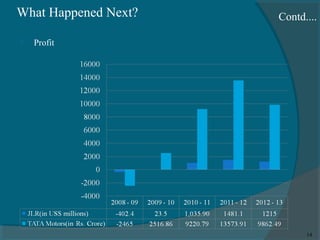

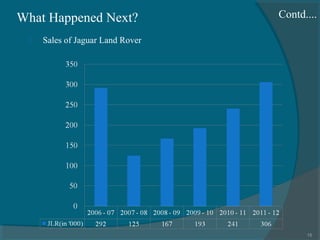

Tata Motors acquired Jaguar and Land Rover from Ford in June 2008 for approximately $2.3 billion, aiming to expand its global footprint and enter the luxury car market. Despite initial challenges, including a global financial crisis and high investment costs, the merger has led to significant revenue growth and improved market capitalization over time. The deal was endorsed by key stakeholders and positioned Tata Motors to leverage JLR's engineering capabilities and product offerings.