Tata Motors acquired Jaguar Land Rover from Ford in 2008 for $2.3 billion. This was a major acquisition for Tata that helped them expand globally. Post acquisition, Tata Motors implemented several cost cutting measures at JLR's UK plants to improve cash flows, including reducing production shifts, extending supplier payment terms, and offering voluntary retirement to some employees. Going forward, Tata Motors plans to grow JLR's business through new product development, expanding into new markets like China, and increasing marketing and dealerships globally to better compete with other luxury brands.

![Post merger

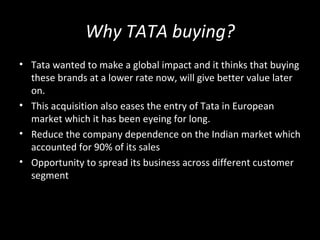

• Following Cost Rationalisation initiatives were taken to

improve cash flows:

1] Single shifts and down time at all three UK assembly

plants.

2] Supplier payment terms extended from 45 to 60 days

in line with industry standard.

3] Receivables reduced by £133 million from 38 to 27

days.

4] Inventory reduced by £217m between June 2008 and

March 2009 from 70 to 50 days .](https://image.slidesharecdn.com/mafortatajlr-120307070429-phpapp02/85/M-a-for-tata-jlr-21-320.jpg)

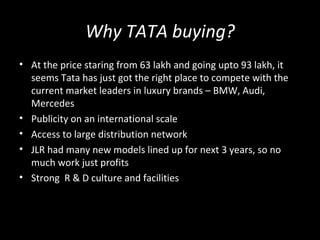

![Contd..

5] Labor actions –

- Voluntary retirement to 600 employees.

- Agency staff reduced by 800.

-Offered leaves to 300 workers of Bromwhich and solihull plant.

-Additional 450 job cuts including 300 managers.

6] Agreement with Unions to implement pay freeze and longer working hours

(equivalent to approximately 20% reduction in labor costs.)

7] Engineering and capital spending efficiencies.

8] Fixed marketing and selling costs reduced in line with sales volume.

9] Reduction in all other non-personnel related overhead costs.](https://image.slidesharecdn.com/mafortatajlr-120307070429-phpapp02/85/M-a-for-tata-jlr-22-320.jpg)