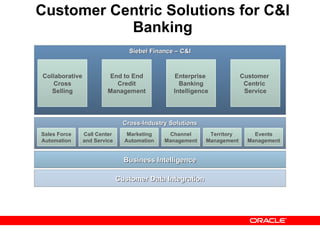

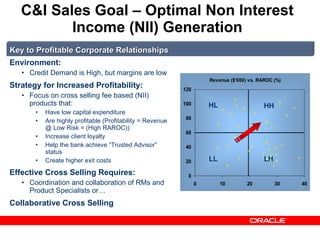

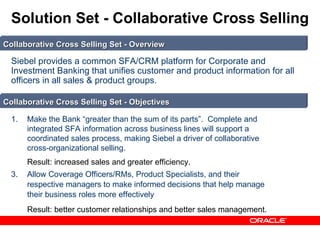

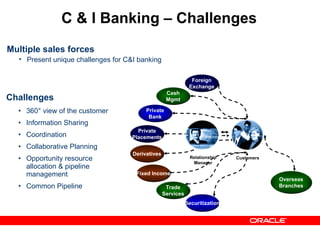

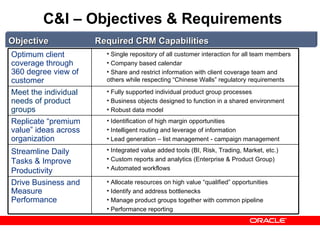

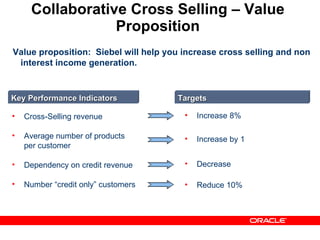

Siebel provides a common customer relationship management (CRM) platform for corporate and investment banking that unifies customer and product information across business lines. This allows for coordinated sales processes and collaborative cross-selling, increasing sales and efficiency. The solution set supports collaborative cross-selling through features like a 360-degree view of customers, information sharing, coordinated planning, and opportunity and resource allocation to drive business performance and non-interest income generation.