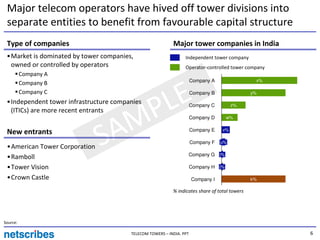

The telecom tower market in India is valued at X billion in 2008 and is expected to require Y thousand towers by 2015, growing at an estimated x% annually. Approximately y% of towers are currently shared, though this is expected to increase. There are four main business models for telecom tower companies: captive, operator controlled, pool and share, and build and operate. Infrastructure sharing in India is currently limited to passive sharing but initiatives by TRAI aim to encourage more sharing. The leading player in the Indian telecom tower market is Company A with x% market share, while new major entrants include American Tower Corporation and Tower Vision.