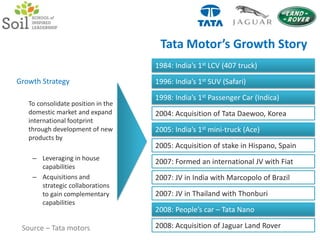

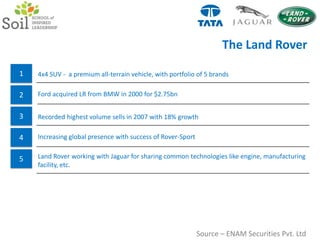

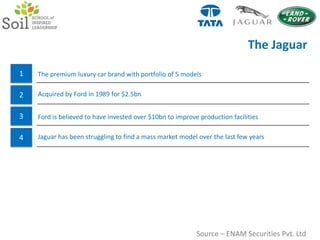

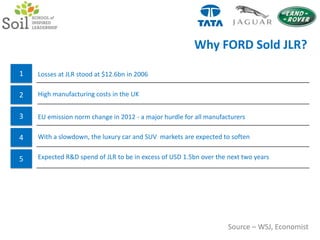

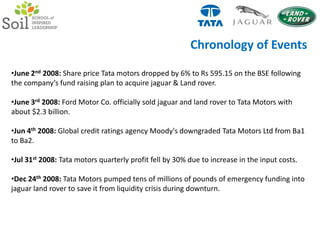

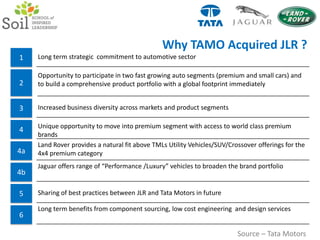

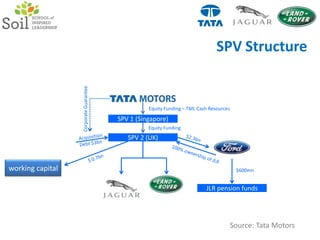

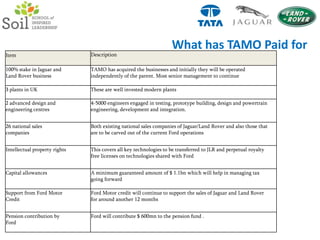

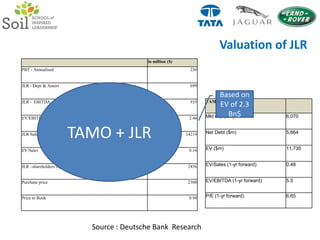

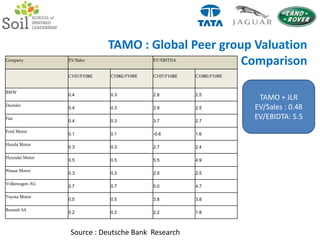

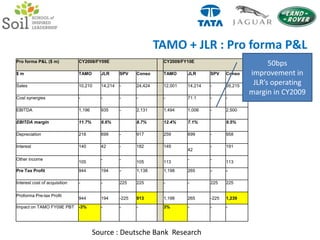

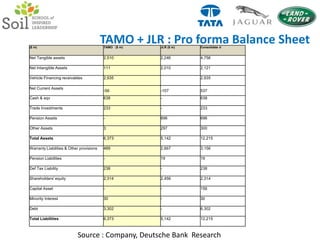

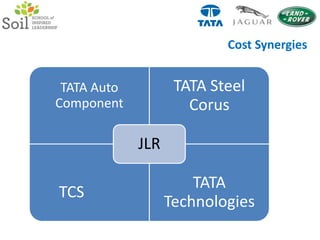

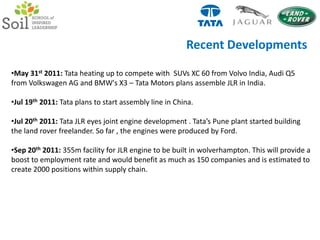

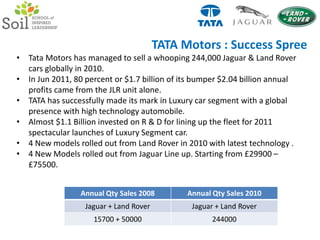

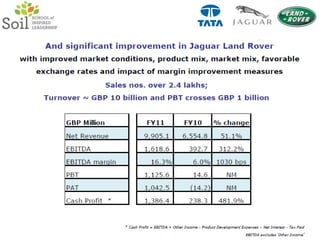

Tata Motors acquired Jaguar and Land Rover from Ford in 2008 for $2.3 billion, using a special purpose vehicle structure. The acquisition was speculated to potentially fail due to Jaguar and Land Rover's past losses under Ford, and the significant debt Tata would take on. However, Tata Motors has since successfully turned around Jaguar Land Rover, with 80% of its $2 billion profits in 2011 coming from the unit. Tata Motors has also invested over $1 billion in research and development, launching several new models.