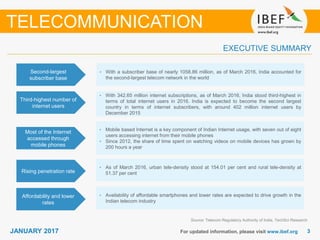

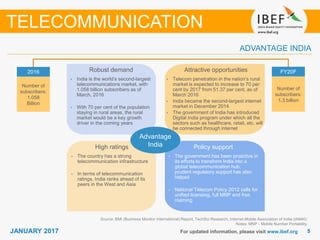

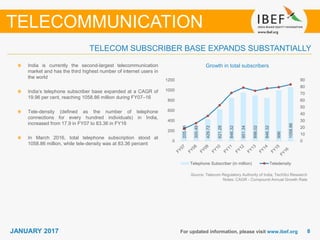

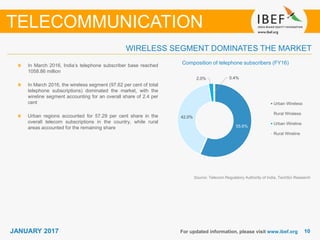

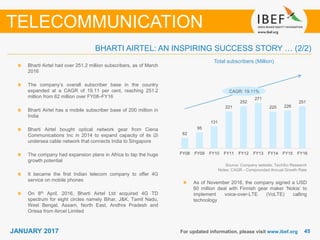

- India has over 1 billion telephone subscribers as of March 2016, with wireless subscriptions accounting for over 97% of the total.

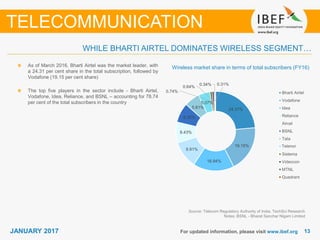

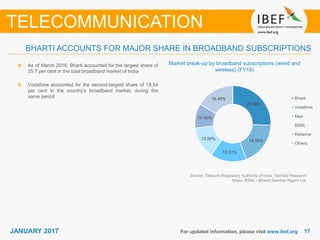

- The top five wireless players are Bharti Airtel, Vodafone, Idea, Reliance, and BSNL, who together hold around 79% of the market.

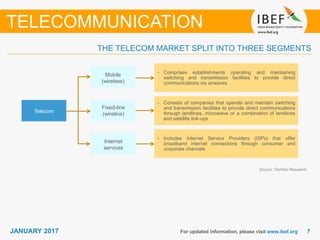

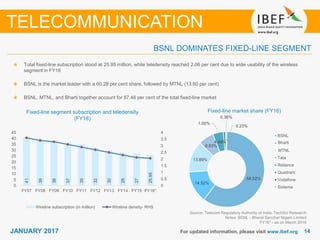

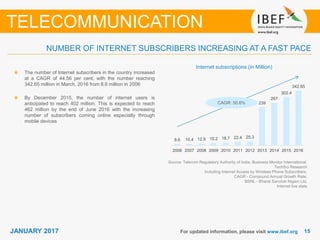

- BSNL dominates the fixed-line segment with around 60% market share, followed by MTNL. Internet subscriptions are also growing rapidly, reaching over 342 million by March 2016.