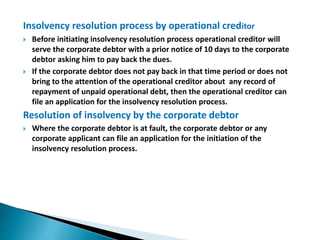

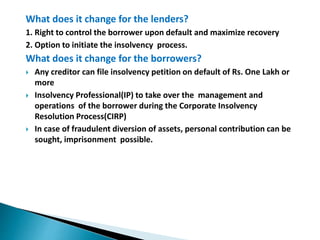

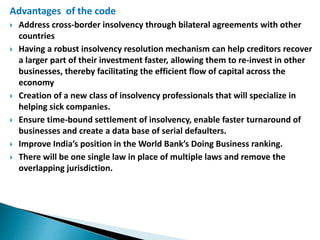

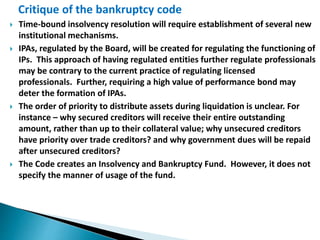

The document discusses key aspects of India's Insolvency and Bankruptcy Code of 2016, including definitions of insolvency and bankruptcy, the laws that previously governed these areas, reasons for introducing the new code, and key parties and processes involved. It also summarizes critiques of the code and amendments made in 2017 to strengthen its provisions.