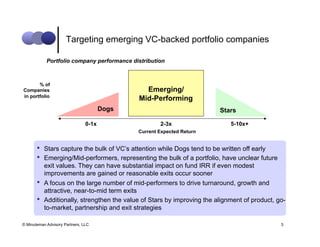

Minuteman Advisory Partners, led by Brad Hafer, specializes in outsourced corporate development for technology companies, focusing on VC-backed portfolios in high-tech and cleantech sectors. They offer consulting services that include strategy development, operational improvement, and partnership execution to enhance company value and prepare for exits. Their engagement model involves internal assessments, strategy development, and ongoing business development support to align companies with potential acquirers.