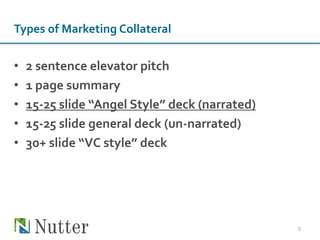

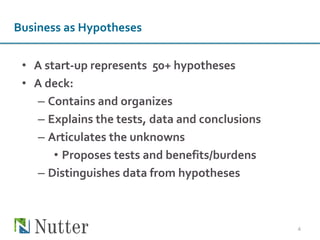

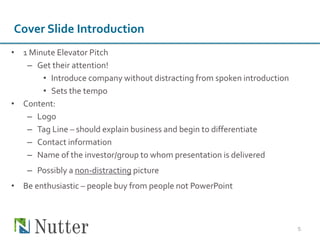

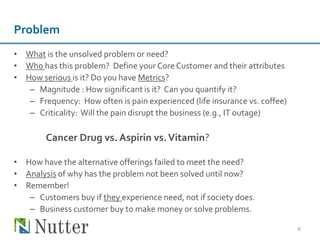

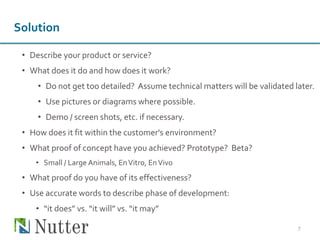

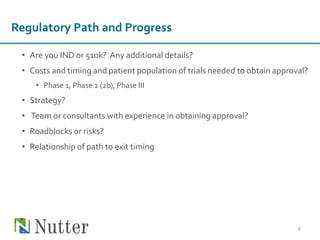

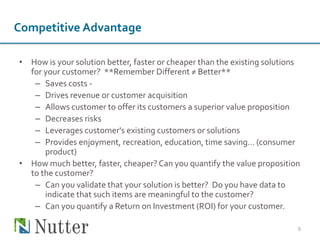

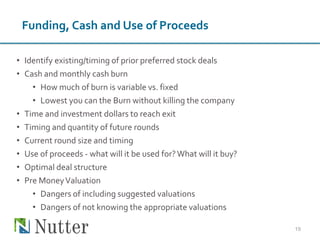

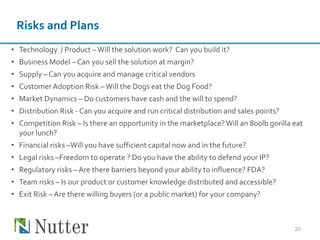

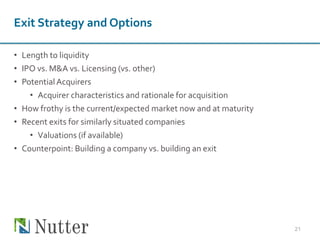

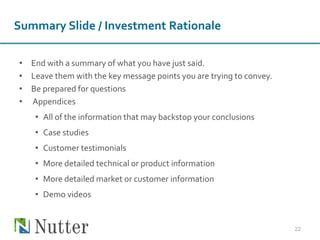

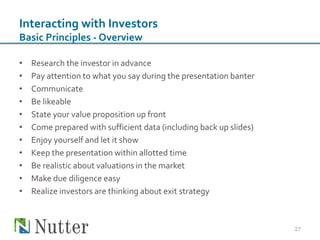

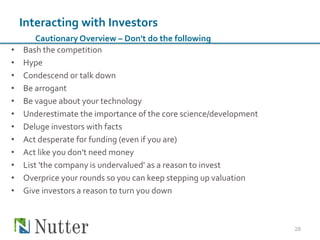

The document provides guidance on preparing a pitch deck for startups, emphasizing the importance of organizing content around hypotheses and clearly articulating the business's problem, solution, and competitive advantage. It covers aspects such as marketing collateral, regulatory paths, market analysis, and funding requirements while stressing the need for clear communication and effective presentation skills. Additionally, it advises on investor interactions, outlining dos and don'ts to establish a positive rapport while conveying the business proposition.