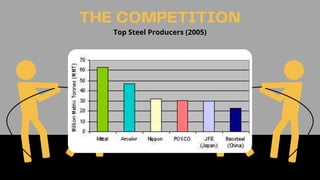

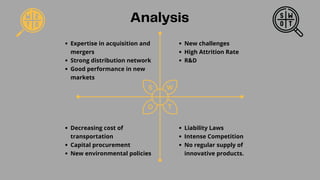

The document discusses the controversial acquisition of Arcelor by Mittal Steel, highlighting the motivations behind the deal, such as a significant premium offered and the goal of creating a top global steel producer. It details the ensuing challenges, including resistance from Arcelor's leadership and government, and the financial outcomes post-acquisition, showing increases in revenue and profit. Ultimately, it reflects on the risks and achievements of Laxmi Mittal in transforming the steel industry landscape.