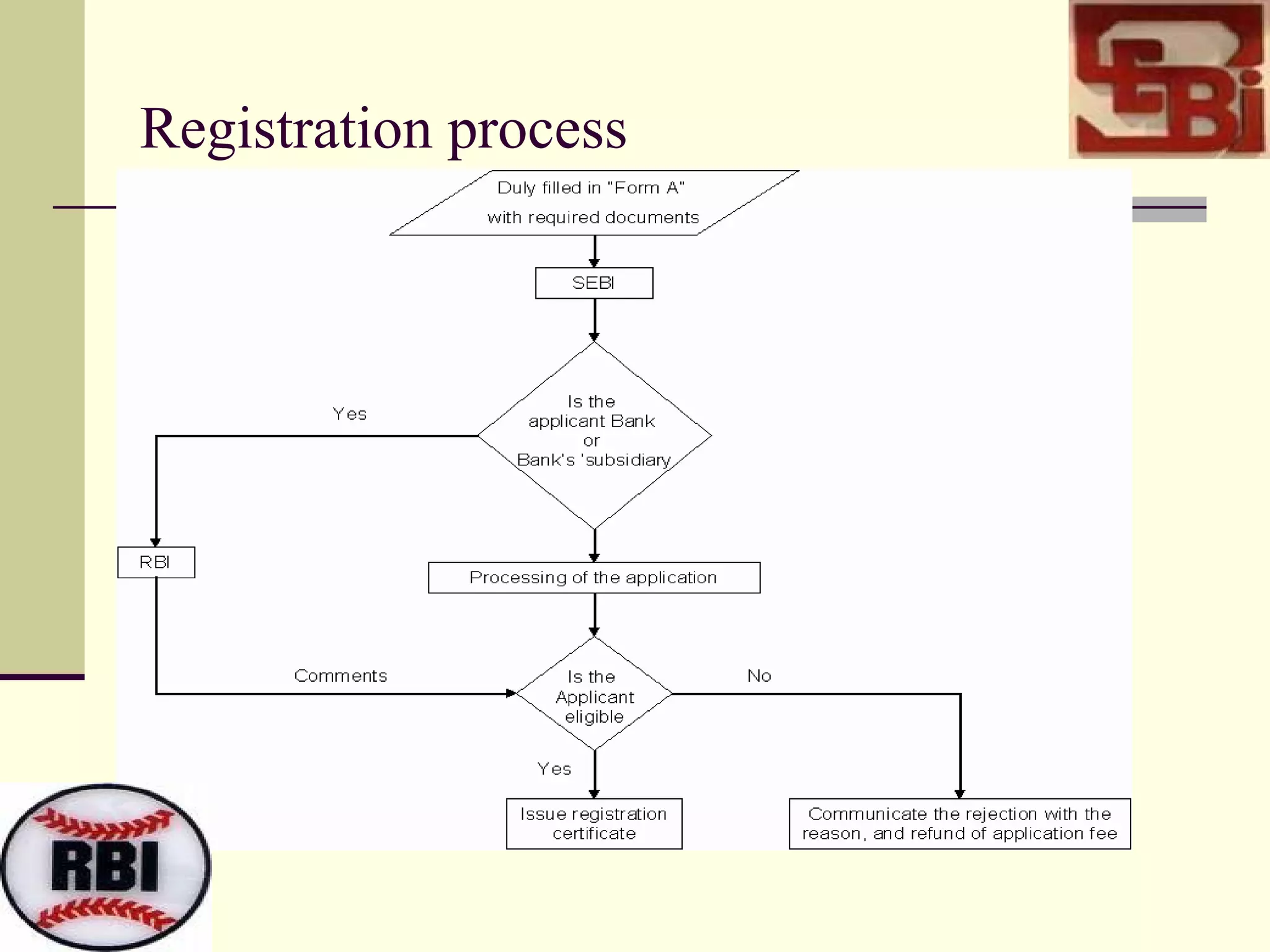

Foreign institutional investors (FIIs) began investing in India in 1992 when the stock market opened to foreign investors. FIIs are foreign corporations registered with SEBI to trade in India's equity market. Eligible FIIs include pension funds, mutual funds, and asset management companies. To register, applicants must meet criteria like regulatory oversight in their home country and appoint a local custodian. Registered FIIs can invest in Indian shares, bonds, derivatives and other securities. FIIs provide capital for India without debt but also increase volatility as they enter and exit markets. While FDI is more stable, FIIs play a significant role in India's financial markets.