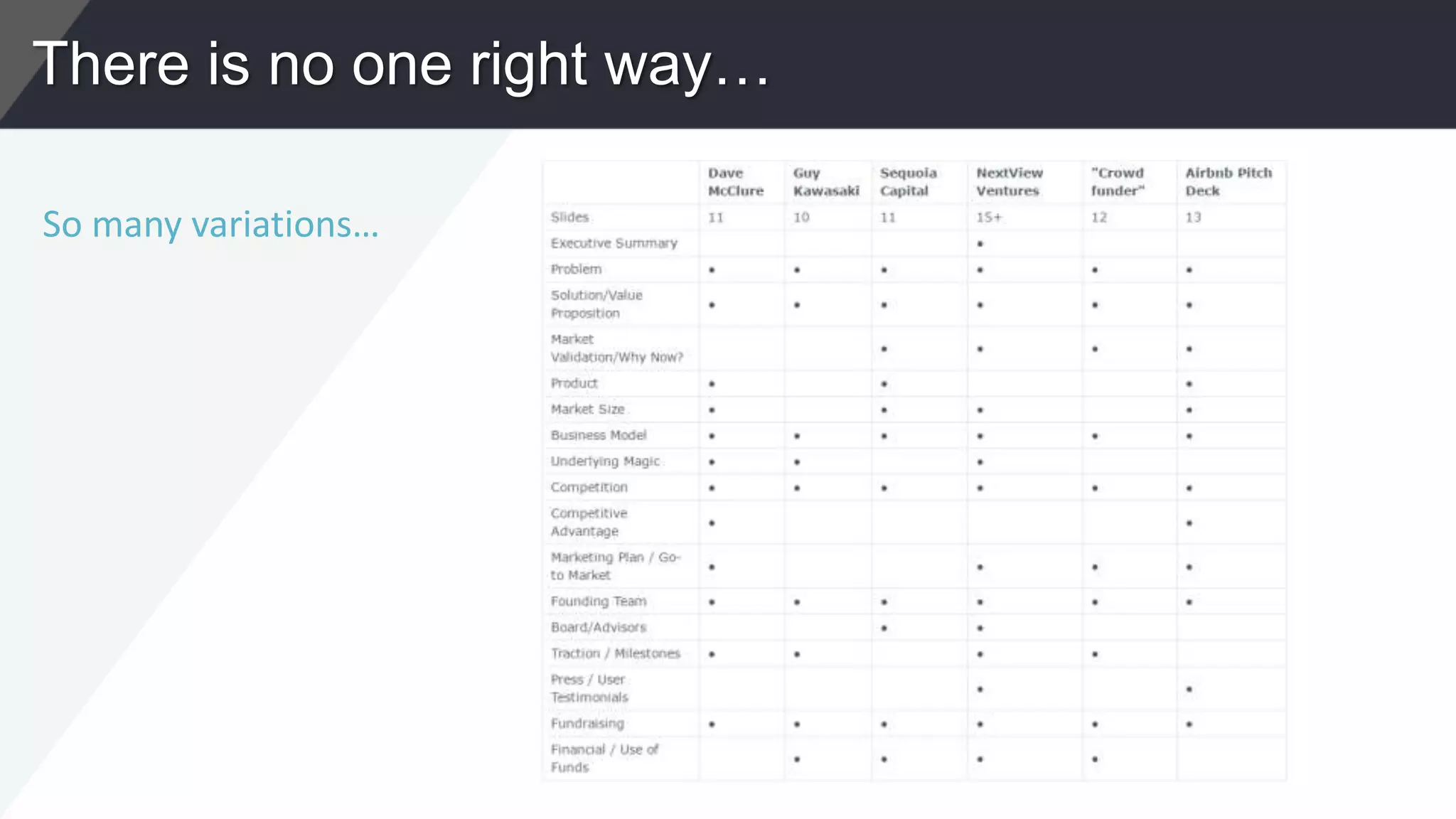

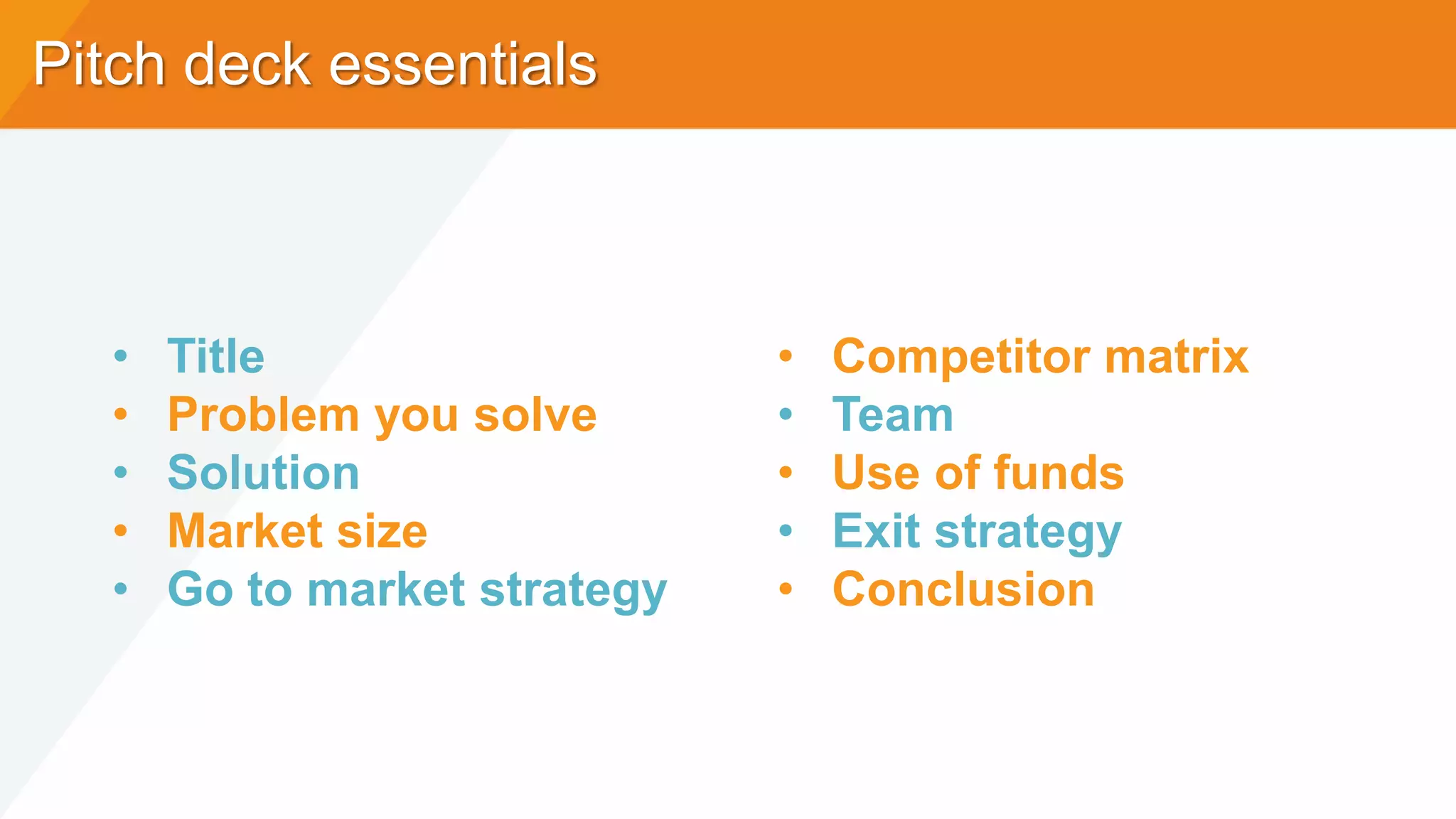

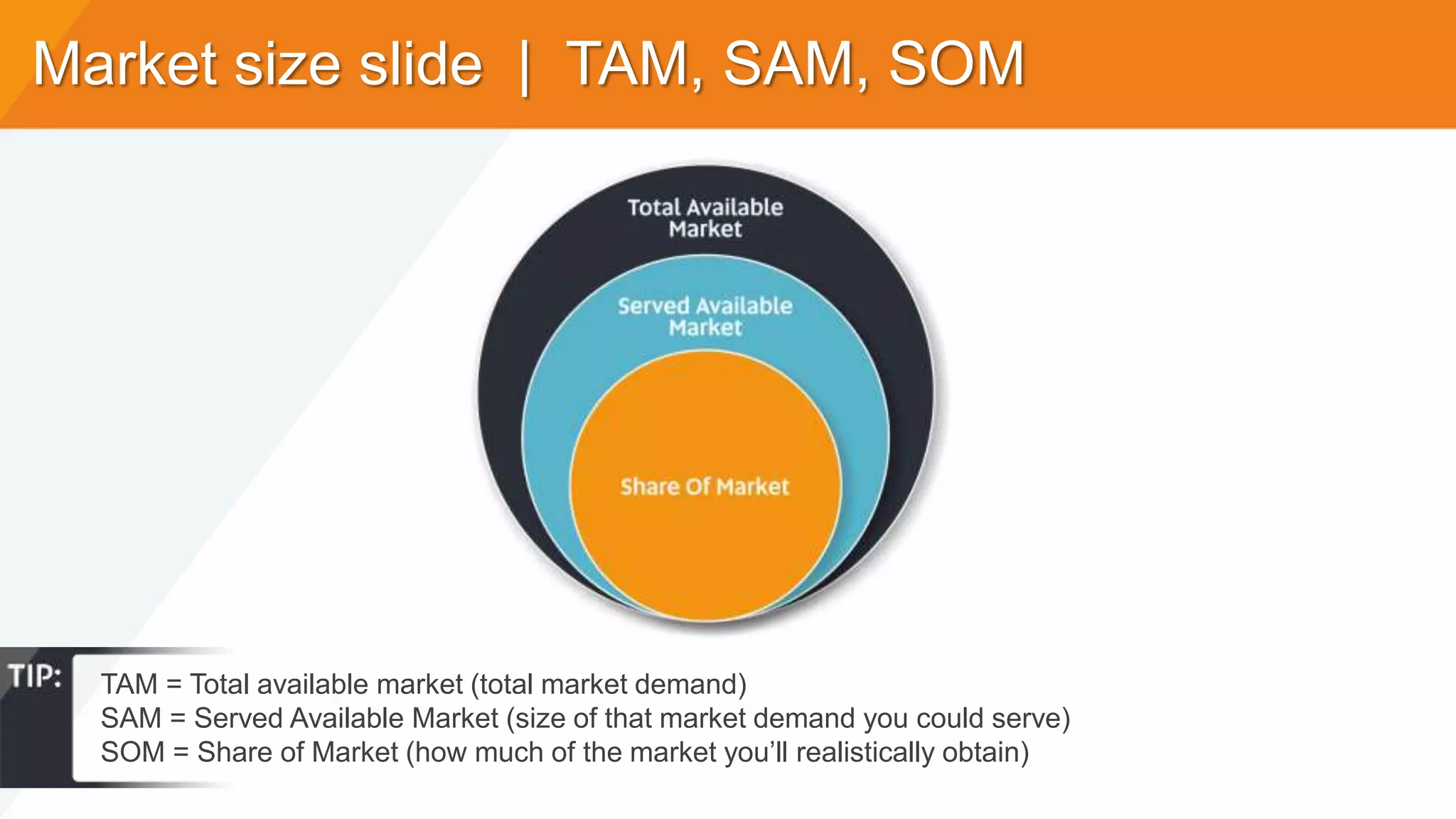

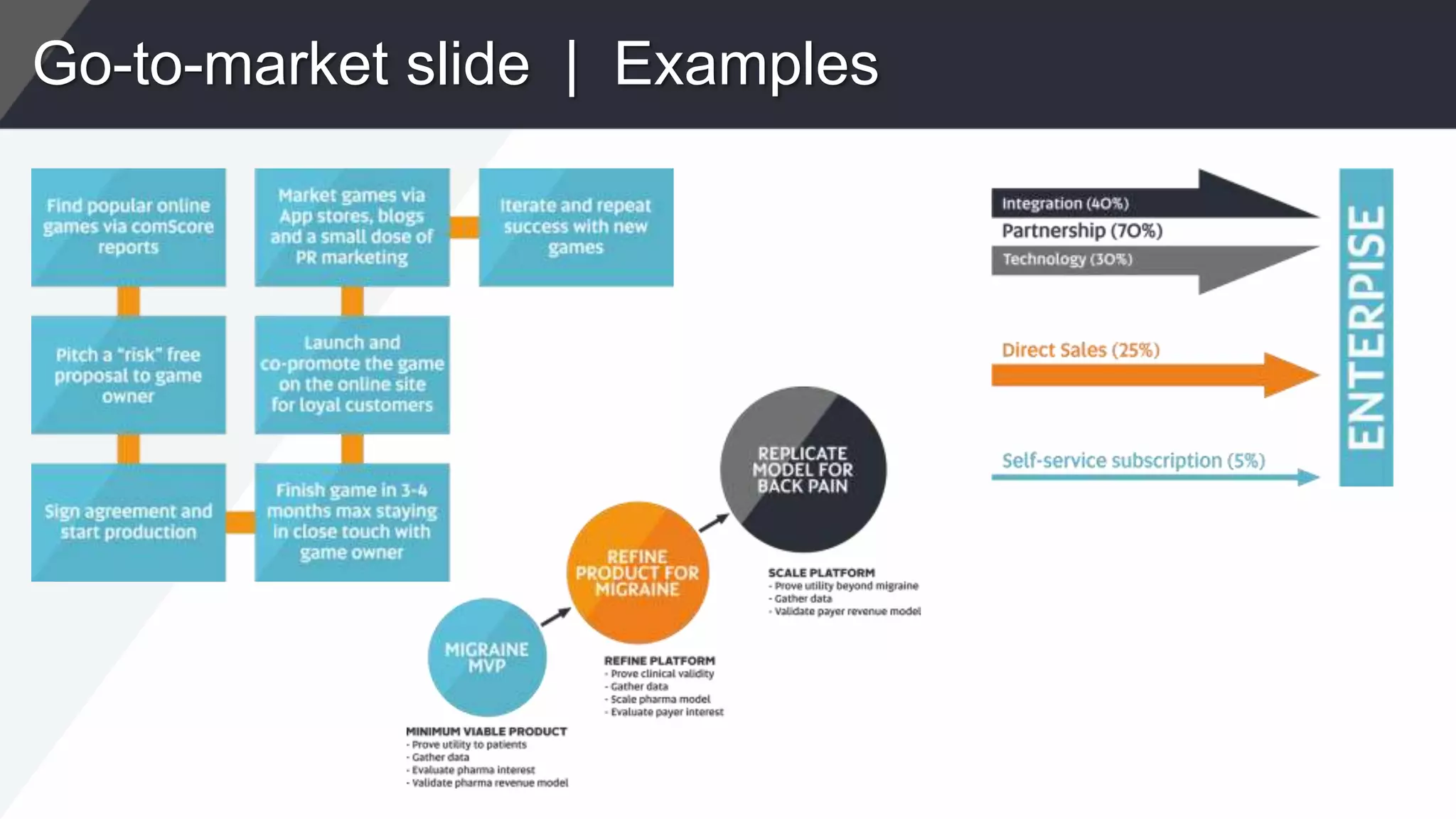

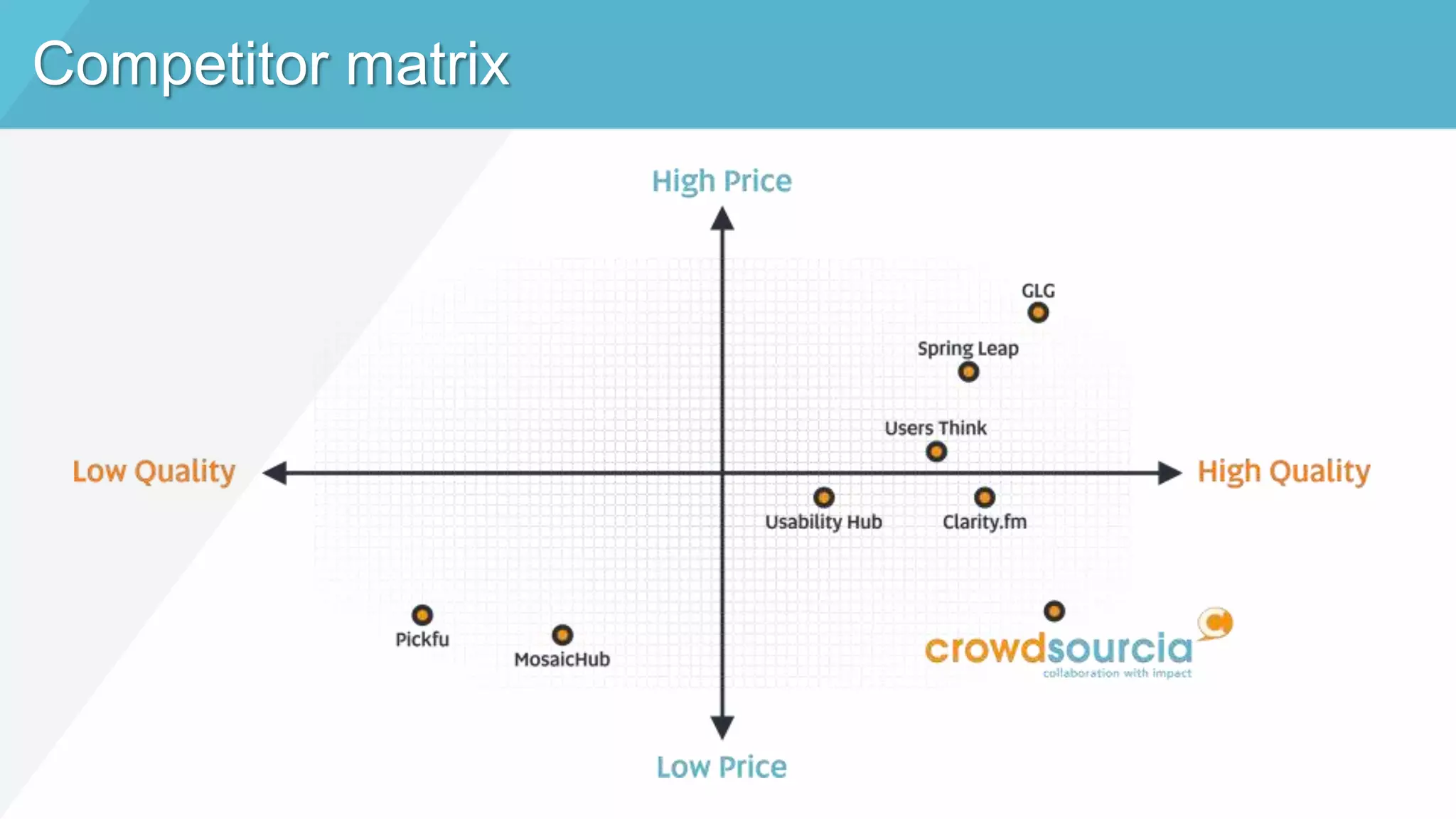

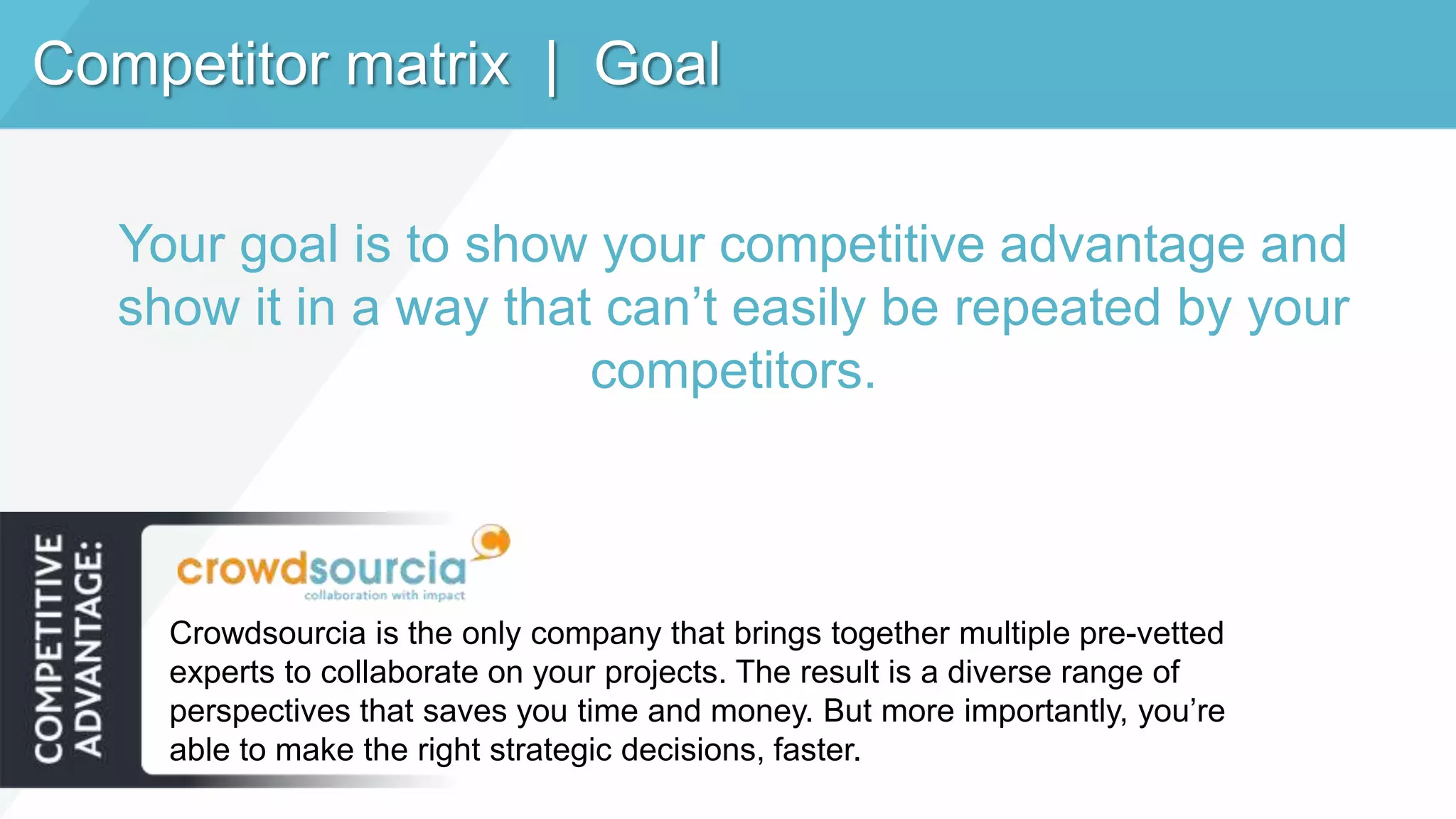

This document provides tips for creating an effective pitch deck to get funding. It recommends including essential slides on the problem, solution, market size, go-to-market strategy, competitors, team, use of funds, and exit strategy. Each slide should be concise and visually compelling. The goal is to grab attention, demonstrate a large market opportunity, prove the competitive advantage, and show investors how their money will be used and a potential exit. Feedback from experts can help strengthen the deck before presenting to investors.