1. The document discusses various tax planning strategies for individuals based on their residential status and income sources. It provides tips to minimize tax liability for income from salaries, house property, business/profession, capital gains, and other sources.

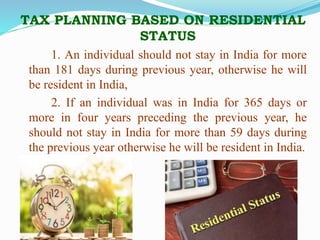

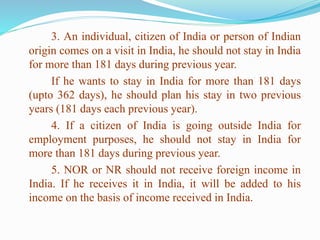

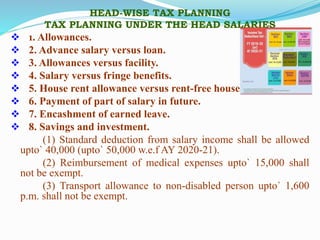

2. Key recommendations include choosing residential status to avoid being a resident in India, deducting interest on home loans, investing in tax-free bonds or dividends, and transferring property between family members to avoid income clubbing.

3. The document also discusses tax planning strategies like timing of asset sales, expense payments, and depreciation claims to reduce tax outflows.