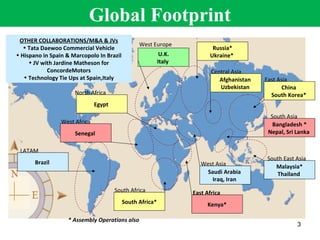

- Tata Motors is an Indian multinational manufacturing company founded in 1945 and headquartered in Mumbai, India. It operates in over 6 continents with automotive interests in commercial and passenger vehicles.

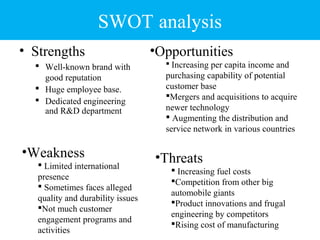

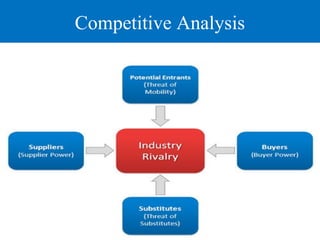

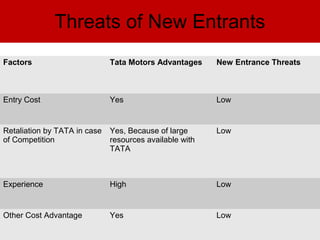

- A SWOT analysis identifies Tata's strengths as its well-known brand reputation and large employee base, while weaknesses include limited international presence and occasional quality issues. Opportunities exist in emerging markets and acquisitions, while threats include rising costs and competition.

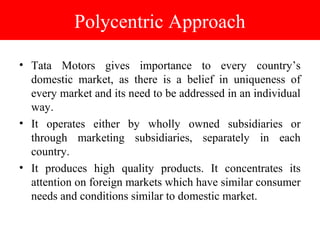

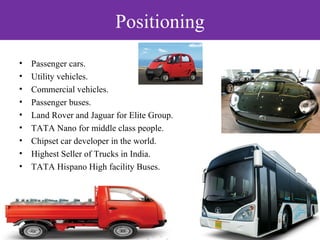

- Tata pursues a polycentric approach by treating each foreign market individually through local subsidiaries. It targets markets where customer needs align with India, such as commercial vehicles in South Korea, buses in Spain, and luxury vehicles in Western countries through Jaguar