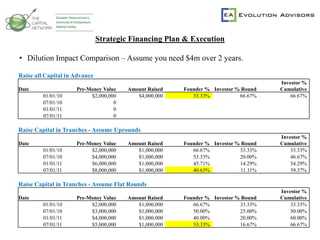

This document provides guidance on strategic financing plans and pitching plans to investors. It discusses determining how much capital to raise initially and in the future to fund business needs. It also covers dilution impacts, credibility with investors, the fundraising sales process, marketing materials, pitch deck organization and content, and presenting to investors. Key recommendations include raising the least capital needed, being forthright about risks and unknowns, and tailoring materials for specific investors while maintaining consistency.