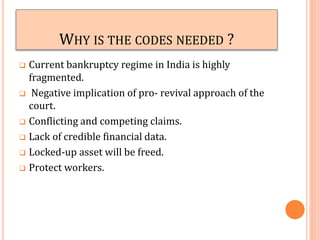

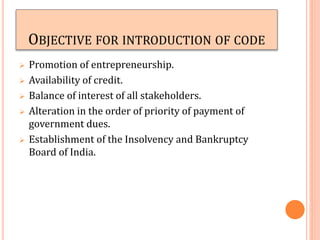

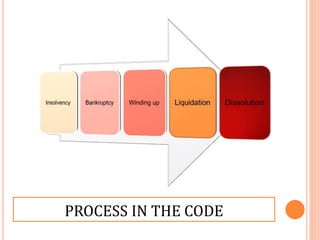

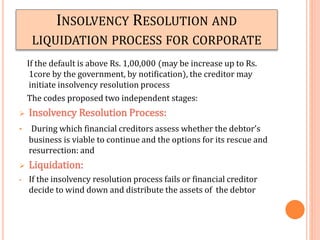

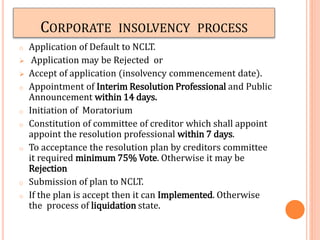

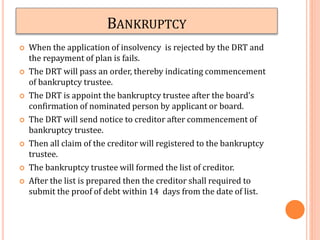

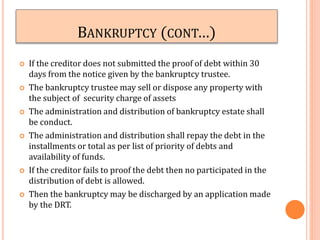

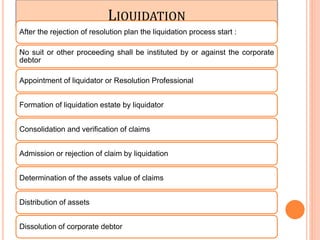

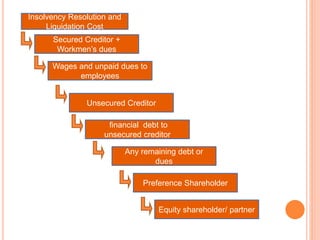

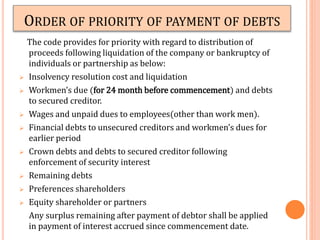

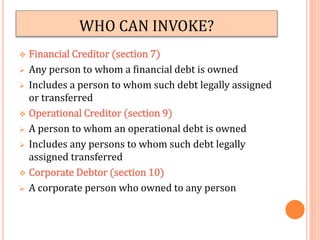

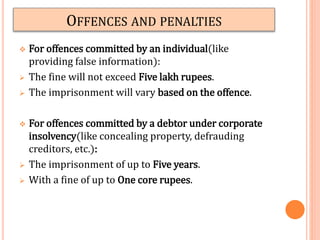

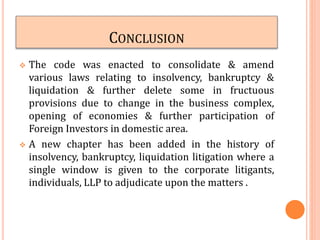

The document summarizes India's Insolvency and Bankruptcy Code of 2016. It consolidates previous bankruptcy laws into a single code and establishes mechanisms for insolvency resolution, regulation, and adjudication. The code aims to promote business and availability of credit. It outlines procedures for insolvency resolution and liquidation of corporate entities. If resolution fails, assets are liquidated according to the order of priority of payments to secured creditors, wages, financial and unsecured debts. The code establishes a new framework for addressing insolvency and bankruptcy in India.