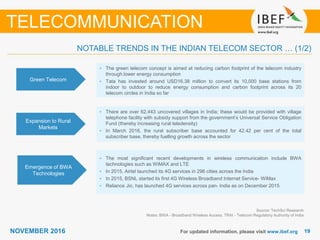

The document provides an overview of the Indian telecommunications market with the following key points:

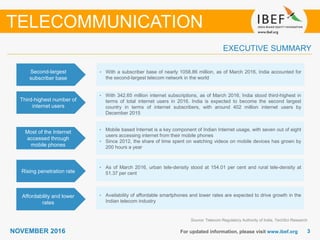

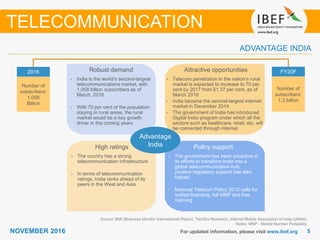

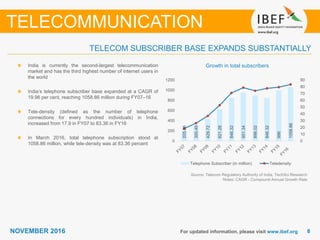

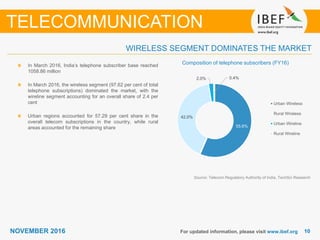

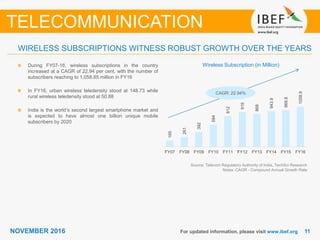

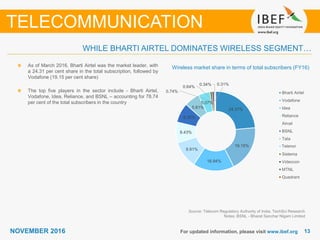

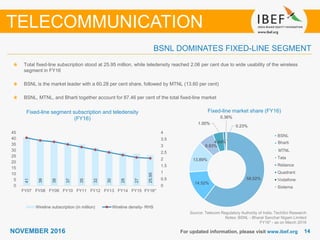

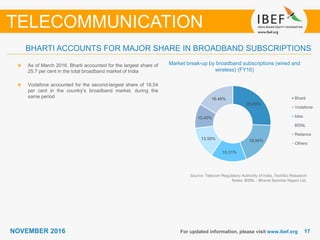

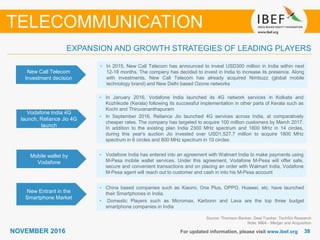

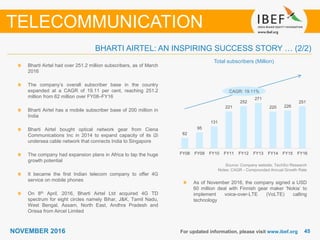

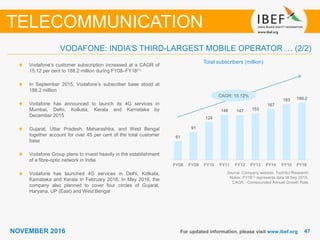

- India has the second largest telecom subscriber base in the world with over 1 billion subscribers as of March 2016. The market is dominated by wireless/mobile services which account for over 97% of subscribers.

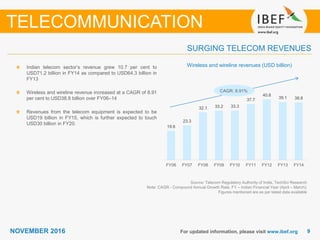

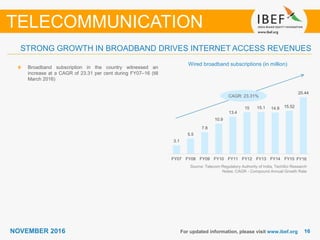

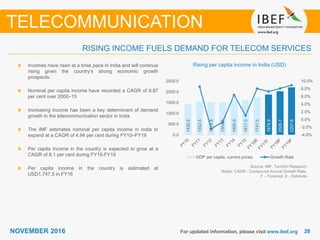

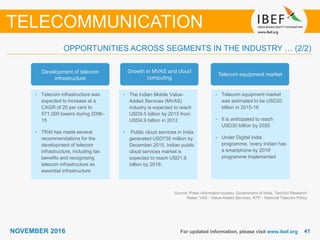

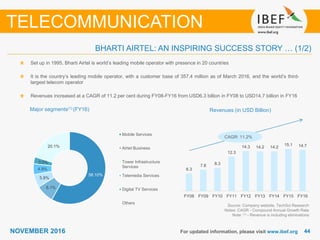

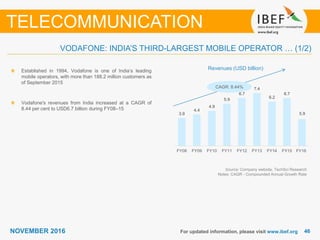

- Total telecom revenues have been growing at a CAGR of 8.9% from 2006-2014 and reached $38.8 billion in 2014. The sector is expected to see continued growth driven by rising penetration in rural areas where tele-density is still low.

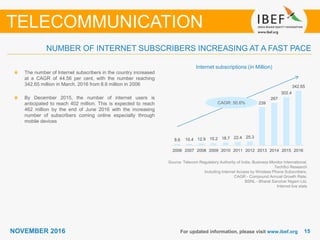

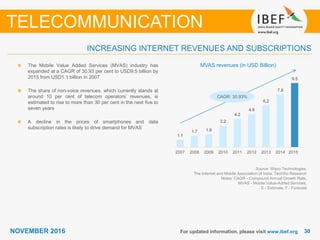

- Internet usage is also growing rapidly in India, with over 342 million internet subscribers as of March 2016. Mobile devices account for the majority