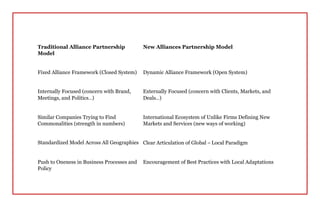

The document discusses the evolution of business consulting, highlighting the transformation of professional services firms due to changing market dynamics and customer sophistication. It emphasizes the shift from traditional consulting models to more flexible, collaborative frameworks, driven by the need for adaptability in a mature consulting industry. Emerging markets are also noted for their unique development paths, contrasting with established North American and European models.